Bitcoin Price Analysis: The Calm Before The Storm? BTC’s Trying To Maintain The Crucial Support Line

Over the past two days, we had seen the price of Bitcoin trading mainly under a very tight range between $8600 and $8700.

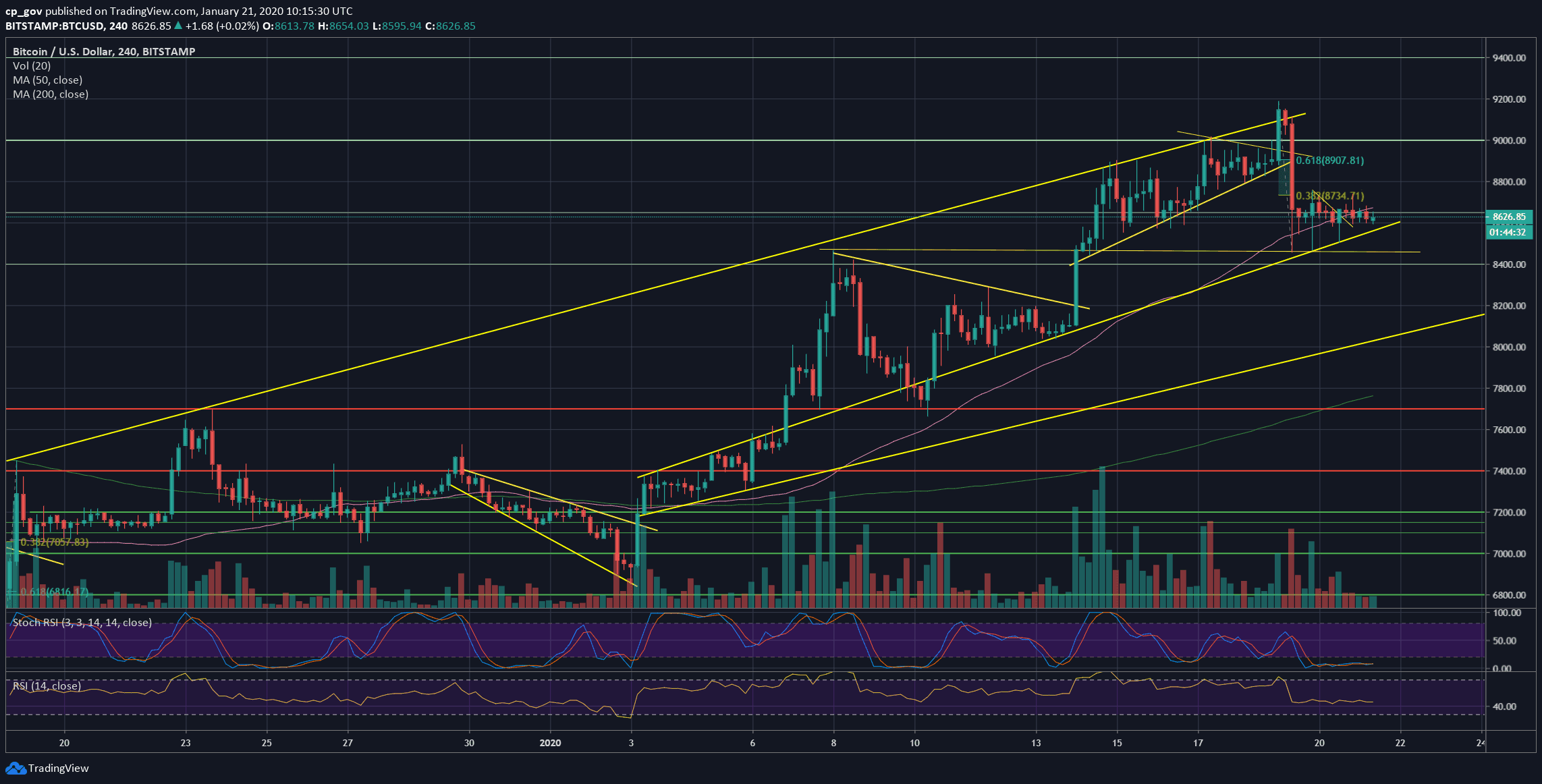

As a reminder of the recent price action, Bitcoin had gone through a decent rally since starting the new decade.

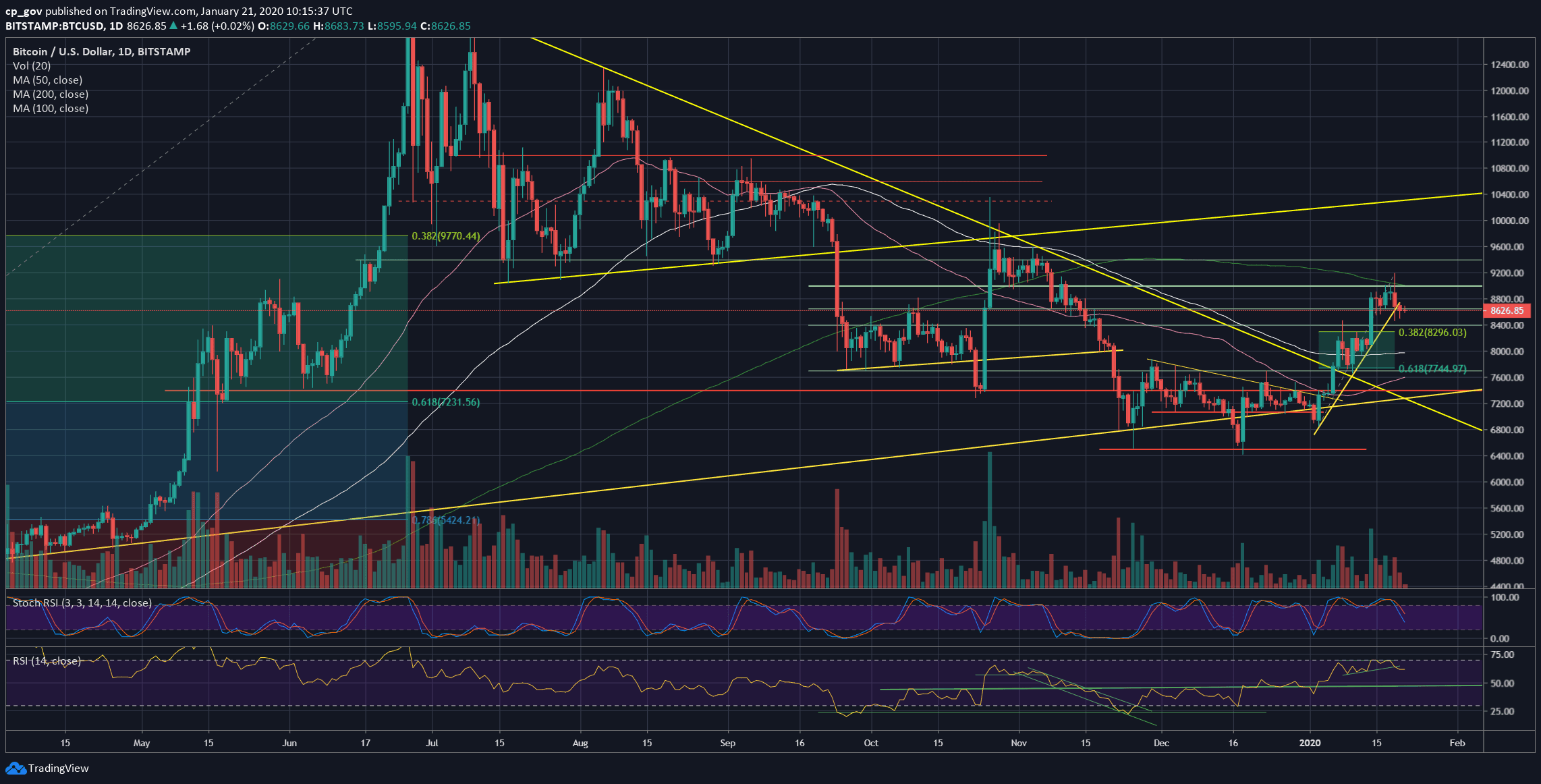

However, right after touching the significant 200-days moving average line (marked light green on the following daily chart), Bitcoin got rejected, plunged more than $700 intraday, and trading safely around the $8600 mark since then.

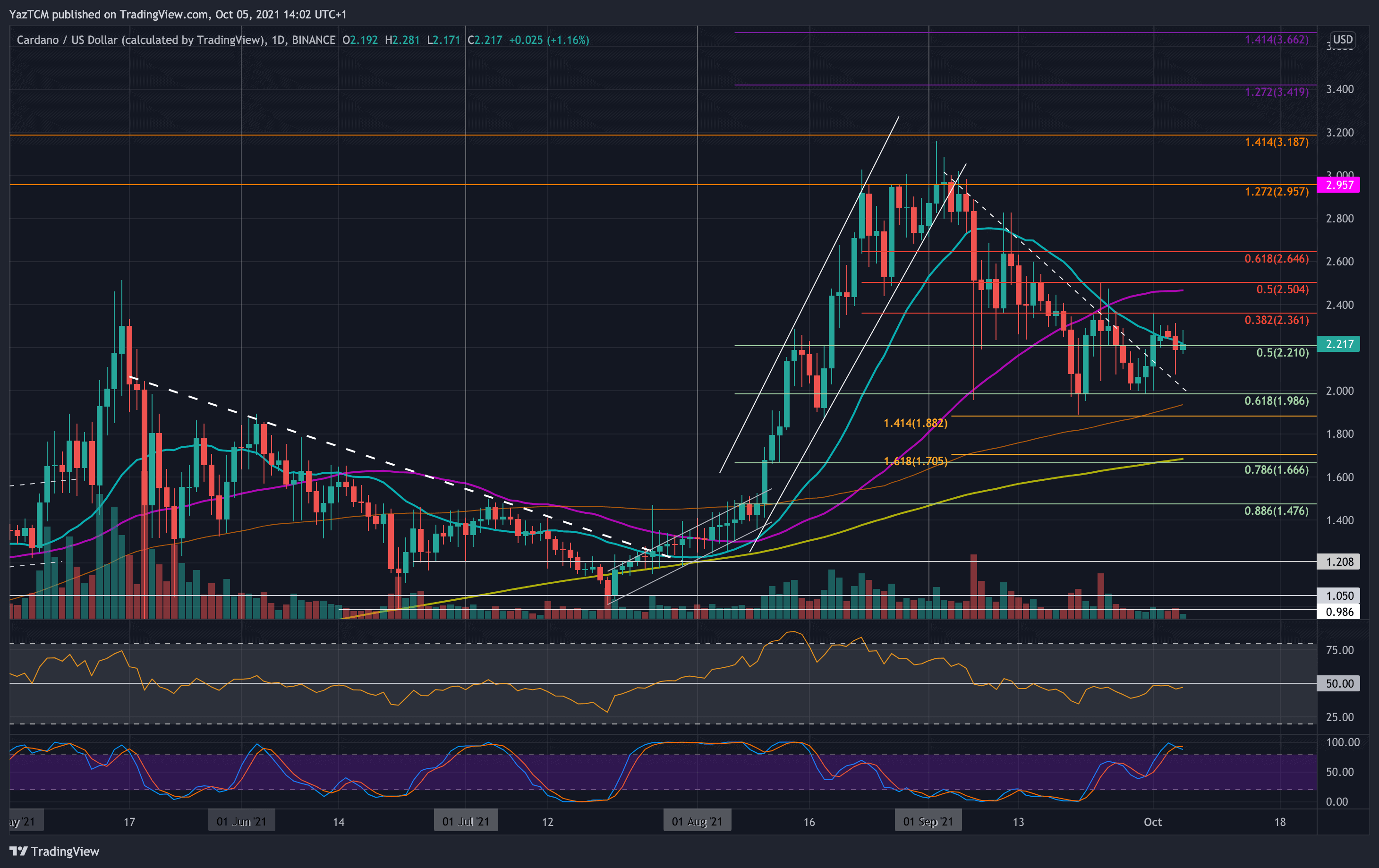

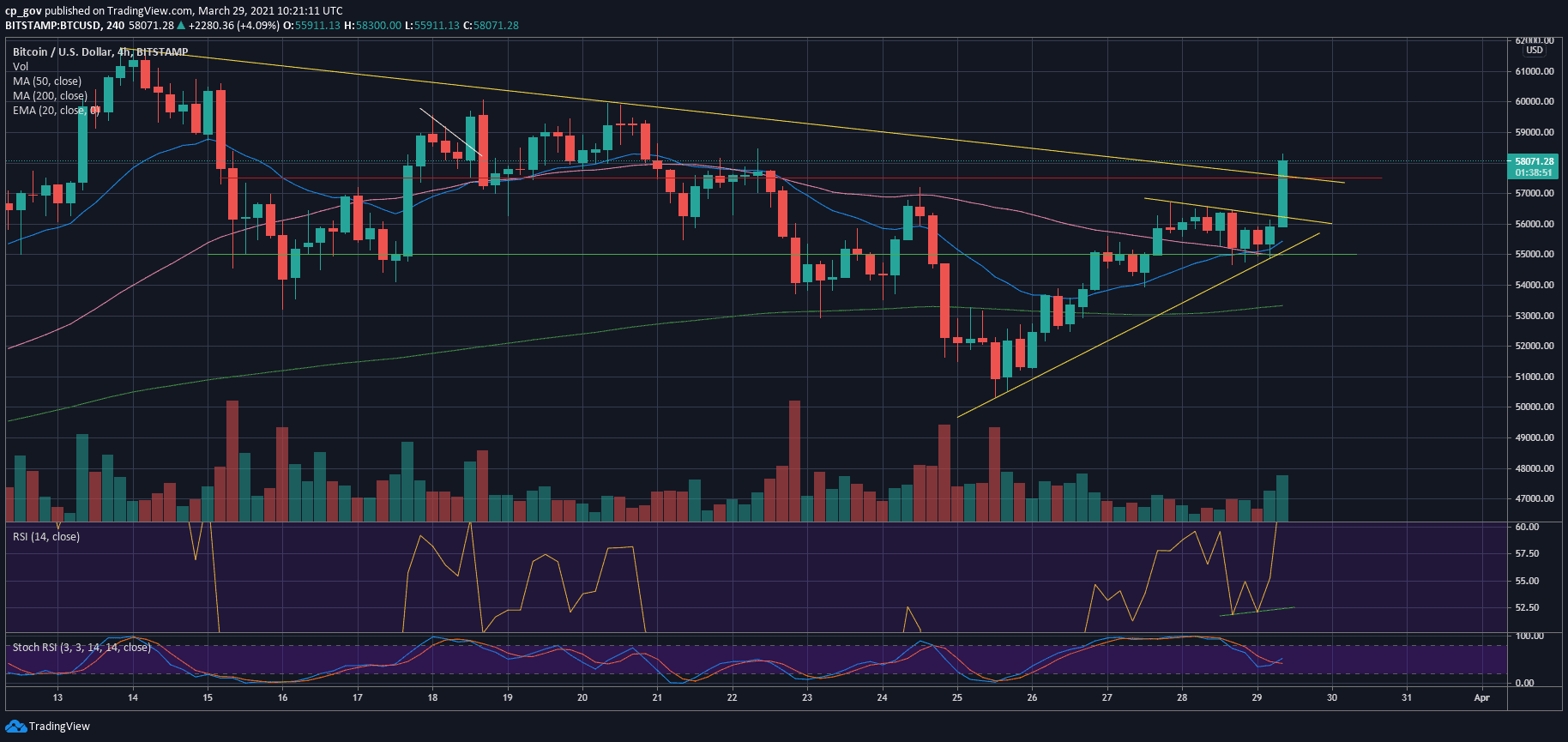

In the micro-level, we can see Bitcoin’s immediate correction reaching the 38.2% Fibonacci retracement level (~$8730) of the enormous price plunge, as can be seen on the following 4-hour chart.

Besides, the drop had reached the lower trend-line of the marked ascending channel on the 4-hour chart. Bitcoin respected that technical pattern since the beginning of the month.

Bitcoin Short-term’s Fragility

Usually, after a huge move like this, which is followed by a price consolidation period, another big move takes place. And this is precisely the situation here. Especially because Bitcoin is trading right by the lower marked trend-line.

The bulls would like to see Bitcoin finding support on top of the ascending line, and in general, not breaking the $8460 – $8600 range.

Total Market Cap: $238.7 billion

Bitcoin Market Cap: $157 billion

BTC Dominance Index: 65.8%

*Data by CoinGecko

Key Levels To Watch & Next Targets

– Support/Resistance levels: The bigger picture hadn’t changed since our previous analysis from two days ago.

The first line of support is the mentioned ascending trend-line (on the 4-hour chart). Further below is the double-bottom on the 4-hour’s chart, which is this week’s low at $8460.

A little below is the confluence zone of $8300 – $8400, along with the Fibonacci retracement level of 38.2% (of the January rise), before reaching the $8000 area, along with the 100-days moving average line (marked by white).

From above, $8730 – $8750 is still the first level of resistance Bitcoin will face (38.2% Fib level), which Bitcoin couldn’t overcome in the past two days. The next major resistance is $8900, along with the Golden Fib of 61.8%.

Further above is $9000, along with the most significant resistance at the current price area – the 200-days moving average line.

– The RSI Indicator: Following the recent price action, the RSI is showing some bearish signs, after breaking below the short-term ascending trend-line. The RSI is now facing support at 60.

The bearish momentum can also be seen in the Stochastic RSI oscillator, which is pointing lower following a crossover in the overbought territory.

– Trading volume: The recent price plunge didn’t carry a tremendous amount of volume, as compared to last month’s average volume levels. Yesterday ended with a relatively low amount of volume, maybe because of the holiday in the US.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

The post Bitcoin Price Analysis: The Calm Before The Storm? BTC’s Trying To Maintain The Crucial Support Line appeared first on CryptoPotato.