Bitcoin Price Indicator is Most Bearish Since December

View

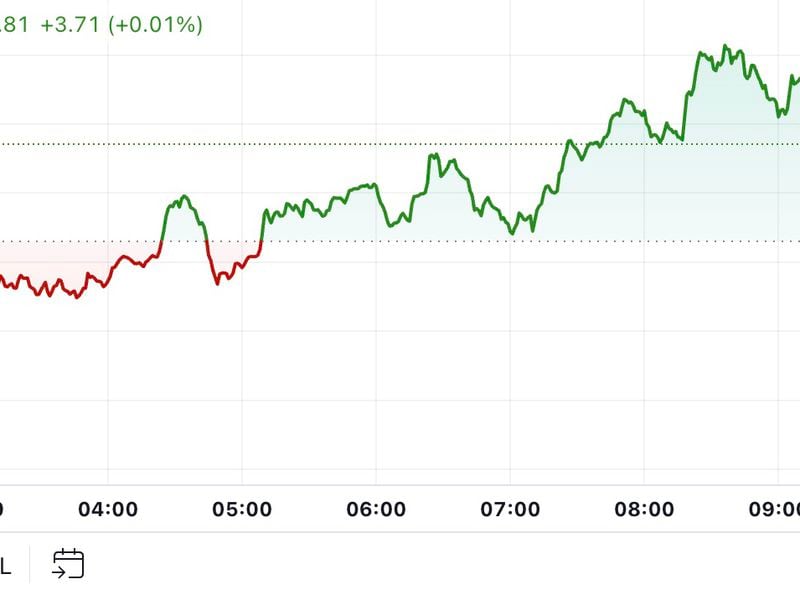

- Bitcoin’s weekly moving average convergence divergence (MACD) histogram is reporting strongest bearish bias since December, suggesting the cryptocurrency may soon dive out of a narrowing price range.

- Daily chart indicators are also biased bearish. A range breakdown, if confirmed, would open the doors for a drop below $9,000.

- A range breakout would imply a resumption of the rally from April’s low of $4,000 and could yield a sustained move above key resistance at $12,000.

Bitcoin’s three-months of sideways trading may soon end with a notable price drop, as key indicator is reporting strongest bearish bias in nine months.

The leading cryptocurrency’s stellar rally from April’s low of $4,000 ran out of steam at highs above $13,880 at the end of June. Since then, BTC has produced a series of lower highs well above $11,000 and higher lows in $9,000 to $10,000 range.

With a reward halving (supply cut) due next year, many investors are expecting the ongoing consolidation to end with a bullish breakout. The cryptocurrency is also expected to received a boost from Bakkt’s launch of physically-settled bitcoin futures.

However, the weekly MACD histogram – an indicator used to identify trend changes and the momentum of the bearish or bullish movement – is calling a range breakdown.

The histogram crossed below zero in August, confirming a bullish-to-bearish trend change and is now seen at -206, the lowest level since the last week of December 2018, as seen in the chart below.

Weekly chart

The bearish bias is currently the strongest in nine-months, according to the MACD histogram.

Technical analysts would argue that the MACD is based on moving averages and tends to lag price.While that is true, the indicator has produced reliable trend reversal signals in the past.

For instance, the indicator crossed above zero in February, indicating bullish reversal and the cryptocurrency broke into a bull market with a high-volume move to $5,000 in the first week of April.

The MACD crossed below zero and fell to -8.18 in the second week of November 2018 following which prices fell sharply below $5,000.

Also, other indicators are aligning in favor of the bears. Notably, the chaikin money flow, which incorporates both prices and volumes, is currently seen at 0.08, the lowest level since April 8, meaning the buying pressure at is at the weakest in 5.5 months.

Daily chart

BTC created a bullish hammer last Thursday, but so far, that has failed to draw bids. In fact, the follow-through has been bearish – prices are currently down more than $400 from the hammer candle’s high of $10,480.

The MACD histogram has crossed below zero and the 14-day relative strength index is reporting bearish conditions with a below-50 print.

BTC, therefore, risks falling to the contracting triangle support, currently at $9,482. A UTC close below that level could yield a sell-off to levels below $9,000.

Meanwhile, a high-volume close above the upper edge, currently at $10,758 would imply a resumption of the bull market and open the doors for $12,000.

As of writing, BTC is changing hands around $9,920 on Bitstamp.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Bitcoin image via CoinDesk Archives; charts by Trading View