Bitcoin Reached 2% From ATH As Cardano (ADA) Now 4th Biggest Cryptocurrency

After another increase that took BTC to $41,000, the cryptocurrency has retraced beneath the coveted $40,000 level. The crypto market cap reached ATH above $1.2t but has retraced as most altcoins have also corrected slightly. Cardano is the main exception, with a massive 20% surge to a new 3-year high.

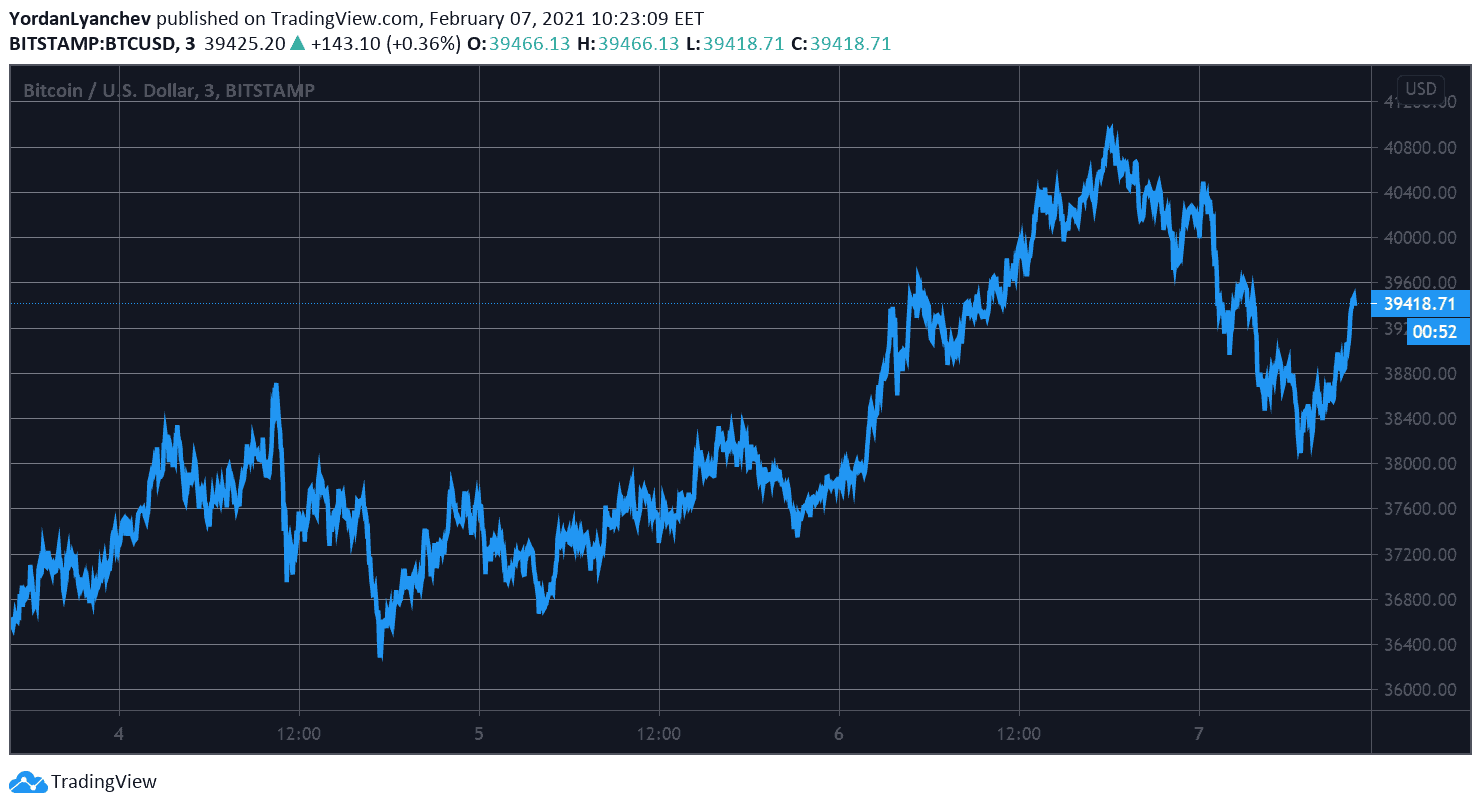

Bitcoin Touched $41K But Retraced

The primary cryptocurrency was gradually increasing in value since Monday’s dip until it broke above $37,000 a few days back. However, the bulls pulled it together at that point and drove BTC above $40,000.

Furthermore, bitcoin reached an intraday high of $41,000. Thus, the cryptocurrency came just $1,000 away from its ATH of $42,000 (roughly around 2%).

However, the bears intercepted the move at that point and didn’t allow another leg up. Just the opposite, BTC started to retrace to an intraday low of $38,000. Nevertheless, it has bounced off since then and reclaimed $39,000.

From a technical perspective, BTC would still have to overcome the resistance lines at $40,000, $40,735, and $41,000 before potentially challenging $42,000.

Alternatively, the support levels at $38,550 and $38,000 could assist in case the price falls again.

Cardano’s New Record While Alts Retrace

Most alternative coins marked serious gains in the past few days, which resulted in new all-time highs for Ethereum, Polkadot, and Binance Coin. Consequently, the total market cap also went for a record at $1.220 trillion.

However, the situation has changed to some extent in the past 24 hours. Ethereum has declined by over 2% and is currently beneath $1,650. Bitcoin Cash (-5%) is down below $460.

Chainlink (-4%), Polkadot (-2%), and Litecoin (-4%) are also in the red, while BNB and XRP have charted minor gains.

However, Cardano is the most significant gainer from the top 10 with a massive 23% surge. As a result, ADA has jumped to $0.67 – a new 3-year high for the token.

More gains are evident from Decentraland (30%), Dogecoin (21%), Quant (16%), Avalanche (16%), Huobi Token (14%), Elrond (14%), and Decred (13%).

In contrast, Nexo (-11%), FunFair (-10%), Alpha Finance Lab (-10%), 0x (-9%), Ampleforth (-8%), and Ren (-7.5%) have lost the most.