Bitcoin Rejected at $30K, TRON and Polkadot Spike 4% (Weekend Watch)

After yesterday’s brief price surge to $31,000, bitcoin stalled and retraced back to below $30,000. Most altcoins are also slightly in the red today, except for TRON and Polkadot, both of which are up by around 4%.

Bitcoin Failed at $31K

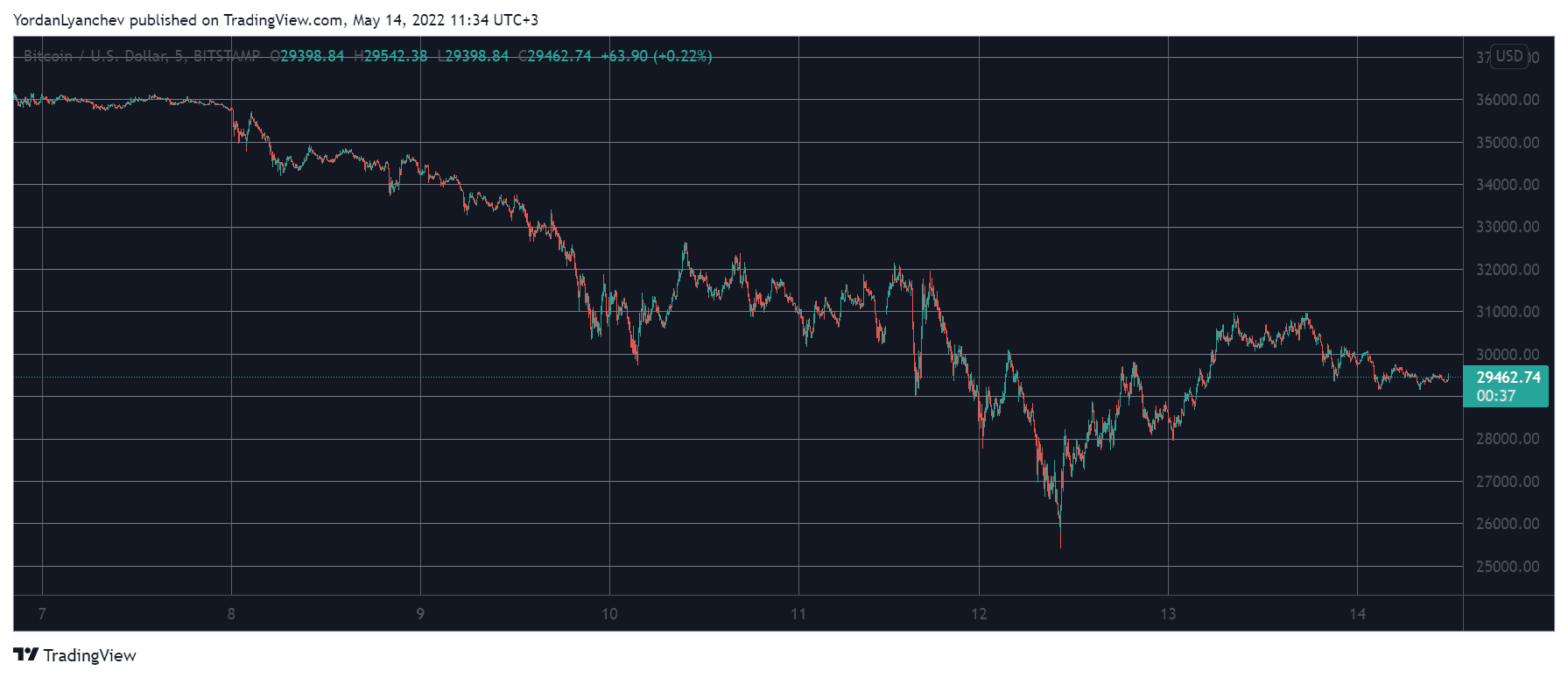

No other word can explain what transpired last week better than “massacre.” Bitcoin stood close to $40,000 on May 5 before the bears took complete control over the market and pushed it south hard.

At first, BTC lost $4,000 in a day before the negative market sentiment brought it down to $33,000 and later to $30,000. However, May 12 turned out to be the most violent day during this crash as bitcoin dumped to $25,300 (on Bitstamp), which became its lowest price tag since late December 2020.

At that point, though, the bulls reminded of their presence and drove the cryptocurrency north. In just a day, the asset recovered around $6,000 and spiked to $31,000. Nevertheless, it failed at breaching that level twice and has retraced by nearly $2,000 since then.

As a result, BTC’s market capitalization has declined on a daily scale and stands just north of $550 billion.

TRX and DOT Chart More Gains

The alternative coins went through a similar, if not even more violent, rollercoaster in the past ten days. Ethereum was close to $3,000 before it plummeted to a multi-month low of $1,700. However, the second-largest crypto reacted well and touched $2,100 yesterday. Despite retracing slightly since then, ETH still stands above $2,000 as of now.

Binance Coin dropped to around $230, tapped $300 yesterday, and now trades just under $290 following a minor daily decline.

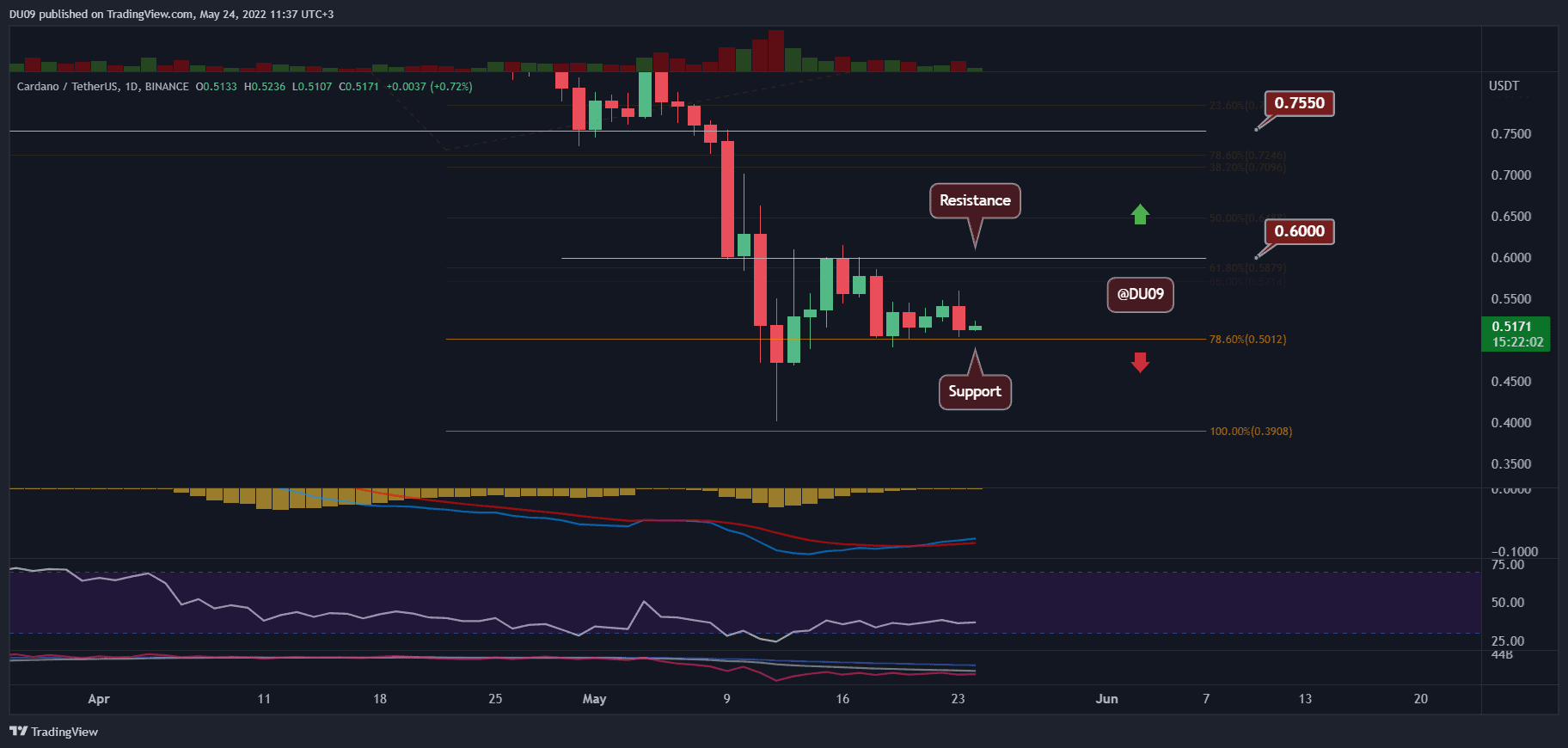

While Ripple, Dogecoin, Shiba Inu, and Litecoin are also slightly in the red, Cardano and Avalanche, have both dropped by more than 7% in a day.

TRON and Polkadot are among the very few coins in the green, with price increases of around 4% each.

The crypto market cap stands around $1.250 trillion, meaning that it’s up by $140 billion since the low on May 12. However, the metric is down by $600 billion in the past ten days.