Bitcoin Price Surge: May Not Be Trade War but Whales

This article was originally published by 8btc and written by Olusegun Ogundeji.

The impact of the trade war between the U.S. and China may be widening on a scale that is causing investment to be diversified into global assets, but it may not be responsible for the surge in bitcoin price, a crypto insider said.

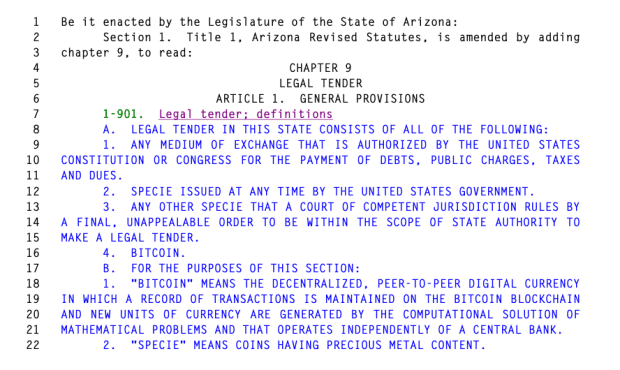

Amid the rising tension between the world’s two largest economies, which saw global stocks fall for a sixth day by August 5, 2019, the head of U.S. operations for CoolBitX — an international blockchain security company specializing in digital asset compliance hardware and software — has a different view of what could be pushing bitcoin price. Tom Maxon believes it has less to do with macro conditions and more to do with whales taking advantage of the market momentum.

After admitting that the global market turmoil could have been responsible for the recent bitcoin surge above $11,000 and acknowledging that a lot of currency holders can see the top cryptocurrency as a safe haven, he said that the activities of whales in the ecosystem are a much bigger issue.

“However, there is a much bigger issue at play in the digital asset marketplace,” he said. “Billions of dollars in daily volume are handled by whales and managed portfolios through over-the-counter (OTC) desks, and actually relatively smaller volume is held in exchanges that are accessible by retail investors. OTC desks are largely unregulated and, therefore, it is impossible to know exactly where the inflows and outflows are coming from. These whales and shrewd, large-volume traders (including exchanges themselves) will most likely leverage bitcoin’s current upward momentum toward a new high from its previous peak in order to short it to the detriment of less powerful retail traders.”

The trade war intensified following recent threats of tariff imposition by U.S. President Donald Trump while China’s currency fell below a key 7-per-dollar level for the first time in a decade. Though not confirmed as a deliberate move, the devaluation of the yuan is a big shift as it could help China cope with the likely impact of Trump’s next round of tariffs.

Doubts have been mounting that the Chinese apex bank will be able to protect the value of the currency even as the yuan could get weaker as the September 1, 2019, tariff deadline draws nearer and threats that Beijing is planning to leave the trade talks altogether are more likely.

A report suggests that this growing fear is causing a bit of Chinese money to flow into cryptocurrencies as their prices are surging at the same time as the worrying trade war escalates. The nexus between public reaction — as evident in social media’s trending #RMBcrack7, which has garnered over 350 million views so far — and the trade tension serving as a risk factor to trigger capital flight is not hard to build.

The post Bitcoin Price Surge: May Not Be Trade War but Whales appeared first on Bitcoin Magazine.