Bitcoin Price Surge Unlikely With System Volatility So High

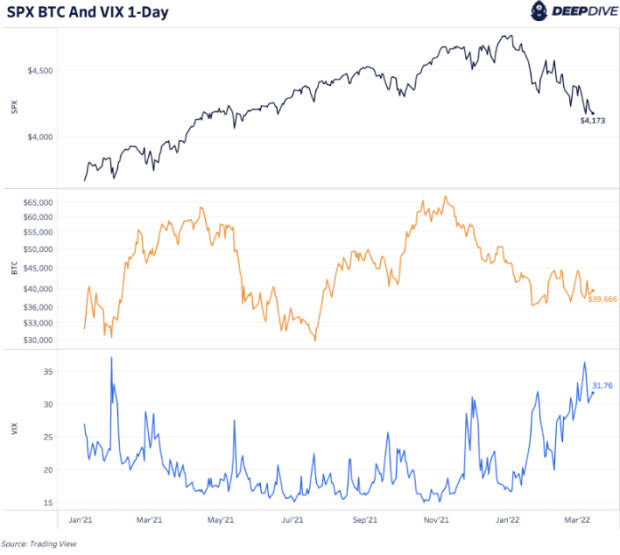

With the VIX indicating systemic volatility, it’s hard to imagine bitcoin making a larger upwards move in price.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

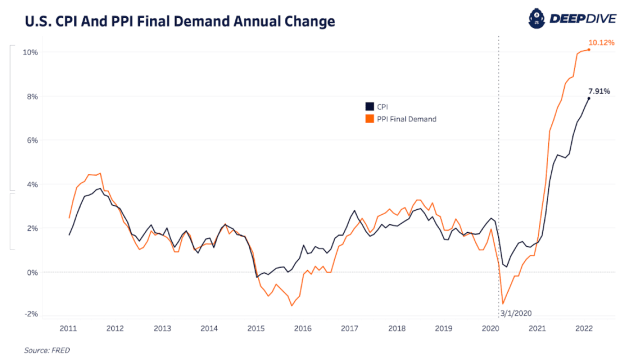

The latest United States producer price index (PPI) figures were released yesterday morning showing a 10% annual index change. The PPI tracks price changes received for goods and services across domestic producers and will be an important key input in the Federal Reserve Board’s decision to tighten monetary policy tomorrow in the face of surging inflation.

The United States PPI growth is still well below what we’ve seen across the European Union and will likely continue higher in the coming months as producer input costs lag the rise in commodities and energy prices. Below we see a clear trend of acceleration in Consumer Price Index and PPI post the COVID-19 response, which came armed with unprecedented fiscal and monetary stimulus.

Volatility in the system remains elevated with the VIX over 31. The initial volatility spikes back in Q4 2021 coincided with the market sell-off in bitcoin and the S&P 500 Index. Based on its historic moves and relationship to the VIX, it’s hard to imagine bitcoin making a larger upwards move with overall equity market volatility so high in the short term. We would have to see a major, fundamental shift (decoupling) or catalyst in the market to change our view.

Our base case is that we are due for another explosive volatility shock and that the VIX has not made its yearly high yet. We also view the likelihood of a recession in the U.S. as a near certainty over the coming four quarters, as real growth likely reverses in the face of soaring energy prices and rising yields.

For bitcoin bulls, the encouraging sign is that under the surface, accumulation is occurring, with free-float supply continuing to decrease, as quantified by a variety of on-chain metrics.

However, due to the accelerating readings of inflation across the global economic sector, credit markets are selling off, and thus broader market liquidity is decreasing as volatility continues to elevate.

In our view, the market will have its pain point tested in the form of higher yields during 2022, and it is not a matter of if but rather when the Fed decides to intervene to quell credit market conditions.