Bitcoin Price Analysis: Range-Bound Market Tests Macro Milestones

Summary:

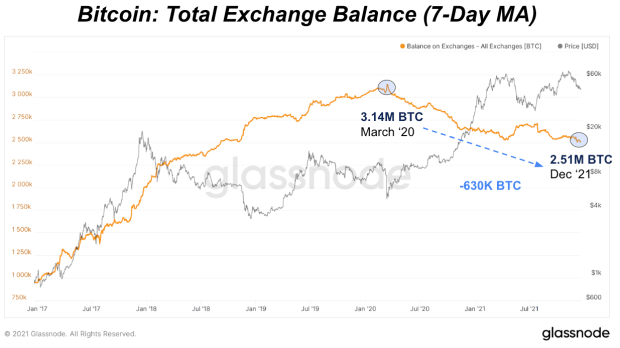

- Amid an otherwise uneventful market structure, bitcoin seems to be making a consolidation pattern known as a “head and shoulders bottom.” The pattern is still forming and is not yet actionable, but if it manages to break to the upside, it could push the market to retest its $12,500 high.

- The bulls really want to see a weekly close above the $10,300 level outlined in this video because that represents a strong weekly/monthly level. A close below this level would be a sign of potential bullish weakness and an inability to drive the market further.

- A failure to rally would mean the market is most likely going to retest support in the $9,000 zone.

Trading and investing in digital assets like bitcoin is highly speculative and comes with many risks. This price analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Inc sites do not necessarily reflect the opinion of BTC Inc. They should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.

The post Bitcoin Price Analysis: Range-Bound Market Tests Macro Milestones appeared first on Bitcoin Magazine.