Bitcoin Price Faces Drop to $6.1K After Range Breakdown

Bitcoin’s (BTC) downside break of a recent trading range has likely opened the doors for a drop to key support at $6,100, technical charts indicate.

The leading cryptocurrency, which was sidelined above $6,400 for ten days straight, fell to two-week lows near $6,200 yesterday, confirming a range breakdown.

Essentially, the bears have come out victorious in a tug of war with the bulls. As a result, risks are skewed to the downside. More importantly, a prolonged period of extremely low volatility ended with a sell-off yesterday, hence, the ensuing bearish move could be a big one.

Still, the bears are cautioned against being too aggressive, as the bounce from the 21-month exponential moving average (EMA) of $6,109 cannot be ruled out. The EMA has acted as a strong support since June. Further, the trendline connecting June lows and August lows is lined up at $6094.

To cut the long story short, BTC’s drop to two-week lows is a bearish development, but it’s close proximity to strong support levels calls for caution.

As of writing, BTC is changing hands at $6,250 on Coinbase, representing a 1.8 percent drop on a 24-hour basis.

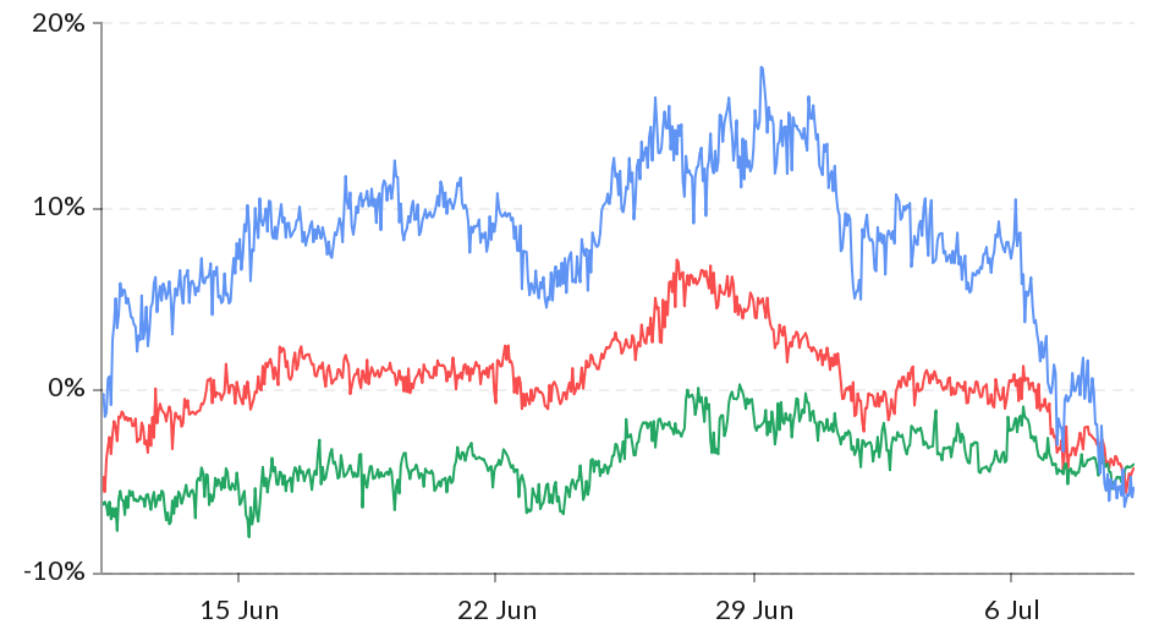

Daily chart

As seen in the above chart, the 5-day and 10-day EMAs have rolled over in favor of the bears following yesterday’s range breakdown.

The indicators are also biased toward the bears. For instance, the MACD has produced a bearish crossover (red bar below zero). Both relative strength index (RSI) and the stochastic are reporting bearish conditions below 50.00.

Monthly chart

Over on the monthly chart, the sell-off from the record high of $20,000 seems to have ended around the 21-month EMA in the last four months.

So far, however, the bulls have failed to produce a meaningful bounce, despite the repeated bear failure to beat the EMA support.

The bear market would resume if the cryptocurrency closes below the 21-month EMA tomorrow (monthly close).

View

- The range breakdown could yield a drop to major supports lined up at $6,100.

- A UTC close today below the trendline support of $6,094 would bolster the already bearish setup and boost the prospects of a monthly close (tomorrow) below the 21-month EMA.

- A UTC close above the 10-day EMA of $6,355 would weaken the bearish pressure.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Water drop image via Shutterstock; charts by Trading View

Join 10,000+ traders who come to us to be their eyes on the charts and sign up for Markets Daily, sent Monday-Friday. By signing up, you agree to our terms & conditions and privacy policy

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.