Bitcoin Realized Market Cap Breaks $400 Billion All-Time High

Bitcoin’s realized market capitalization, a measure of the average cost basis for all bitcoin on the network, has broken its all-time high and hit $400 billion.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

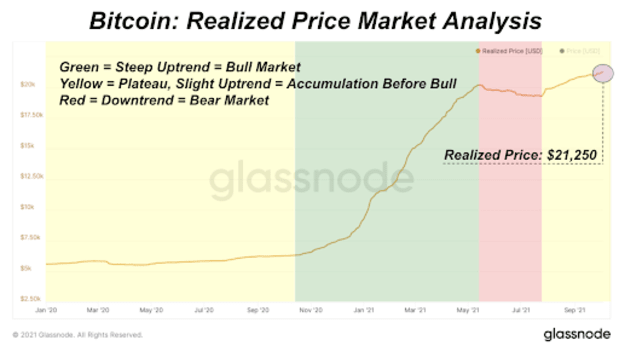

The realized market capitalization of bitcoin just broke another all-time high and surpassed $400 billion. Realized price and market capitalization is an on-chain trend we follow extremely closely in The Deep Dive, as the realized price is essentially the average cost basis for all bitcoin on the network.

With the realized market capitalization breaking $400 billion, the bitcoin realized price is at $21,250.

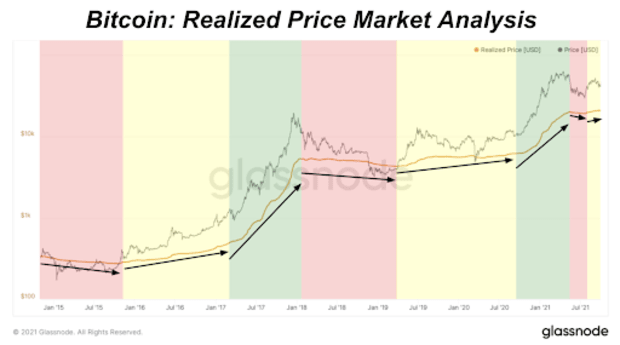

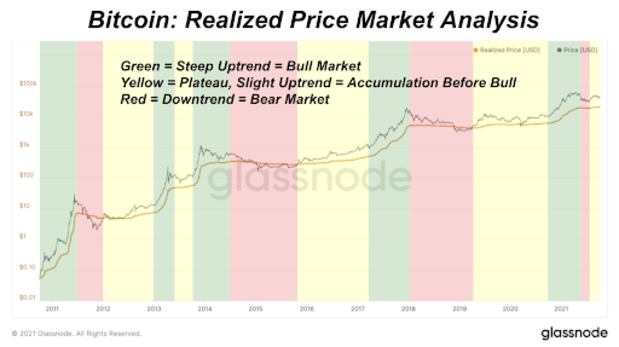

When analyzing the history of the bitcoin realized price, we can identify clear trends that identify the underlying market trends. First covered by The Deep Dive in July in The Daily Dive #022, realized price gives a very transparent view of the status of the bitcoin market cycle. When realized price is appreciating rapidly, it means that bitcoin is in a bull market (green). This occurs as a new wave of entrants enter the market and attempt to secure their share of the network, which places a large bid in the market.

At the same time, with price going parabolic (due to the fundamental supply/demand imbalance) old holders take some chips off the table and the dynamic of coins switching hands leads to a rapid appreciation of realized price/cap.

Conversely, during bear markets (red), the realized price trends downwards as coins are spent at a loss (compared to when they were originally acquired). It is important to note, however, that the realized price falls far less proportionally compared to the market price/market capitalization, which was subject to the reflexive phase of the bull market.

Lastly, during the accumulation phase (yellow) of the market cycle, you will see realized price stay stagnant or rise slightly as coins are transferred from weak hands to strong hands, from speculators to convicted HODLers.

Although some may argue that we have been in one constant bull market since the halving in May 2020, when looking at realized price trends we observe a bull market from October 2020 to May 2021, a brief two month bear market and now a reaccumulation phase before the next parabolic bull trend.

Some may argue that the recent upwards trend reflects that bitcoin is structurally in a bull market, however, it is important to note the slope of the uptrend in logarithmic scale is the true reflection of a bitcoin bull run. When viewed in linear scale (the chart above) for perspective, it may look like a bull market, but in logarithmic terms with a multiple cycle view it is clear that we are in the accumulation phase, coiling up for the next parabolic bull market move. The arrows below display the slope of realized price during each market phase.