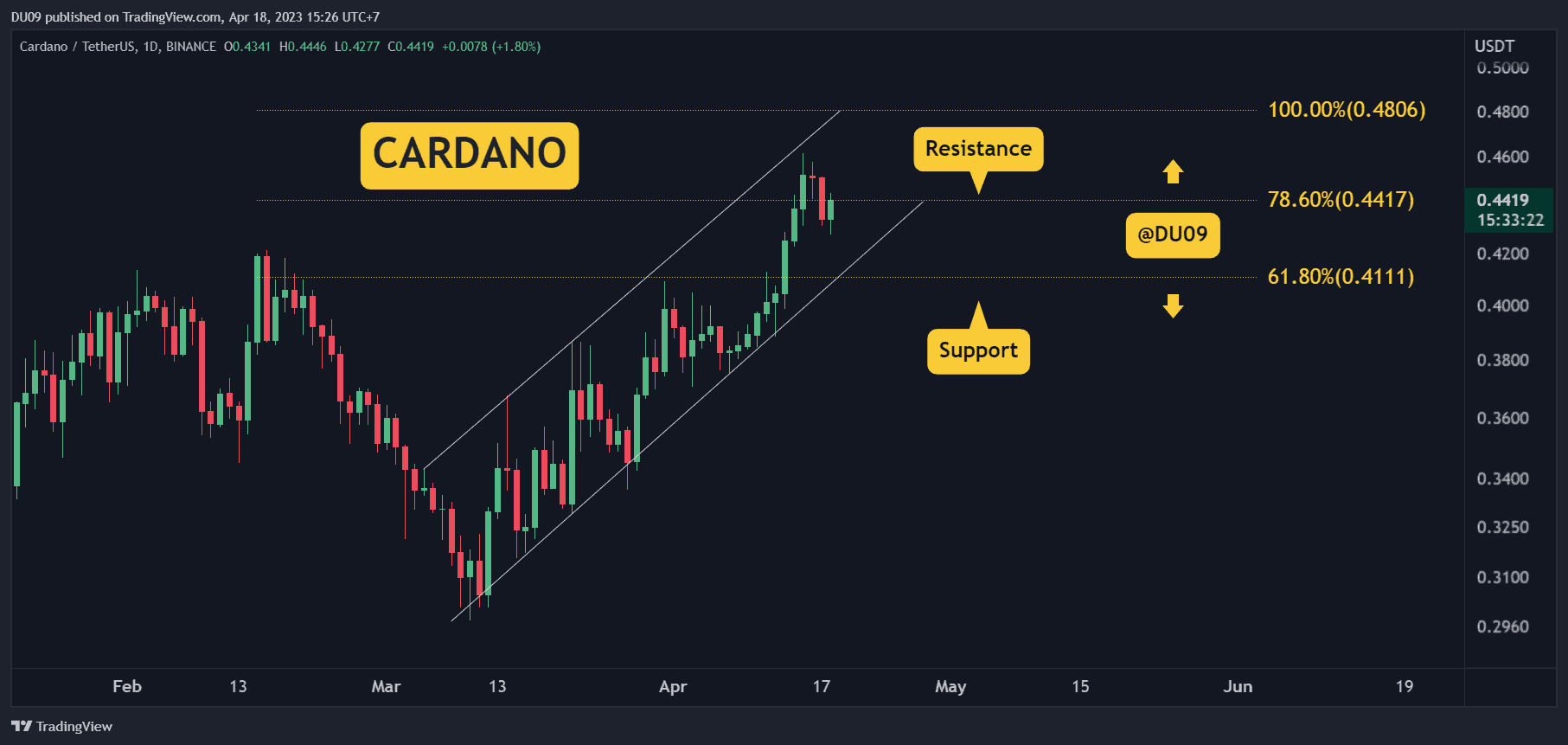

Bitcoin Price Analysis Nov.8: First Signs of Bullishness

On our previous BTC price analysis, we’ve mentioned the significant bullish signal which is the RSI breakout on the daily chart.

It hasn’t been long till Bitcoin passed $6500, for the first time since October 11. What might also contribute to the bullish environment is the increasing trading volume coming from South Korea. South Korean exchanges had a major role in the latest bull-run at the end of 2017.

The 4-Hours chart:

- Bitcoin looks positive: Rising trading volume, and the breakout of the populated-zone of resistance (including the three moving average lines – 50, 100 and 200 days MA). But, I would look for creating a higher low right here (around $6500) before a possible continue upwards.

- Currently, BTC is facing the next major resistance area at $6500 – $6530. The next resistance levels lie at $6650 and $6800.

- From the bear side, resistance-turned support area at $6350 – $6430 including the above three moving average lines and the ascending trend-line. Further support level lies at $6250 and $6100.

- BitFinex has now 21K BTC open short positions. The number had reduced a bit since our last update.

BTC/USD BitStamp 4 Hours chart

Cryptocurrency charts by TradingView. Technical analysis tools by Coinigy.

Cryptocurrency charts by TradingView. Technical analysis tools by Coinigy.

The post Bitcoin Price Analysis Nov.8: First Signs of Bullishness appeared first on CryptoPotato.