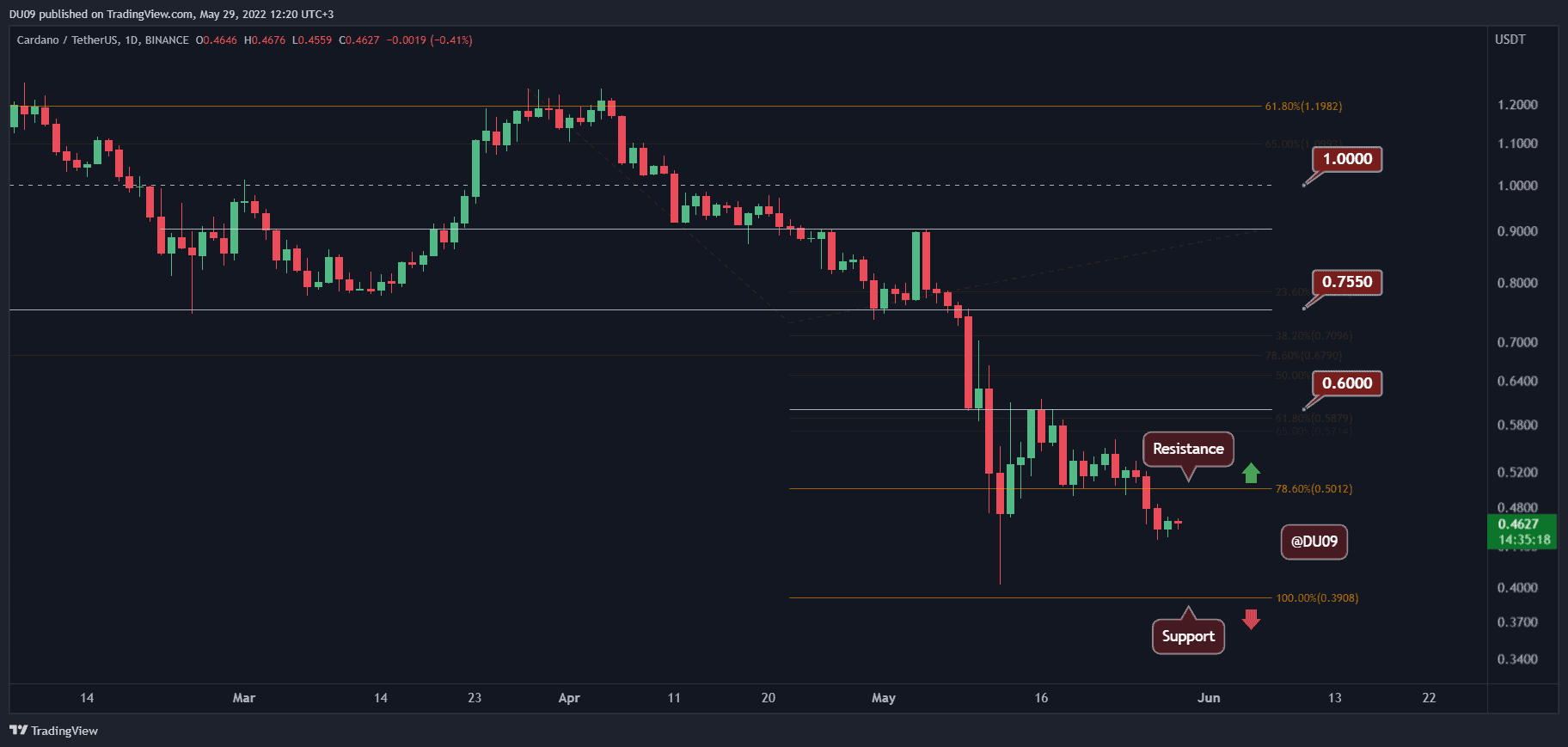

Bitcoin Price Analysis Nov.26: First signs of a reversal in a critical level

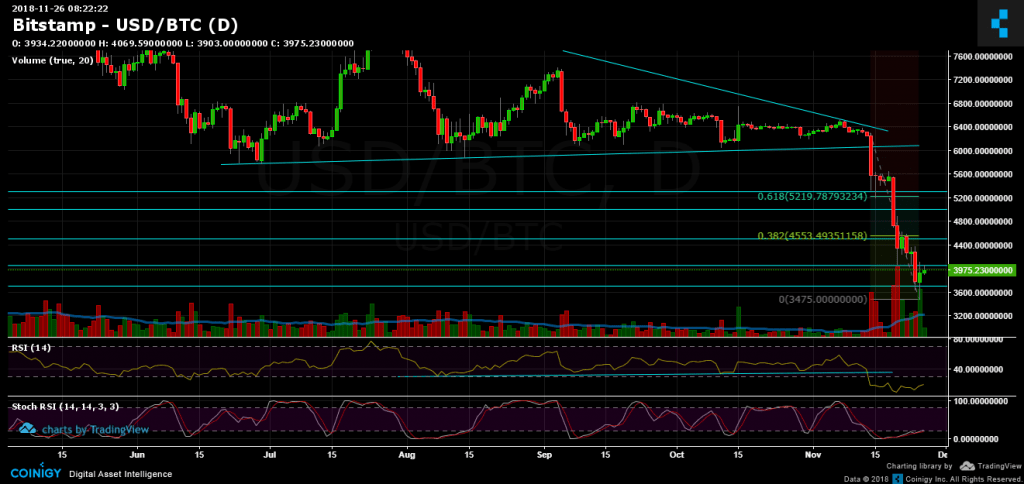

Since our yesterday’s analysis, Bitcoin had conquered a new yearly low at $3470 (Bitstamp). This is about 83% decrease from BTC’s all-time high (!). Is that enough for now? Maybe.

When we see such violence to any side, we could expect another violence, this time to the opposing side: In a 5-hour move, Bitcoin gained more than $500, back to re-test the support turned resistance level of the $4K area. We mentioned that in our yesterday’s analysis:

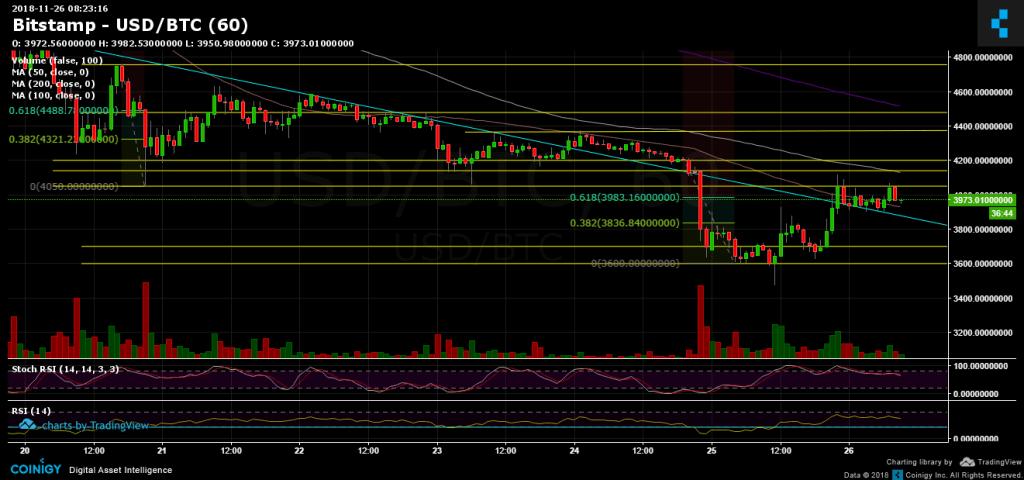

Breaking the $3700 is likely to send Bitcoin to Fibonacci retracement levels: ~$3830 (38.2%) and ~$4000 (support-turned resistance along with Fib level 61.8%).

Over the past few hours, Bitcoin is consolidating between the above resistance level on top of the 50 days moving average line (marked in orange).

Is the blood over yet? Too early to tell. Bitcoin is still under bear market, and so far this is just a deeper correction to the severe declines since breaking down the $6K mark.

Looking at the 1-day chart & 1-hour chart

- First signs of reversal: By looking at the hourly chart, we see higher green candles (buyers) than red ones (sellers). In a healthy growing market, there are more buyers than sellers. Are the buyers finally back? Too early to tell, but by the last day – it seems like that.

- More than that, the daily candle ended green in a Doji shape. This is also a bullish pattern.

- In case of breaking the $4K resistance mark, there is a possibility of testing the $4550 area. The above is the Fibonacci retracement level %38.2. I wouldn’t consider the market as bullish till breaking the above level with an impressive amount of volume.

- But there is always the other option: If Bitcoin fails to break the $4K, it could quickly lose momentum, and the bears will get back to work: From below there are the $3500, $3300 and the significant resistance level at $3000.

- The RSI indicator of the daily chart still has some room to climb up to get out of the bearish area. Stochastic RSI had crossed in the oversold level a couple of days ago – this may leave some space for BTC to go up.

- BitFinex open short positions have declined to around 30K, after yesterday’s daily high at 35K.

BTC/USD BitStamp 1-Hour chart

BTC/USD BitStamp 1-Day chart

Cryptocurrency charts by TradingView. Technical analysis tools by Coinigy.

The post Bitcoin Price Analysis Nov.26: First signs of a reversal in a critical level appeared first on CryptoPotato.