Bitcoin Price Rockets to Two-Month High Above $9,400

Bitcoin Price Rockets to Two-Month High Above $9,400

Bitcoin jumped to two-month highs early on Thursday and now looks set to register its biggest monthly gain in nearly a year.

The top cryptocurrency by market value rose to $9,469 at 06:05 UTC, the highest level since Feb. 25, having rallied from $7,700 to $8,900 on Wednesday, according to CoinDesk’s Bitcoin Price Index.

At press time, the cryptocurrency had dropped back to around $8,750, still up more than 36 percent on a month-to-date basis. That is the biggest monthly gain since May 2019, when the cryptocurrency had rallied by 62 percent. It’s now also up 22% on a year-to-date basis.

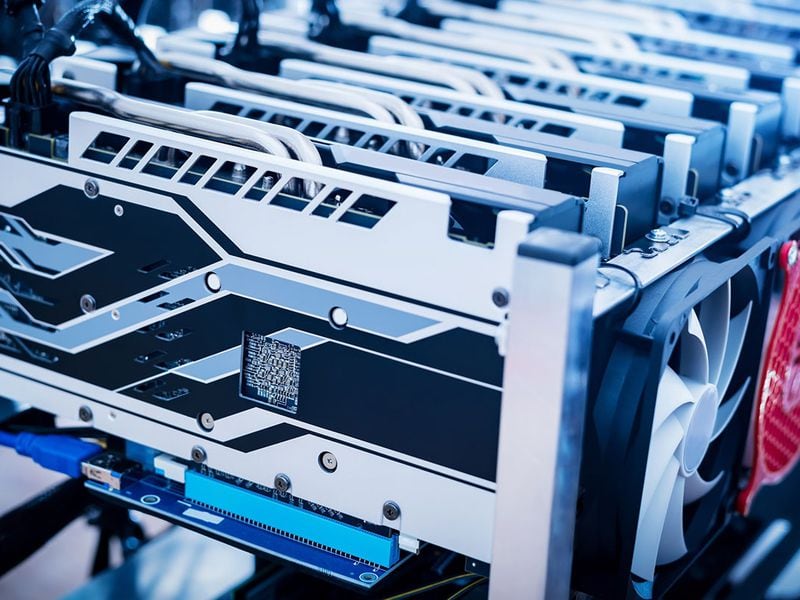

Bitcoin’s big move higher has revived interest in options or derivative instruments used to hedge against sudden price swings.

Major exchanges – Deribit, LedgerX, Bakkt, OKEx, CME – registered a total trading volume of nearly $180 million on Wednesday to register a 350% rise from Tuesday’s tally of $40 million, according to data provided by crypto derivatives research firm Skew.

The volume witnessed on Wednesday was the highest since “Black Thursday” (March 12), when bitcoin fell by nearly 40% to levels below $5,000. Major exchanges registered a record trading volume of more than $280 million on the crash.

An option contract is an agreement between a buyer and seller that gives the purchaser of the option the right, but not obligation, to buy or sell the underlying asset at a predetermined price on or before a specific date. A call option represents a right to buy, while a put option buyer has a right to sell.

Call options draw higher prices

The one-month put-call skew, which measures the price of puts relative to that of calls, has dropped below zero for the first time since March 26. “The negative skew indicates calls are more expensive than puts,” explained Darius Sit, co-founder and managing director at Singapore-based QCP Capital.

A week ago, put options were claiming higher prices than calls and the skew was hovering near 15%. Back then, demand for puts was higher, possibly due to fears of another macro-driven sell-off in cryptocurrencies.

Leverage-driven rally

While on-chain data suggests increased participation from small traders, the big rise seen in the last 24 hours looks to be a leverage-driven rally.

“It is the leverage in the space that creates large moves,” Sit told CoinDesk, while adding that a lot of traders who were short leveraged (holding short positions in futures or short call options) are now covering their positions.

Seasoned option traders usually write, or sell, call options when they expect the market to consolidate or drop. Note that bitcoin was largely stuck in $7,500 to $6,400 range in the two weeks to April 23. Additionally, many observers were worried about another sell-off in bitcoin.

As a result, investors may have sold call options or bought put options back then. The one-month skew was also reporting a bearish bias a week ago, as noted earlier.

With bitcoin’s sudden move higher, these short positions in call options are likely being squared off, leading to an exaggerated price rise.

It’s worth noting that selling options – whether put or call – is a limited profit, unlimited loss strategy.

Looking forward

Most analysts are of the opinion that the speculative buzz surrounding a bullish narrative around this month’s mining reward halving event is driving the cryptocurrency higher and could push the cryptocurrency into five figures ahead of event, due May 12.

“The sudden jump in bitcoin’s price to well over the $9,000 can be explained by the fact that bulls have been triggered by the upcoming halving event and the anticipated appreciation of BTC’s value in its aftermath. For those buying into bitcoin now, many see this as an opportunity to buy BTC at essentially discounted rates ahead of a post halving price increase,” said Matthew Dibb, co-founder of Stack.

Cautiously long bitcoin

QCP Capital is positioned for an extended bullish move in the medium term but is also hedged for a sudden collapse in prices. “We remain core long BTC and short puts, but have now turned cautious on our spot holdings, while at the same time rolling our longer-tenor puts to a higher strike,” Sit told CoinDesk in a Telegram chat.

To simplify, QCP is holding a long position, which faces the risk of a reversal lower. To protect against a potential downside move, the trading firm is also buying longer duration put options (bearish bets) of higher strike prices.

Being hedged long makes sense, as historical data shows the cryptocurrency fell after its previous halvings.

“The 2012 halving was followed by an immediate 10% sell-off and the 2016 event was followed by over 30% decline,” Nicholas Pelecanos, head of trading at NEM Ventures, told CoinDesk.

Disclaimer: QCP Capital is a crypto market maker based in Singapore and has been trading the spot market and options since 2016. The firm is an investor in crypto research firm Skew and crypto derivatives exchange Deribit.)

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.