Bitcoin Price Analysis Sep.13: A short bear’s recess?

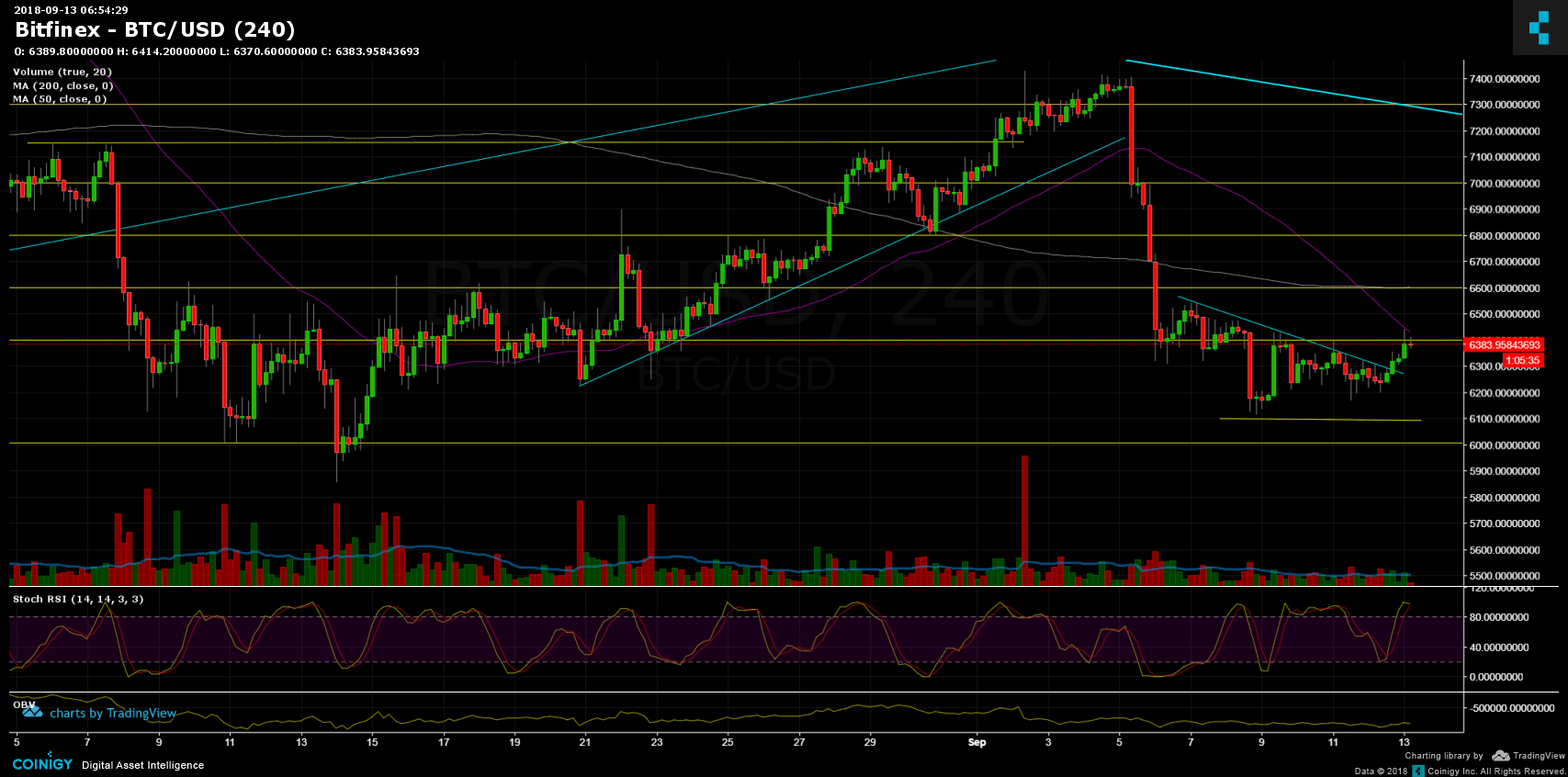

Following our previous price analysis, Bitcoin had breached out the descending trend line at $6270 for a nice green 4 hour candle up to re-test $6400 resistance level and moving average 50 days (purple line on the chart) at $6443 (BitFinex).

As of the recent hours, the current resistance level seems to halt BTC from continuing up to re-test the major $6600 level, where lies the important moving average 200 days (pink line).

The way up hasn’t been followed by decent amount of trading volume, what supports the option of a correction before re-testing $6000 zone. Also, RSI is at it’s high levels, though the market is overbought and might need a correction down in order to continue.

As mentioned before – cautious is needed! This kind of market is hard to trade with no real direction.

To Sum up

Resistance area at $6400 (moving average 50 days), and as mentioned $6600 strong resistance (moving average 200 days).

Support areas: $6300, $6100, $6000, $5700 – $5800 (yearly low – major support).

Bitcoin Prices: BTC/USD BitFinex 4 Hours chart

Cryptocurrency charts by TradingView. Technical analysis tools by Coinigy.

The post Bitcoin Price Analysis Sep.13: A short bear’s recess? appeared first on CryptoPotato.