Bitcoin Price Analysis: Despite Slight Retracement, is $70K In Sight for BTC?

Bitcoin continues with the technical breakout above $64.8K. It’s also worth noting that, from a macro perspective, the SPX recently reached a major technical target at 4710, struggling to close about it, and is also overextended to the upside with overbought conditions seen in the near-term.

These temporary weaknesses in the stock markets could also pressure BTC, but the bullish on-chain metrics suggest that the cryptocurrency’s breakout is likely to continue towards $70K and $80K.

The Technicals

The cup-and-handle pattern looks complete, with multiple daily closes above $64.8K. It’s now important to see $64.8K flipped into support and for it to hold on to all backtests. A weekly close above the level would be an important confirmation for the breakout. Essentially, this is what matters the most at the time of this writing – the intraweek moves above a key level don’t mean as much as the weekly close above said level.

There momentum on the higher timeframe charts, such as the 3-day, weekly, and bi-weekly, is bullish, and this confirms the long-term bull thesis for BTC’s price.

If it’s able to make multiple successful closes above $64.8K, we can expect further upside towards $70.1K, $74.2K, $74.7K, and $80.5K.

In the near term, the bulls must protect the $64.8K level, especially after completing the cup-and-handle pattern.

The On-Chain

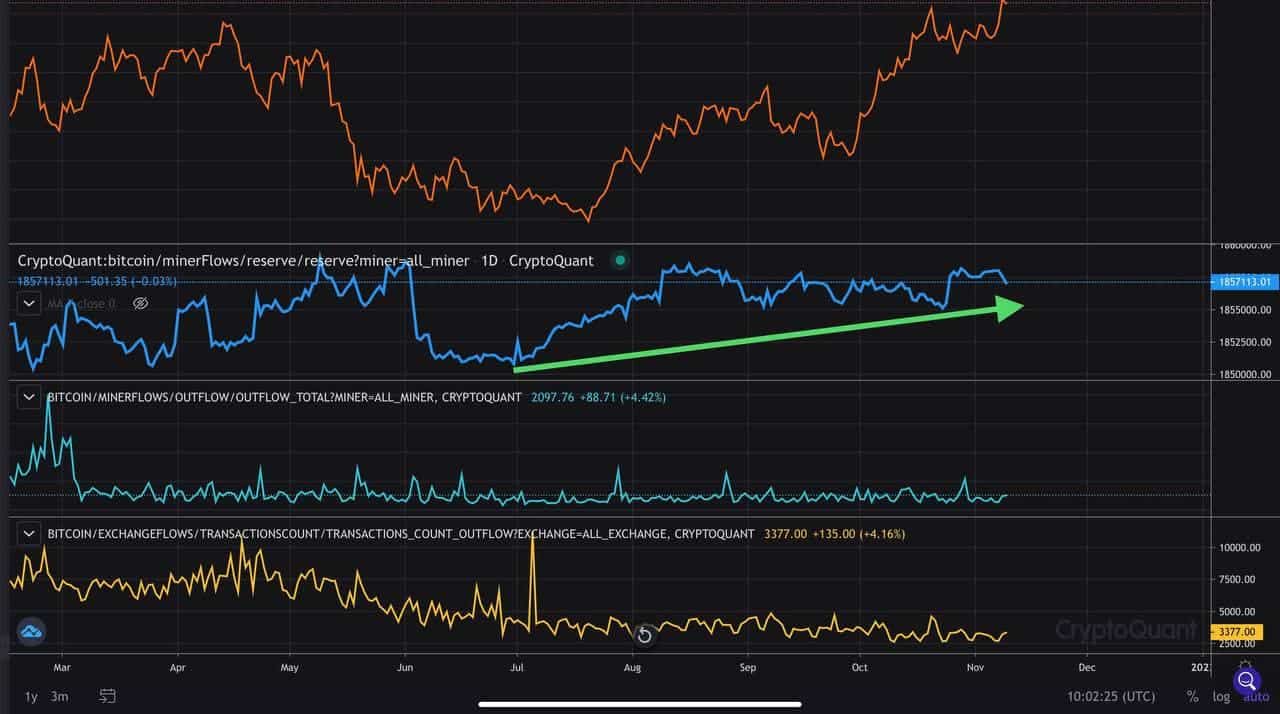

On-chain metrics remain bullish. The 2-to-7-year-old cohorts distributed periodically but predominantly small amounts and not consistently enough to form a trend. The Mean Coin Age has consolidated, but it has recently pushed back up and almost made a new all-time high.

Miners are distributing lightly, but the overall reserves remain stable. The lack of a trend of distribution from long-term holders (LTHs) suggests that the Bitcoin bull market is likely to extend into the first quarter of 2022, opening the potential for even more upside.

This is what the bulls need to see to make this rally more sustainable. Many market participants currently expect the peak to happen in December 2021, similar to previous cycles. This is possible, but it really makes the rest of the bull market feel very rushed.

Once a trend of distribution forms, we will be watching its rate very closely. The most ideal scenario is to have a gradual trend of distribution from LTHs and miners. This makes a bull market rally more sustainable.

Macro Perspective

The Federal Reserve announced its plans to taper bond purchases, which was highly telegraphed for months ahead of time. The stock market reacted with a rally to new all-time highs further validating our call on the risk-on trade resuming.

This is because rates are still at zero, the Fed is still printing money and buying bonds (just not as much), the Fed balance sheet will continue to grow (just at a slower rate), and trillions of dollars of capital are still searching for a store of value against inflation.

Conditions remain favorable for risk assets, but it’s also expected for near-term shakeout to take place, providing investors with buying opportunities.

With the cup-and-handle pattern completing, long-term holders distributing lightly, and no signs of retail FOMO, the bull market has plenty of upside.