Bitcoin Price Analysis: The RSI At Its Lowest Since February 2019, New BTC Lows Coming Up?

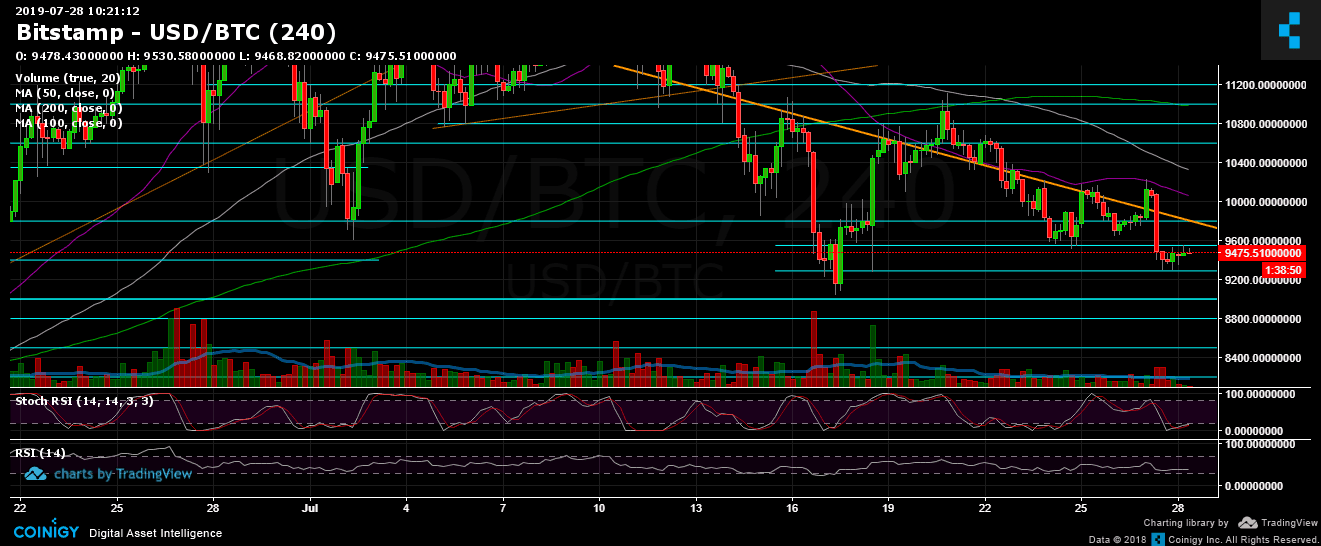

In our recent analysis, we had mentioned the fragility surrounding the current price action of Bitcoin, and we also added that the coin tends to move sharply during weekends (low volume, it’s much easier to manipulate the markets).

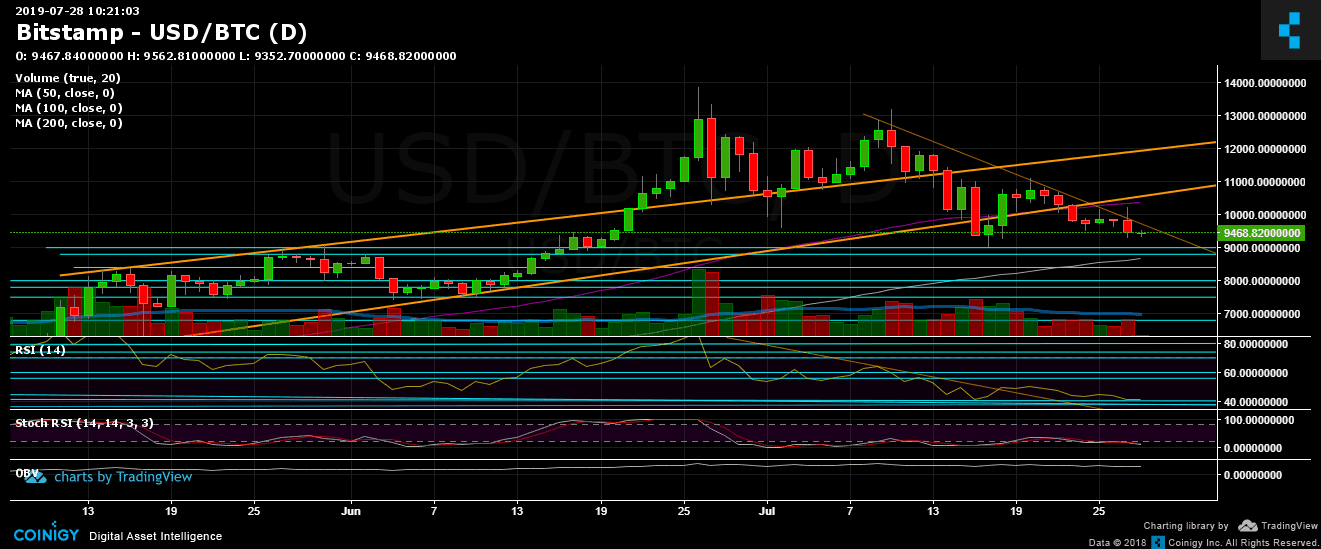

Looking on the daily chart, we can see that yesterday Bitcoin reached a daily high of nearly $10,200 (50-days moving average), which quickly turned into a false break-out of the mid-term descending trend-line (that trend line was started forming three weeks ago). An evidence to the fake breakout can be seen on the wick of yesterday’s red candle.

That fake breakout ended up as a long squeeze before plunging to mark the daily low at $9,289. This is not a coincidence; this is the low that was reached exactly ten days ago.

Since the severe plunge, Bitcoin is trading between the low mentioned above (~$9300), and the support turned resistance area around $9550. To my opinion, there are higher chances for Bitcoin to discover lower price areas before getting back on the bullish track (which is the longer-term sentiment).

The RSI At Its Lowest Since February

Looking on the daily chart’s RSI, which is hovering below the bullish territory for the past two weeks, the indicator is facing the 40 level, which is its lowest level since February 6 of this year.

The current price low, since the last parabolic uptrend started, stands approximately at $9,000. Not far from where BTC is trading as of writing this.

From below, there is an immediate target area to watch for, which contains decent demand. This is the $8500 – $9000 level: the above range includes the 100-days moving average line (marked in white), along with significant Fibonacci retracement long-term level (~$8500) and the support key-levels of $8800 and $8500.

However, since many analysts mentioned the $8,500 as a possible target for the short term, we might not reach there when everyone says something, the chances that it will happen decrease. Hence, I had mentioned $8,500 to $9,000. Added to the above, there is also the possibility to go lower than $8,500. Bitcoin tends to be unanticipated.

From the other side, since reaching the $13,880 yearly high, Bitcoin is moving in a tooth-style and producing lower highs and lower lows. If this continues, then there is also the chance to see another lower high (roughly below $10K) before getting below $9,000.

Total Market Cap: $263 billion

Bitcoin Market Cap: $169 billion

BTC Dominance Index: 64.4%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance:

Added to the above, from the bullish side, the $9550 area had become support turned resistance level. This, and the mid-term descending trend-line (marked with orange) is the first obstacle for Bitcoin in its short-term way to correct yesterday’s plunge. Higher above is the $9,800 – $10K resistance zone. Before getting to the 50-days moving average line – now around $10,300.

– Daily chart’s RSI: Discussed above.

– Trading Volume: The past week, Bitcoin’s trading volume is seeing monthly lows. The interest had declined, with Google Trends showing 50% decrease in searching for “Bitcoin.” Is this the calm before the storm?

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

The post Bitcoin Price Analysis: The RSI At Its Lowest Since February 2019, New BTC Lows Coming Up? appeared first on CryptoPotato.