Bitcoin Price Analysis: Is the Dip Below $60K Following Highest Weekly Close a Worrying Sign for the Bulls?

It’s been a challenging day for crypto bulls as the price of almost every single cryptocurrency from the top 50 is in the red on a 24-hour scale. The same is true for Bitcoin.

BTC’s price plunged to an intraday low of $58,500 on Bitstamp but has since recovered to around $60,100, where it currently trades. Still, it’s down almost 8% in the past 24 hours, dipping below the important level of $60K.

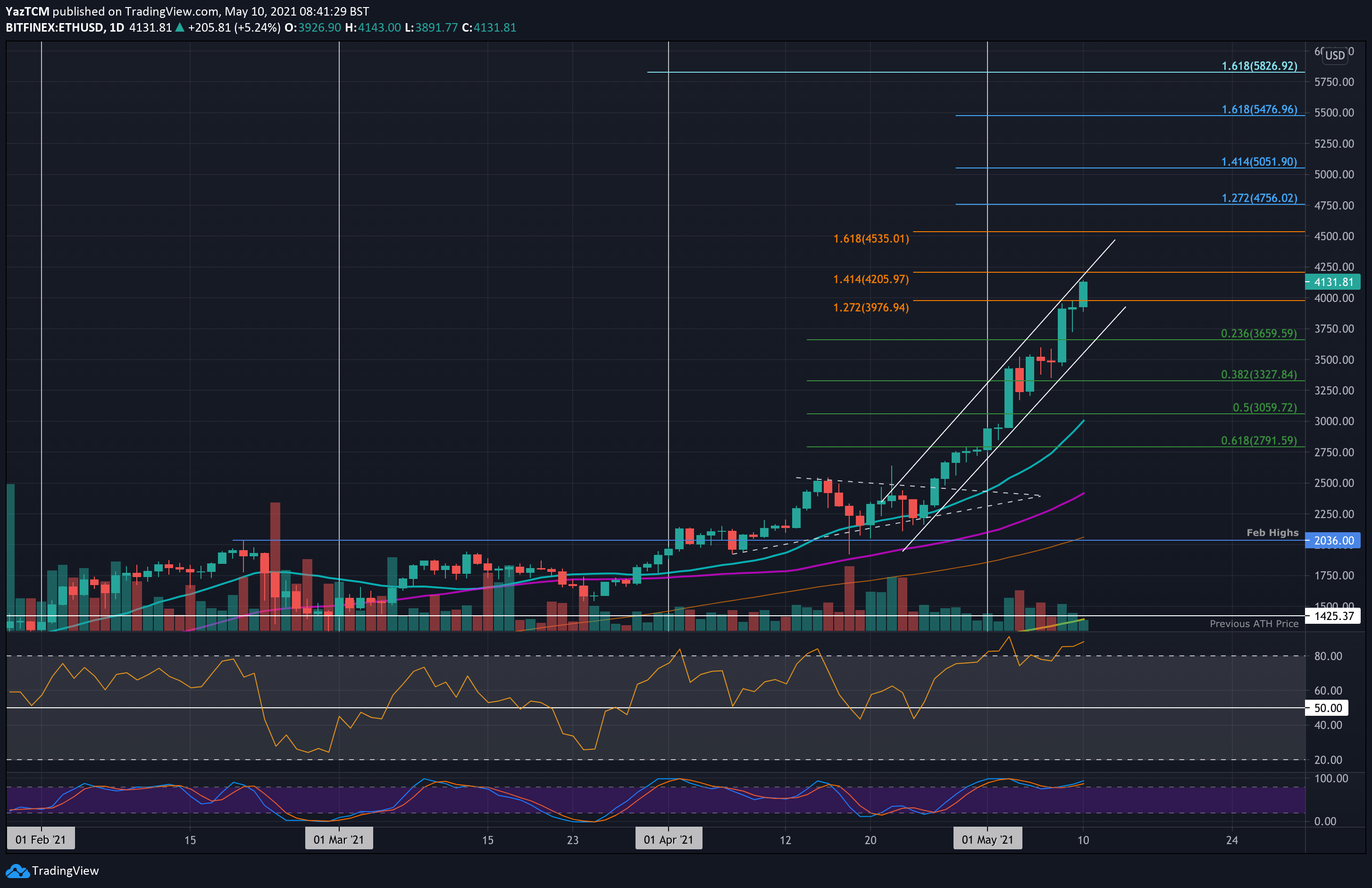

The Technicals

Well-known Bitcoin on-chain analyst Daniel Joe doesn’t seem too concerned and attributes the current dip to a few different things.

First things first, before coming to any serious conclusions, he noted that we need to see where the BTC price will close. The 50-day MA was tested, but buyers stepped in decisively, and we’re currently seeing the recovery bounce.

This pullback can be construed as an intraweek dip below $64.8K which was the previous all-time high. As it is, though, it remains particularly important for the price to push back above this level for the weekly close.

Key support levels are found at $60K, $58.7K, and $57.1K.

The On-Chain

From an on-chain perspective, Joe notes that there was no aggressive distribution from long-term holders today. Miners are also not selling this pullback aggressively.

The spot inflows did increase slightly today, which also caused the reserves to trend a bit higher – a potential sign of caution for the short term. However, the analyst remains bullish for the medium and long-term and considers this a buying opportunity.

I am buying the BTC dip between $60K to $57.1k. There’s some nenar-term uncertainty, but the bullish macro trend on BTC has not changed (bullish on this decade). I’m looking to protect and grow multi-generational wealth. I’m excited to see dips, small or big. – He notes.

Yet, it’s also worth noting that Joe did wave a flag of worry.

3-to-5-year, 18m-to-2-year, and 12m-to-18m BTC cohort has been lightly distributed during the pullback. Not ideal to see, especially with price falling. Lots of BTC longs getting liquidated today, with an intraday drop below $60K.

The analyst also noted that some of the reasons for the current pullback include the liquidation of leveraged long positions, the rising dollar, elevated overall leverage, stocks hitting major technical targets, overbought conditions, as well as the fear of Mt. Gox distribution.