Bitcoin Price Analysis: This Key Resistance Could Prevent BTC’s Surge to $90K

Bitcoin has recently rebounded from the critical $78K support level and is now testing a significant resistance at $85K.

If it manages to reclaim this level, the next target will likely be the $90K region.

Technical Analysis

By Shayan

The Daily Chart

BTC’s recent price action has seen a slight rebound from the ascending wedge’s lower boundary, which aligns with the 0.618 Fibonacci retracement level at $78K. This confluence of support levels strengthens the likelihood of buyers defending this area in the mid-term.

However, Bitcoin has now headed toward a key resistance zone at $85K, which coincides with the 0.5 Fibonacci retracement level and the 200-day moving average. While a breakout above this region could trigger a surge toward the $90K threshold, the presence of sellers at this level suggests that further consolidation is the more probable short-term scenario.

The 4-Hour Chart

On the lower timeframe, Bitcoin’s recent upward movement has brought it close to the upper boundary of the descending wedge at $85K. This pattern often signals a bullish market rebound if the price breaches the upper trendline. If Bitcoin sustains its momentum and successfully breaks above this resistance, a rally toward the $90K level will likely follow.

However, given the current market conditions and the lack of strong buying demand, further consolidation within the wedge remains the more likely short-term outcome.

On-chain Analysis

By Shayan

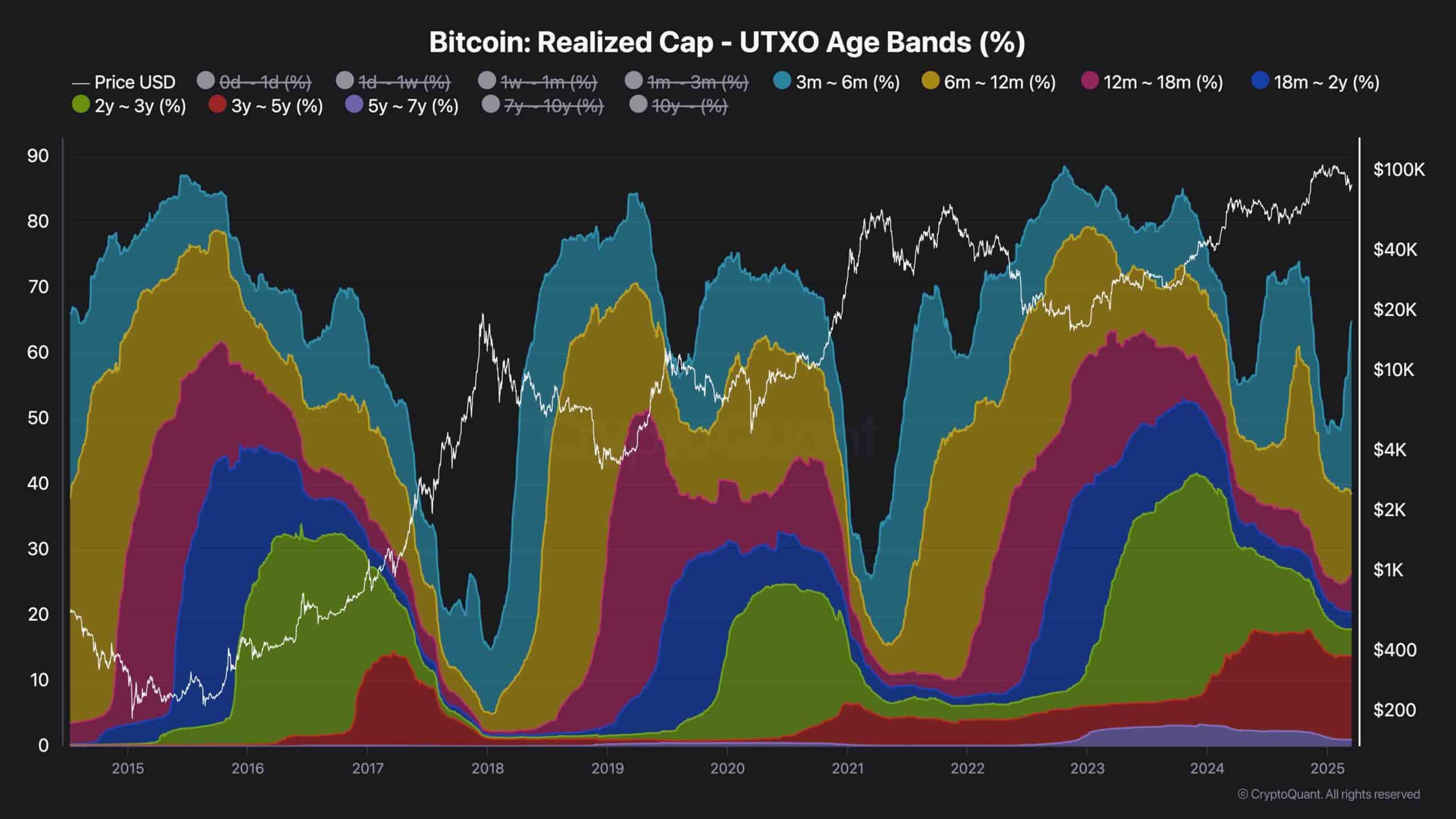

The Realized Cap UTXO Age Bands (%) is a valuable on-chain metric that illustrates the distribution percentage of Bitcoin based on the duration they have been held.

According to the latest data, the percentage of coins held for 3 to 6 months has been rising rapidly, mirroring the accumulation patterns observed during the prolonged correction in the summer of 2024. This trend highlights a holding sentiment, where investors refrain from selling their Bitcoin despite the current market correction.

Historically, this type of resilience among Bitcoin holders has played a crucial role in forming market bottoms and igniting new uptrends. As long-term holders continue accumulating, the available supply in circulation decreases, making Bitcoin more scarce. When demand eventually picks up, this supply squeeze often leads to price surges, pushing Bitcoin toward new record highs.

Given this behavior, the data suggests that Bitcoin’s current market phase is more of a healthy correction rather than the start of a prolonged bear market. Many market participants still view Bitcoin as a long-term valuable investment, reinforcing the potential for an eventual bullish continuation.

The post Bitcoin Price Analysis: This Key Resistance Could Prevent BTC’s Surge to $90K appeared first on CryptoPotato.