Bitcoin Price Could Soon Reach $8300, According To This Inverse Head & Shoulders Pattern (Analysis & Overview)

Over the past two days, the volatility surrounding the price of Bitcoin had calmed down a bit.

Despite a little glitch to the downside, Bitcoin (BTC) is trading between $7000 and $7400 over the past 48 hours.

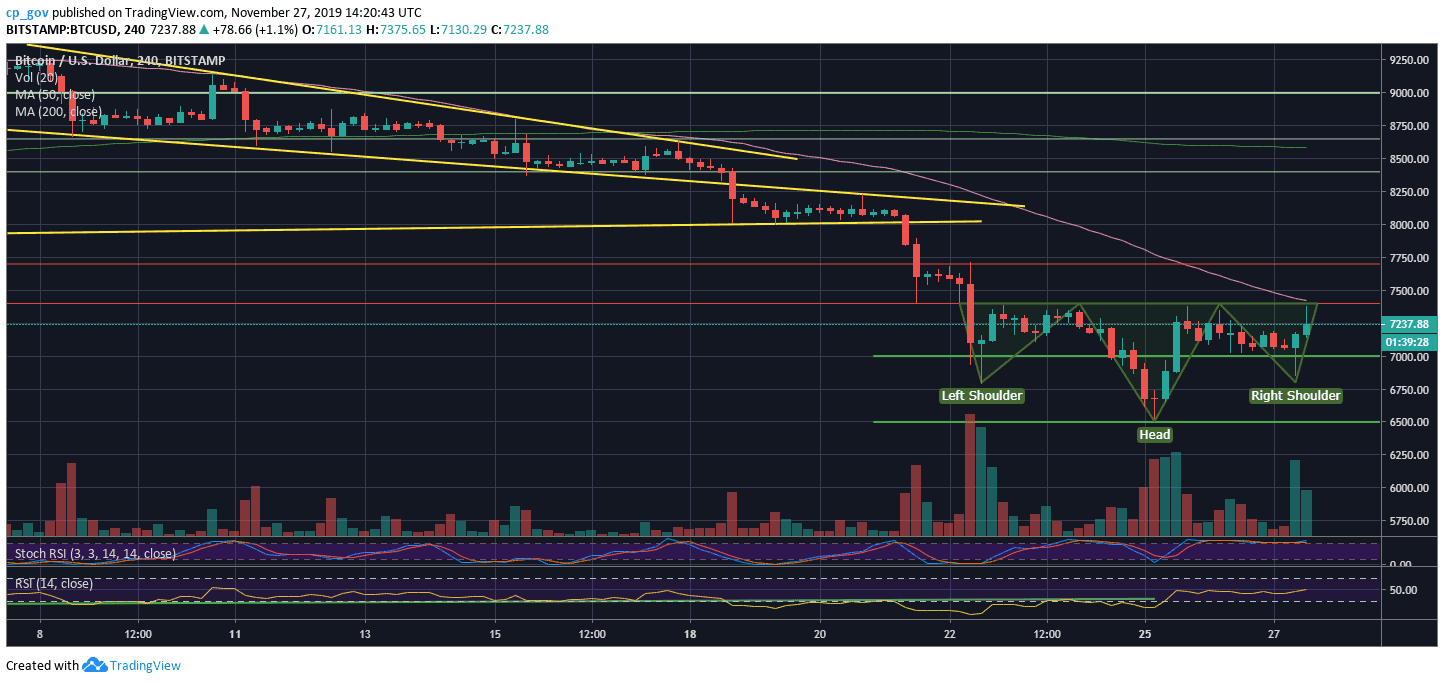

The good news could be the formation of an inverse head and shoulders pattern, that if played out, can grant Bitcoin a decent short-term target around $8300.

The pattern can be clearly seen on the following 4-hour chart, and it will play out in the case of a breakout of the $7400 neckline in the next several hours, and it needs to be followed by a reasonable amount of trading volume.

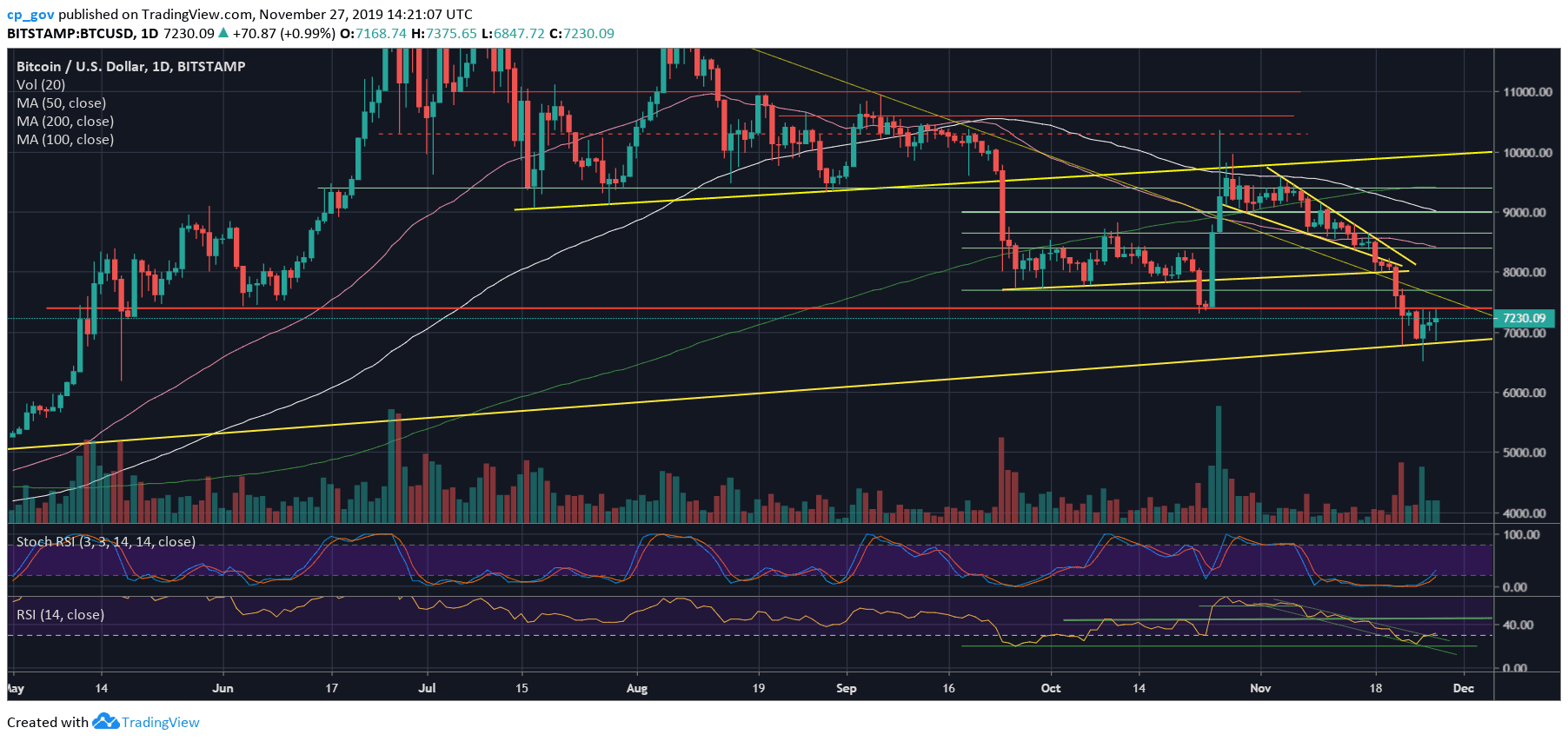

On the macro level, as seen on the following daily chart, we can see that the significant mid-term ascending trendline, which started forming in April 2019, still holds the price nicely.

Total Market Cap: $198.5 billion

Bitcoin Market Cap: $131.6 billion

BTC Dominance Index: 66.4%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance: As mentioned above, Bitcoin is now facing the significant $7300 – $7400 resistance area, which was a clear boundary for Bitcoin over the past five days. In case of a break-up, the next resistance lies at $7700. In order for Bitcoin to return to the bullish track, it will need to at least get over the $8000 benchmark and confirm it as support by creating a higher-low. The above-described inverse head and shoulders’ target is above $8000.

From below, $7000 is now the first line of support. In case Bitcoin goes lower, then $6800 is the next support level (the “right shoulder” that supported Bitcoin this morning), along with the significant ascending trend-line (as mentioned above). Further below is $6500, which is the weekly low.

Further down lies $6000 – $6200, that should serve as a secure demand zone, in case Bitcoin gets there

– The RSI Indicator: The RSI is at a crucial area, starting to break-out from the descending channel (as can be seen on the daily chart), which can turn into a bullish sign.

The stochastic RSI oscillator that recently produced a bullish cross-over is just about entering the neutral territory. This may also lead to a bullish break-up of the $7400 resistance.

– Trading volume: Following the huge sell-off candle from Friday, the bulls produced their own decent green volume candle from the last Monday. This is another sign that the price area is a “war zone” between the bulls and the bears.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

The post Bitcoin Price Could Soon Reach $8300, According To This Inverse Head & Shoulders Pattern (Analysis & Overview) appeared first on CryptoPotato.