Bitcoin Price Analysis Following the $2,000 Plunge: Can the Ascending Support Line Stop the Bleeding?

Just yesterday, following the impressive BTC price rally to over $13,000, I cautioned:

“Such volatility can trigger deep corrections, and a 10% surge can quickly lead to a move of that size in the bearish direction.”

Unfortunately for the bulls, this is precisely what happened. Bitcoin saw a $2,000 daily turnover marking $11,000 as its current daily low (and the price area as of writing this update).

Things are changing very quickly: The volatility level is extreme. An important trading tip on such crazy days is to not trade too much, especially in foggy conditions like these. The mood can quickly change at any given moment. However, some key levels are critical in the short term:

Total Market Cap: $307 billion

Bitcoin Market Cap: $200 billion (Bitcoin is back to the $200 billion level, having declined by 15% in the past day)

BTC Dominance Index: 65.1%

*Data from CoinGecko

Key Levels to Watch

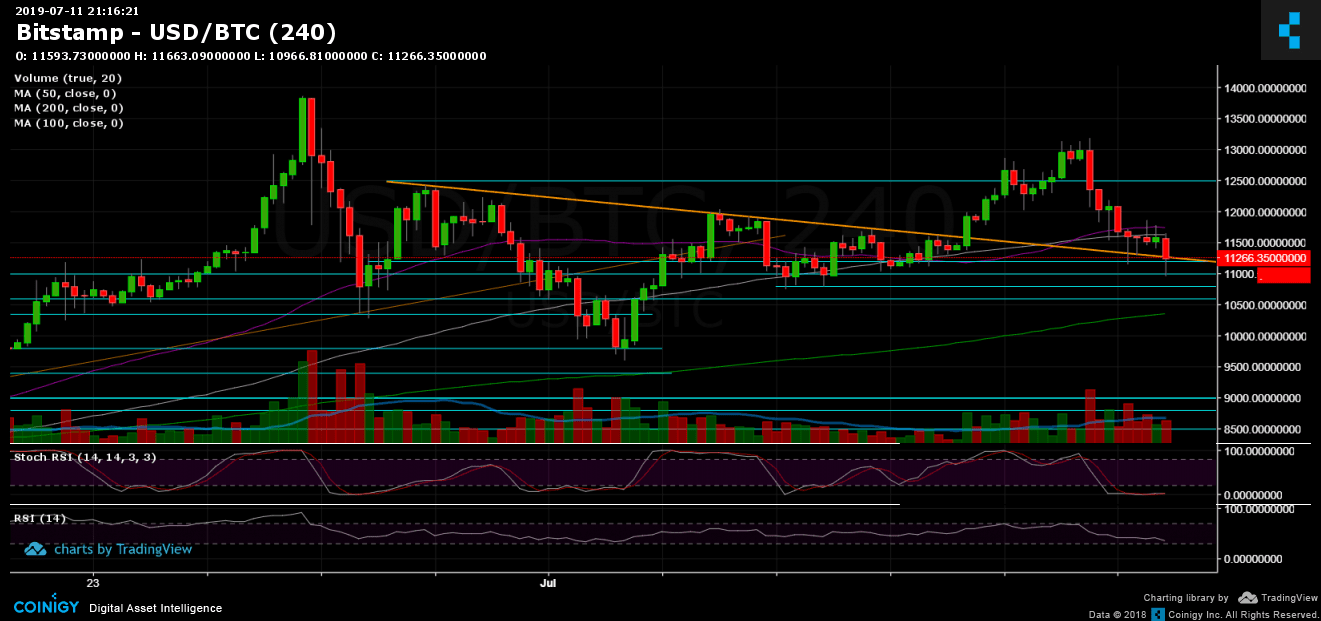

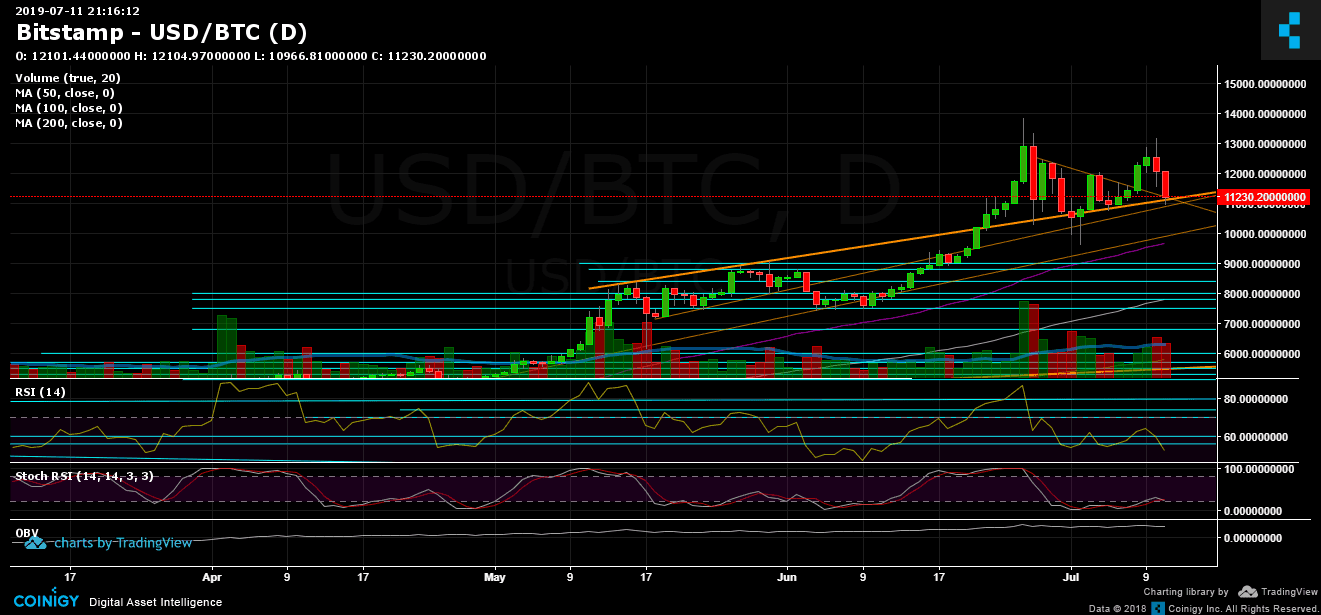

Support/Resistance: Following the red horror candle we saw on the daily chart, Bitcoin is now struggling at the $11,000 support area, along with the mid-term ascending trend line that started forming in the middle of May (marked in orange on the daily chart). A breakdown here and the next support levels lie at $10,800, $10,600, $10,300 (along with the MA-200 on the 4-hour chart) and $10,000. Below $10K, there are two critical levels to watch: $9,600, which is the low from ten days ago, and $9,400 – a significant support level from the previous double-top in June.

$9,600 is the key level here, in my opinion. Break below it, and a new lower low will be created that might change the trend for the longer term.

From above, we note the support-turned-resistance levels of $11,200, $11,500 – $11,600, $12,000 and $12,500. Above $12,500 is the high that was reached yesterday at $13,000 – $13,200.

Daily chart’s RSI: Things get choppy very quickly here too. The RSI is currently facing the 50 area. This is the lowest level it has been since Bitcoin was trading for under $8,000. The RSI could turn bearish very quickly, unless the momentum returns soon to lift the RSI above the 55 support-turned-resistance level.

Trading Volume: A huge amount of volume has followed the past two bloody days. This has come after the nice green volume of the past week. Momentum can change very quickly, as mentioned above.

Bitfinex open short positions: Another odd drop in the shorts has taken place since yesterday, as 63% of the open positions were closed. This could be related to today’s unscheduled Bitfinex offline period. However, this could also turn into a long squeeze.

BTC/USD Bitstamp 4-Hour Chart

BTC/USD Bitstamp 1-Day Chart

The post Bitcoin Price Analysis Following the $2,000 Plunge: Can the Ascending Support Line Stop the Bleeding? appeared first on CryptoPotato.