Bitcoin Price Is $5,500 On BitFinex And $5,190 Elsewhere: Here Is Why

After last week’s fiasco involving BitFinex and Tether, when the New York Attorney General Letitia James had to weigh in with a court order, investors were expecting the cryptocurrency market to become bearish. The bitcoin rate against the U.S. Dollar (BTC/USD) initially turned bearish and fell below the $5,000 level to $4971. However, to everyone’s surprise, it finished the busy trading week above the coveted psychological support around $5,000 per bitcoin.

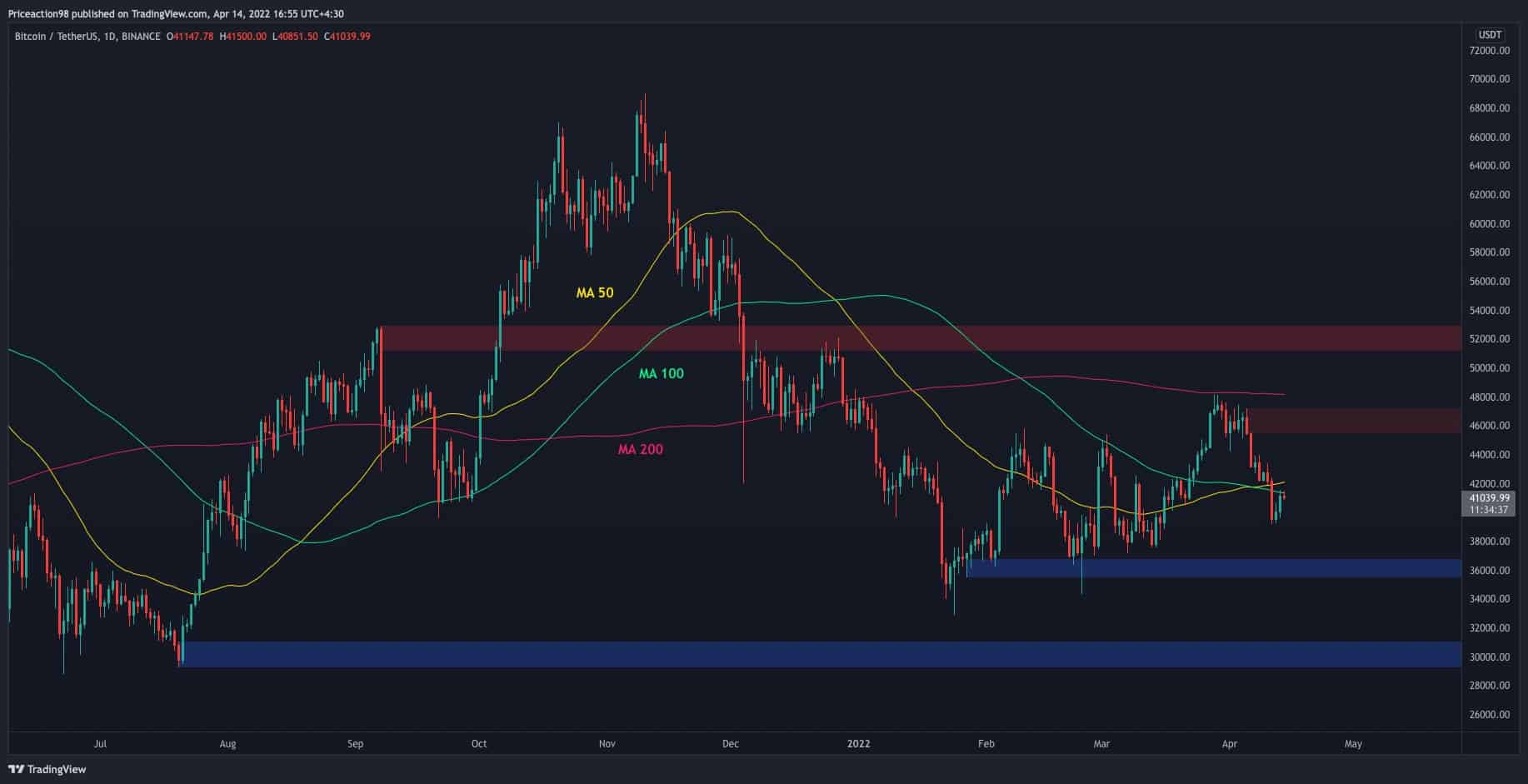

The problem is, there is a substantial divergence between the price of BTC/USD on most cryptocurrency exchanges and BitFinex.

On Sunday, the BTC/USD on popular cryptocurrency exchange Coinbase was trading around $5,190. However, at the same time, BitFinex was quoting the price of BTC/USD at near $5,500!

If we carefully examine the line charts of the BTC/USD price of Coinbase and BitFinex since the beginning of the week, it is clear that time to time, the price diverges on these two exchanges. The fact is, it is perfectly normal to have a small difference in the price of any commodity among exchanges due to the difference in trading volumes and supply and demand conditions.

The crypto community is used to price differences between BitFinex and other exchanges such as BitMEX, But, when the difference of price amounts to a sizable $300, roughly 6%, it prompted analysts to dive into finding the reason behind such substantial divergence.

Why BitFinex is Quoting the Bitcoin Price So High

If you have been following the price gap of Bitcoin between BitFinex and other cryptocurrency exchanges, this phenomenon should not come as a surprise.

In fact, if there is such a large price gap, anyone having basic knowledge about finance and the efficient market hypothesis will argue that it offers a good arbitrage opportunity. So, why no opportunist trader is taking advantage of the arbitrage?

However, the best explanation came from Jeff Garzik, the co-founder of Bloq Inc.

It’s exit buying. To get out of an exchange, one must buy “hard currency” – BTC – when fiat withdrawal methods start failing. The BTC price is therefore higher at dying exchs.

We’ve seen this data pattern many times in past crypto history, including but not limited to MtGox.— Jeff Garzik (@jgarzik) April 26, 2019

It seems logical that the low volume bidding of Bitcoin on BitFinex is actually investors on the platform buying Bitcoin at a higher price to get out of the exchange for good. After all, with all the suspicious activities at BitFinex, any rational investor would be happy to pay a little premium to get their money out of the exchange. During those times, such as we have now following the $850 Million claim, the gap tends to become wider.

The Bottom Line

While market analysts were expecting Bitcoin to turn bearish, in reality, cryptocurrency investors have shown tremendous resilience to bearish pressure and kept the BTC/USD price above the $5,000 mark, as of now. However, as in crypto, anything can happen.

The post Bitcoin Price Is $5,500 On BitFinex And $5,190 Elsewhere: Here Is Why appeared first on CryptoPotato.