Bitcoin Rebounds to $70K, Shrugging Off Hot U.S. Inflation Print

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Bitcoin (BTC) climbed back to $70,000 Wednesday, reversing its knee-jerk dip following hotter-than-anticipated U.S. inflation data for March.

BTC slipped nearly 4% to $67,500 during early U.S. hours after a government report showed the Consumer Price Index (CPI) rising faster than analyst expectations, prompting investors to temper their expectations for rate cuts this year.

The dip echoed through multiple asset classes, but bitcoin gradually erased all its losses, and was up over 1% over the past 24 hours, outperforming U.S. equities and gold, both of which finished with sizable declines for the day. At press time, bitcoin had slipped a bit from the $70,000 level, trading at $69,800.

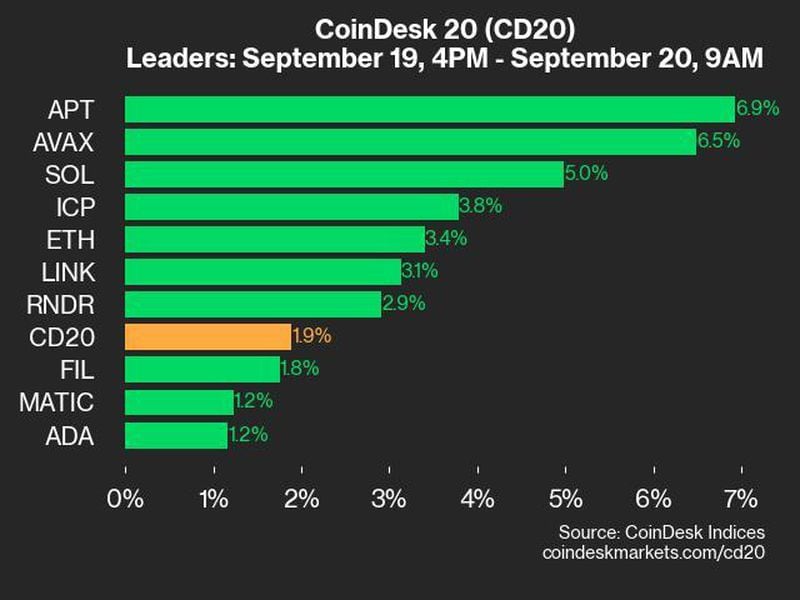

Most cryptocurrencies lagged behind BTC, with the broad-market CoinDesk 20 Index down 0.6% during the same period, dragged lower by a 5%-7% decline in major altcoins polkadot (DOT), bitcoin cash (BCH), near (NEAR) and aptos (APT).

Decentralized exchange Uniswap’s governance token (UNI) plummeted more than 10% as it received an enforcement notice from the U.S. Securities and Exchange Commission, foreshadowing regulatory actions against the platform.

Digital asset hedge fund QCP Capital said the rebound showcased the underlying demand for bitcoin, with investors seeing dips as a buying opportunity.

“This bounce is not surprising as the desk continues to see strong demand for long-dated BTC calls even on this dip,” QCP said in a Telegram update. “It is indicative of deep structural bullishness in BTC.”

Will Clemente, co-founder of Reflexivity Research, noted in an X post that the ever-increasing U.S. debt levels are more important for the big picture than individual CPI readings, and the most likely scenario is that policymakers will let inflation run higher than the 2% target to help inflate the debt. “Bitcoin is an insurance against this,” Clemente added.

UPDATE (April 10, 21:25 UTC): Adds analyst comment from QCP Capital.

Edited by Stephen Alpher.