Bitcoin Price Analysis May 5: BTC Struggles With The Critical $5800 Level – Weekly Overview

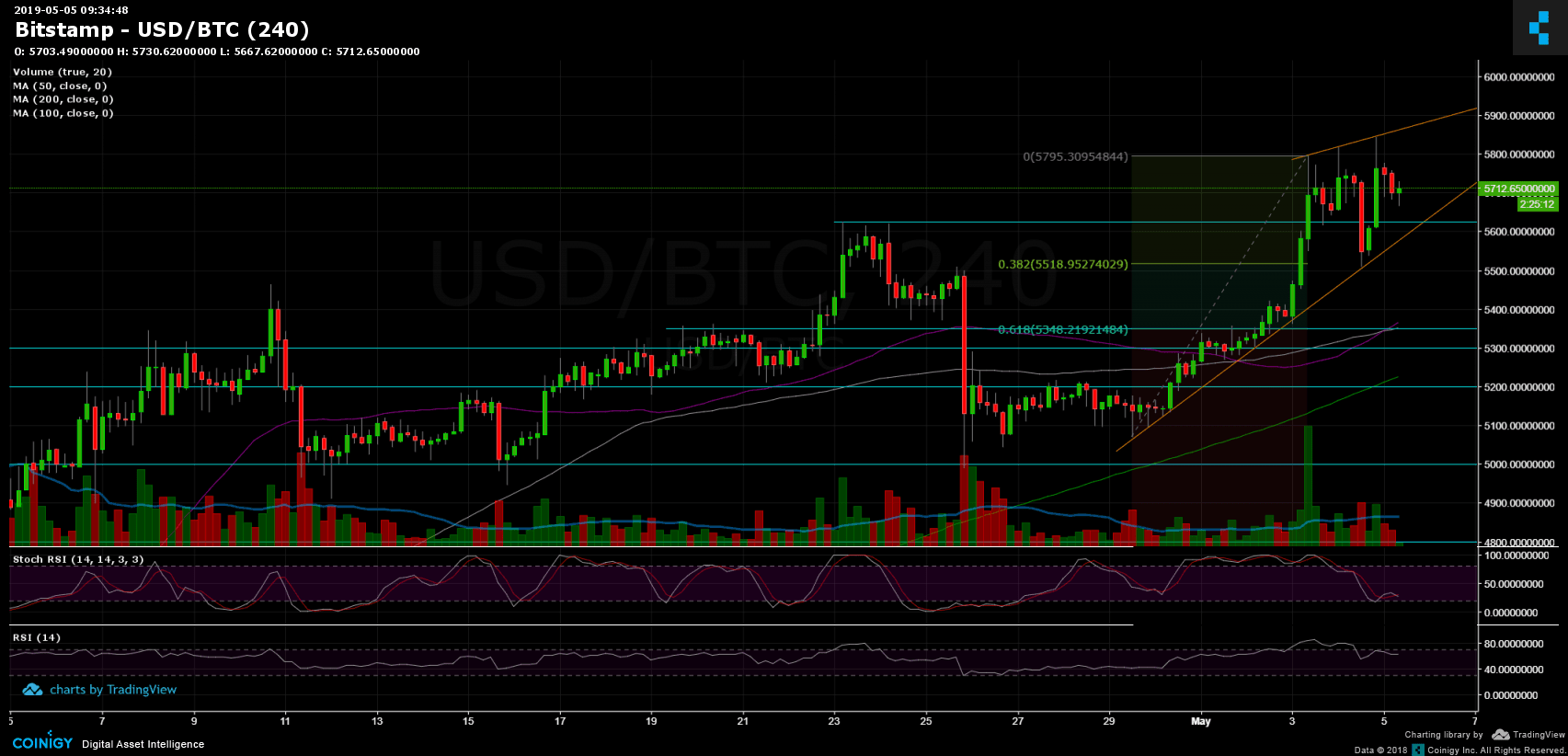

Since our previous analysis, Bitcoin had gone through some typical volatility: After recording its 2019 high, the coin quickly lost momentum, dropped to ~$5500 (38.2% Fibonacci retracement level) and found there proper support to recover.

From there, Bitcoin hadn’t calmed down, recording another 2019 high at $5846 (Bitstamp). As of writing this, Bitcoin is trading around $5700.

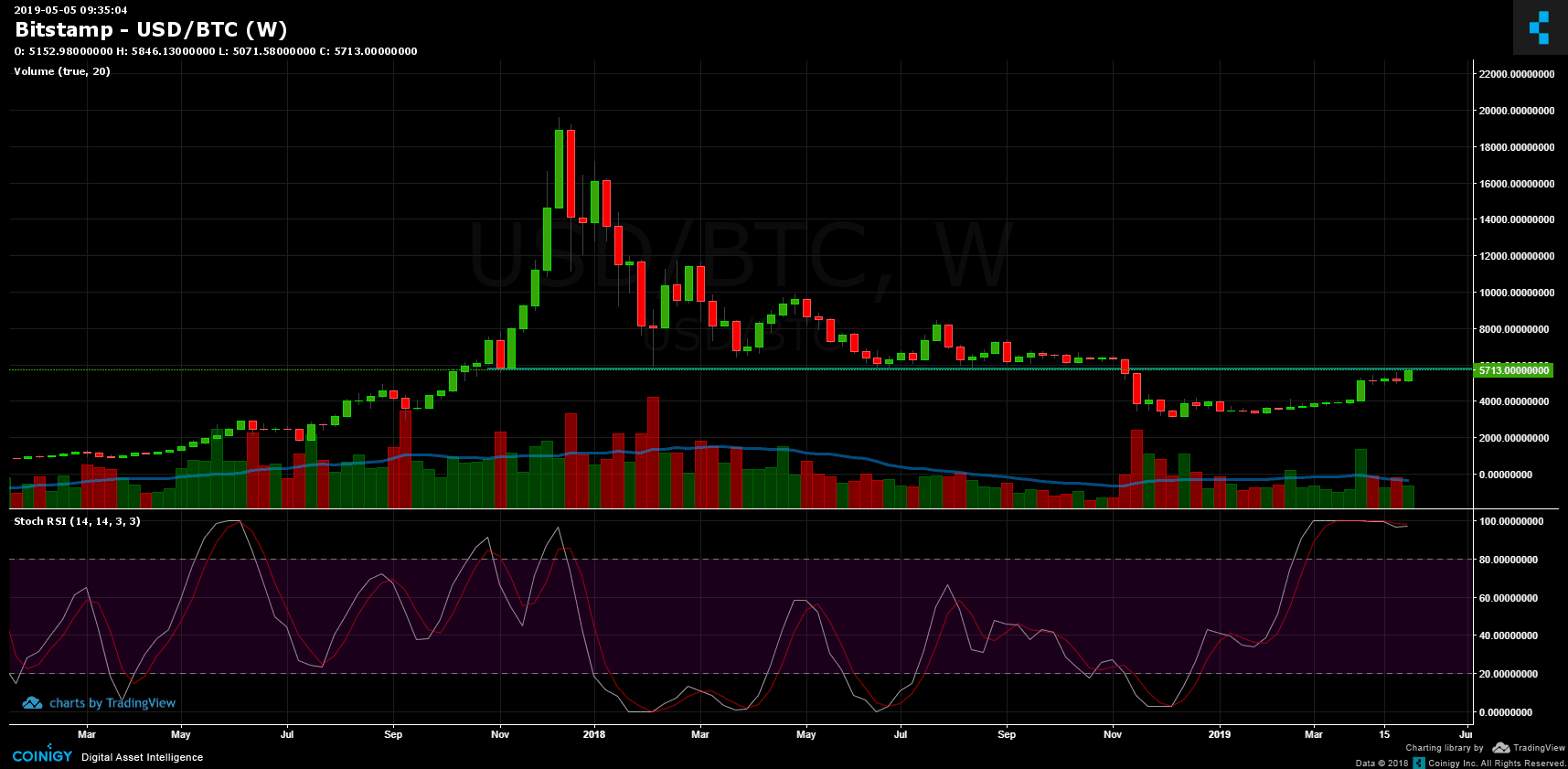

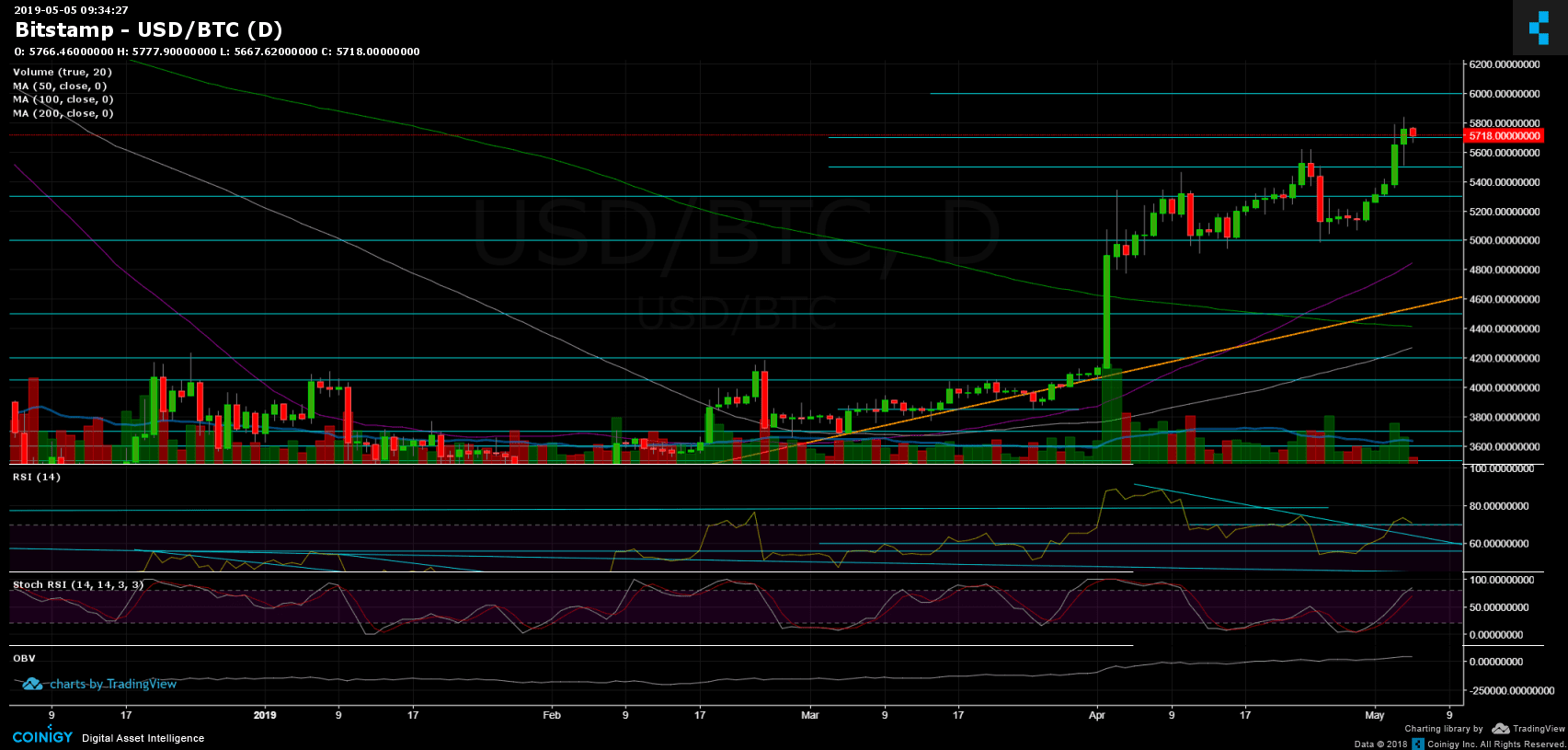

Today is an excellent opportunity to take a look at the weekly BTC chart. As seen below, and mentioned in our previous analysis, the $5700 – $5800 (or $6000 area) will probably won’t be so easy for Bitcoin to overcome.

Add to it the Stochastic RSI oscillator, which had recently seen a crossover at the overbought area. The last time this had happened was during December 2017, while Bitcoin was trading for $14,000.

Total Market Cap: $183.5 Billion

Bitcoin Market Cap: $102.2 Billion

BTC Dominance: 55.7%

Looking at the 1-day & 4-hour charts

– Support/Resistance:

As mentioned above, Bitcoin is now facing the crucial $5700 – $5800 resistance zone. The last was the support barrier from 2018, before finally breaking down (and we all remember what had happened). To my opinion, this should be serving as a tight resistance area, however, in the case of a break-up, the next targets for BTC will be $5900 – $6000 area, before reaching to the significant $6200 level.

From below, as shown on the 4-hour chart, the nearest support is the ascending trend-line (marked in orange), along with the last high at $5625. Below lies the $5500 area, $5400 and the strong resistance turned support $5300 – $5350. Further below is $5200 and $5000.

– Trading Volume: as been said here before, the recent fabulous surge was not followed by the volume levels we could have been expecting. It might be due to the weekend and Holidays.

– Daily chart’s RSI: Following the breakout of the 70 RSI level, we recently see that the indicator is currently retesting it as support. We will also mention (again) the negative divergence in the daily chart’s RSI, which could easily turn into a bearish sign.

– BitFinex open short positions: there hasn’t been much change – still 30.5K BTC open short positions.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

The post Bitcoin Price Analysis May 5: BTC Struggles With The Critical $5800 Level – Weekly Overview appeared first on CryptoPotato.