Bitcoin Price Retraces as Interest Rates Continue to Surge, But Bitcoin BSC Nears $6m Presale Hard Cap

Bitcoin’s (BTC) price continues to fall, with the coin now trading around the $26,250 level.

Although Bitcoin is still up 57% year-to-date, its value has fallen significantly since early August, with the high-interest-rate environment taking its toll on investors.

Meanwhile, Bitcoin-style project Bitcoin BSC (BTCBSC) is nearing its $6 million presale hard cap after a wave of buying momentum in the past few weeks.

Bitcoin’s Price Slide Worries Investors as Key EMAs Broken

Since surging to $27,500 ten days ago, BTC’s price has fallen over 4%, breaching the 20-day and 50-day Exponential Moving Averages (EMAs) to the downside.

More importantly, the coin’s price has also dipped below the 200-day EMA, often used as a proxy for long-term direction.

When the price fell below this EMA, traders viewed it as a bearish sign, believing it could signal further declines.

In turn, it has led to a self-fulfilling prophecy where investors, spooked by the negative signal, have started to sell their holdings.

According to CoinMarketCap, BTC trading volume has sunk 30% in the past 24 hours, indicating a decrease in trading activity.

This lower trading volume suggests fewer investors are buying Bitcoin at its current price.

Additionally, Augmento.io’s BTC sentiment index has dropped to 0.391 over the past two weeks – signifying waning investor interest.

High-Interest-Rate Environment Weighs on BTC Price

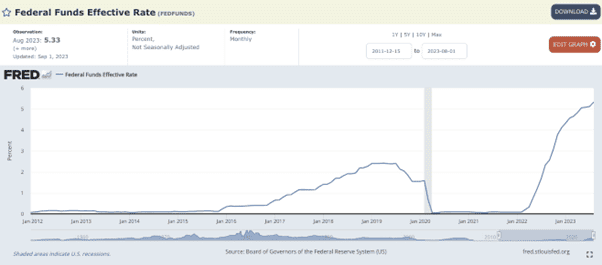

The high-interest-rate environment is a key driving force behind Bitcoin’s declining price.

With the US 10-year Treasury yield rising to 4.55%, its highest in almost 16 years, investors are choosing safer assets to park their capital in – pulling money away from the crypto market.

As referenced by CoinDesk, JPMorgan’s CEO Jamie Dimon has sounded the alarm regarding the high-interest rates, warning that the world may not be prepared for rates to soar to 7%.

The Federal Reserve held rates steady last week at 5.25%-5.50%, yet uncertainty still looms.

Fed Chair Jerome Powell stated that rates will remain higher for longer, while there could be one final rate hike before the end of 2023.

This monetary policy could further weigh on Bitcoin’s price, given that it’s a non-interest-bearing asset.

Investors are instead opting to place their cash in interest-yielding assets, like government bonds, which is worsening the sell-off in the crypto market.

Bitcoin BSC’s Presale Hype Grows as Stake-to-Earn Protocol Draws Attention

Despite the challenging conditions surrounding Bitcoin and the broader crypto market, Bitcoin BSC (BTCBSC) is defying the trend – and has now raised over $5.7 million in early funding.

This new Bitcoin-style project is closing in on its $6 million presale hard cap, thanks to a sustained wave of buying momentum in recent weeks.

The investor enthusiasm surrounding BTCBSC stems from the token’s innovative use cases and unique branding, setting it apart from the hundreds of new cryptos that enter the market each month.

One of the key features resonating with investors is Bitcoin BSC’s staking protocol, which allows holders to lock up their BTCBSC tokens and earn yields of 93% per year.

Given the current economic climate, Bitcoin BSC’s staking protocol is especially appealing, offering a viable alternative for investors seeking a regular yield.

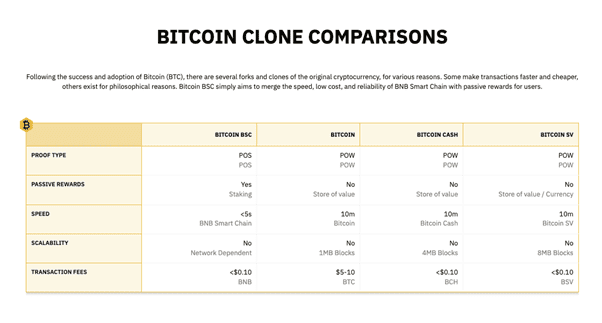

Further enhancing Bitcoin BSC’s appeal is its tokenomics, which draw inspiration from the original BTC.

The total BTCBSC supply is capped at 21 million, much like Bitcoin, with the current presale price set at just $0.99 – reminiscent of BTC’s value back in 2011.

Moreover, Bitcoin BSC runs on the BNB Chain, which does away with the Proof-of-Work (PoW) protocol that makes Bitcoin so energy-intensive.

These factors have played into Bitcoin BSC’s early momentum, with prominent crypto influencer No Bs Crypto describing it as a potential “Bitcoin alternative.”

With the BTCBSC presale trending to sell out in the coming days and DEX listings planned for immediately after, it looks like an exciting time for early backers.

Visit Bitcoin BSC Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Bitcoin Price Retraces as Interest Rates Continue to Surge, But Bitcoin BSC Nears $6m Presale Hard Cap appeared first on CryptoPotato.