Bitcoin Price Analysis: Following $2500 Correction, Will BTC Retest $34K Before a New ATH?

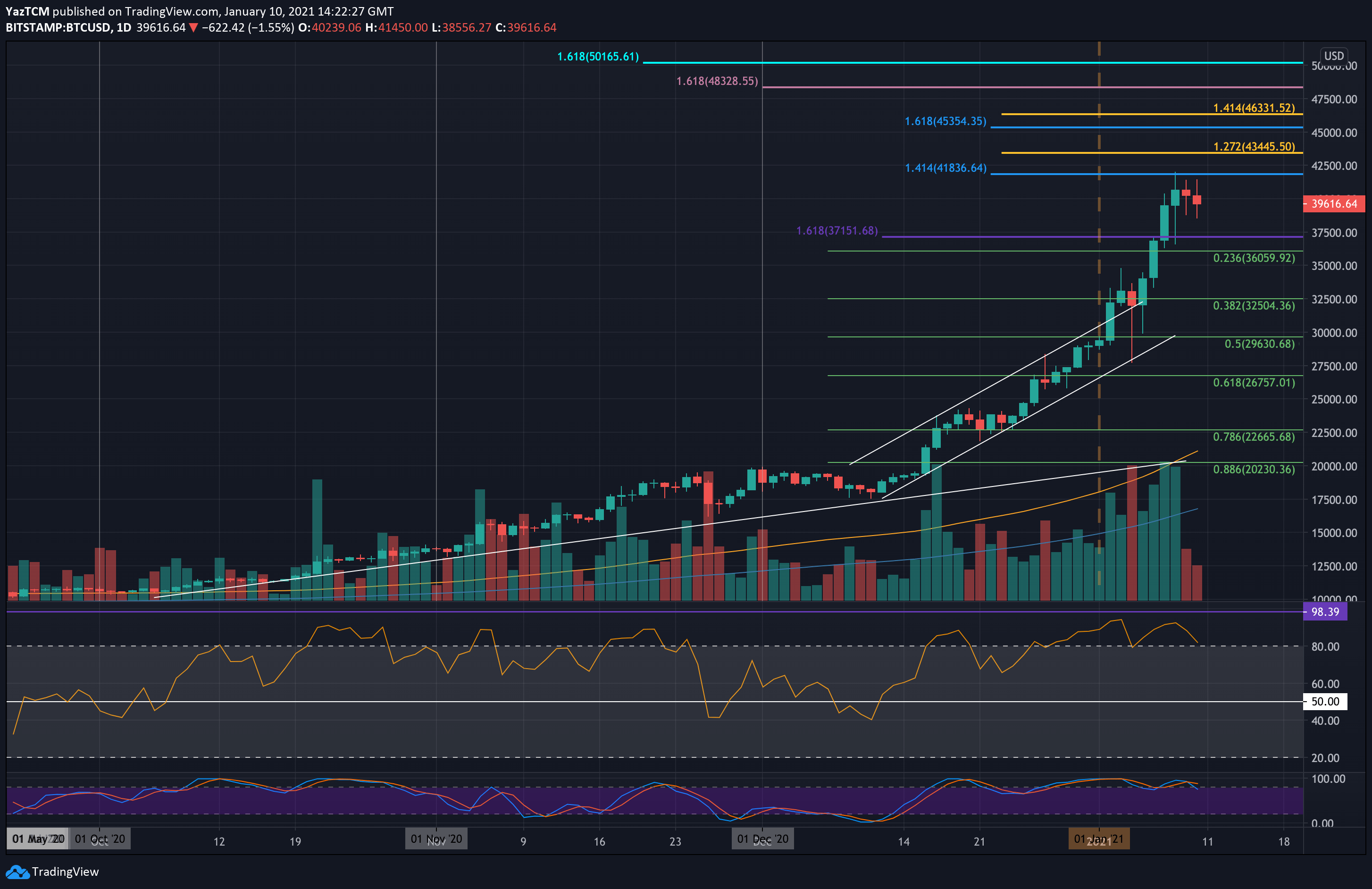

After setting the current all-time high level at $42,000, according to Bitstamp, Bitcoin price saw a retracement to the $38K – $39K area followed by a quick recovery back above $40K over the weekend.

However, despite reaching $41K earlier today, Bitcoin had plunged to a current low of $38,555 (Bitstamp) before recovering slightly to where it is trading right now – $39,500.

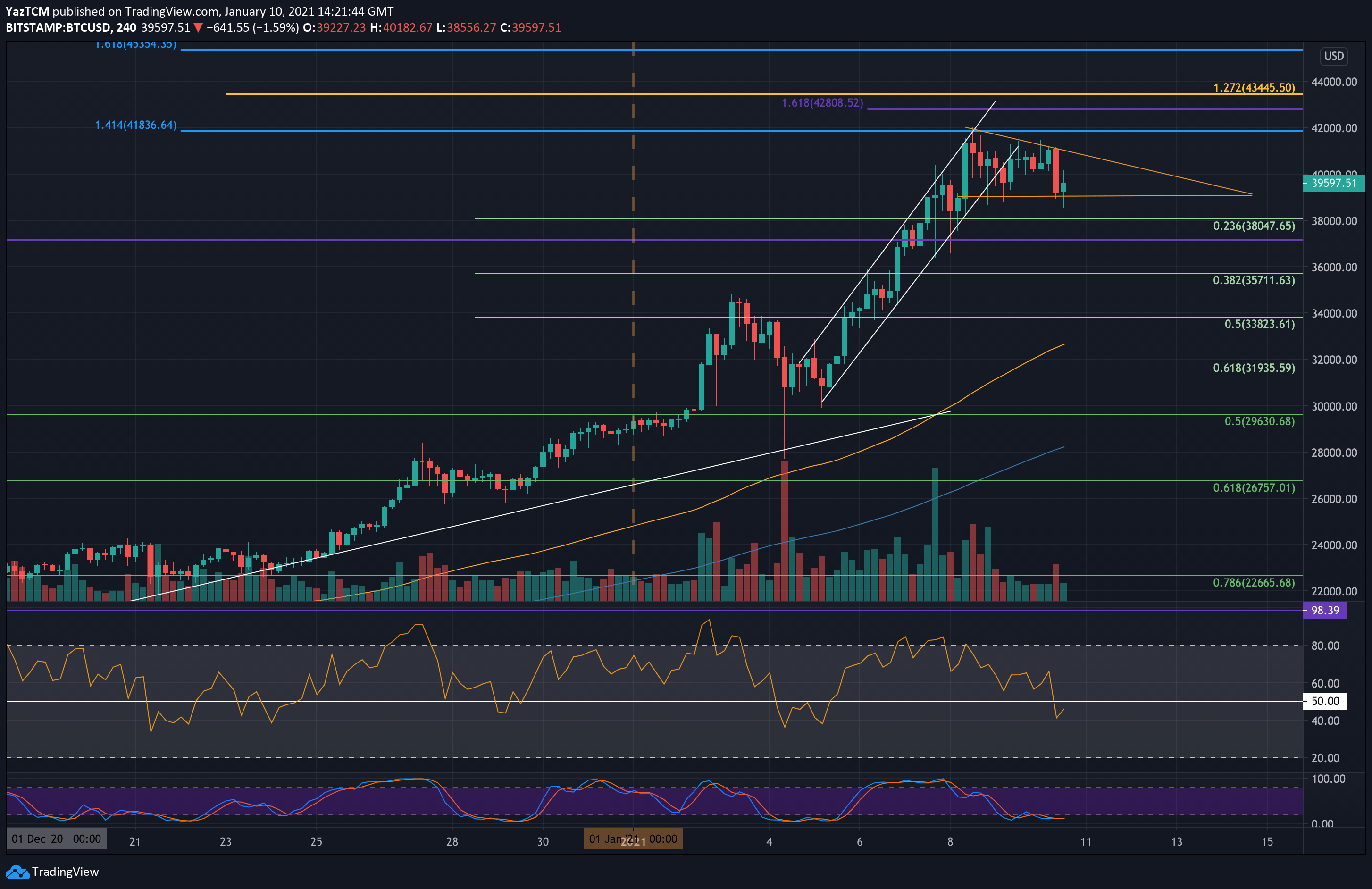

Looking at the bigger picture and as shown on the following 4-hour chart, Bitcoin had broken below the rising channel and is currently forming a bearish triangle.

We saw such triangle formation right before breaking above $32K. but Can Bitcoin repeat the same pattern now – at $42K – and break upside, or is Bitcoin set for a deeper correction toward $34K?

The breakout direction of this descending triangle will determine where BTC will be heading next over the coming days. A break beneath the lower boundary is likely to allow BTC to see a retracement from the massive price surge it witnessed over the past month, with a possible target of $34K.

On the other side, a break above is likely to allow BTC to set new all-time highs over $42,000 and go beyond, maybe for a similar move, similar to the one that took place when BTC broke above $32K.

BTC Price Support and Resistance Levels to Watch

Key Support Levels: $39,000 – $38,500 (today’s low and triangles bottom), $37,150, $36,000, $35,170, $34,000.

Key Resistance Levels: $40,000, $41,000, $42,000 (ATH), $42,800, $45,445, $45,000.

The first two resistance levels lie at $40,000 and the upper border of the triangle, which is the descending trend-line.

Above the triangle, resistance lies resistance at $42,000, which is the current ATH. This is followed by $42,800 (short term 1.618 Fib Extension), $43,445 (1.272 Fib Extension – yellow), $45,000, $45,350 (1.618 Fib Extension – blue), and $45,330 (1.414 Fib Extension – yellow).

On the other side, the first level of support lies at the base of the triangle ($38,500 – $39,000). This is followed by $38,000 (short term .236 Fib), $37,150, $36,000 (.236 Fib), $35,710 (short term .382 Fib), and $34K – $33,823 (bearish traingle target and short term .5 Fib).

Moreover, in favor of the bears: The daily RSI is now showing signs of bearish divergence. As price made higher highs during this week, the RSI failed to make a higher high – leading to the divergence, as the bullish momentum weakens.

The RSI has dropped beneath the mid-line on the shorter timeframe, indicating short term bearish momentum is seeping into the market. However, the middle and long term are still very bullish, even when considering a further correction.

Bitstamp BTC/USD Daily Chart

Bitstamp BTC/USD 4-Hour Chart