Bitcoin Price Faces the Biggest CME Futures Gap: What Does it Mean?

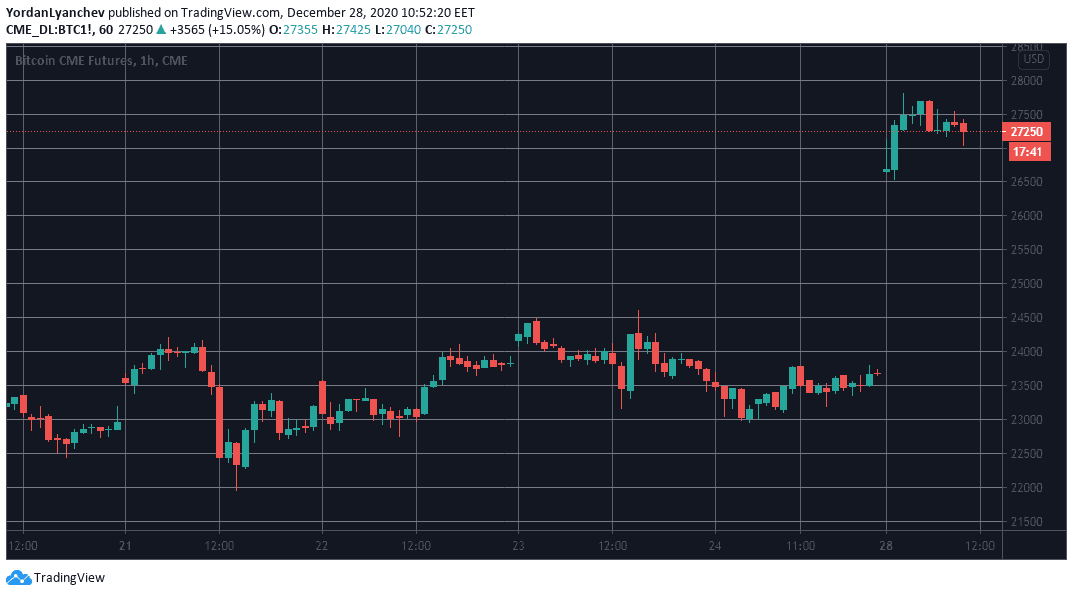

Bitcoin futures on the Chicago Mercantile Exchange (CME) have recorded the largest price gap to date of about $3,000. This came after a three-day Christmas break for BTC trading on the regulated exchange and a massive price jump for the asset resulting in consecutive all-time highs.

Biggest BTC Gap On CME

Launched in late 2017, CME’s BTC futures product enables institutional investors to trade the primary cryptocurrency on a regulated platform. However, being a regulated establishment also means that CME operates between certain hours within the weekdays and halts trading during weekends or official holidays.

In contrast, Bitcoin is a free market asset that trades 24/7 and takes no days off, even on holidays. This creates an interesting situation – when CME closes at the end of a working week, while BTC continues fluctuating in the following days, the so-called CME gaps appear when the regulated exchange opens for trading on the first working day after the weekend.

This is precisely what has transpired now. CME Bitcoin futures closed for trading on Thursday (December 24th), instead of Friday (December 25th) because of Christmas. BTC’s price was $23,660 at the time.

While the Holiday season arrived, bitcoin refused to stay steady. The cryptocurrency went on a tear resulting in breaking above coveted price tags like $26,000, $27,000, and even $28,000 during the long weekend alone.

Therefore, when CME opened on Monday, there was a large gap between the closing price on Thursday and the latest one. Although BTC retraced slightly from the ATH to $26,660 at the time of CME’s opening hours, there was a gap of $3,000 left – the largest one to date.

Will BTC Fill That Gap?

CME gaps appear after almost every weekend, as mentioned above. However, history shows that BTC has the tendency to fill those gaps by initiating massive price fluctuations in either direction.

This raises the question if the cryptocurrency will head towards a violent retracement to do it again. If BTC fills this gap, the asset would have to dump by $3,000 in value.

According to recent data from Arcane Research, CME has become the largest futures market for bitcoin, and its impact on the market continues to grow. This raises concerns for BTC proponents that the effects of the regulated platform could pause or halt the Q4 2020 bull run.