Bitcoin Price Analysis Dec.11: Tight Range, Is It Time For A Larger Move?

Over the past day, Bitcoin had failed to break through the significant resistance area of $3500 – $3600. If an asset fails to break, it is likely to lose momentum. That’s what happened as Bitcoin marked $3350 as the daily low.

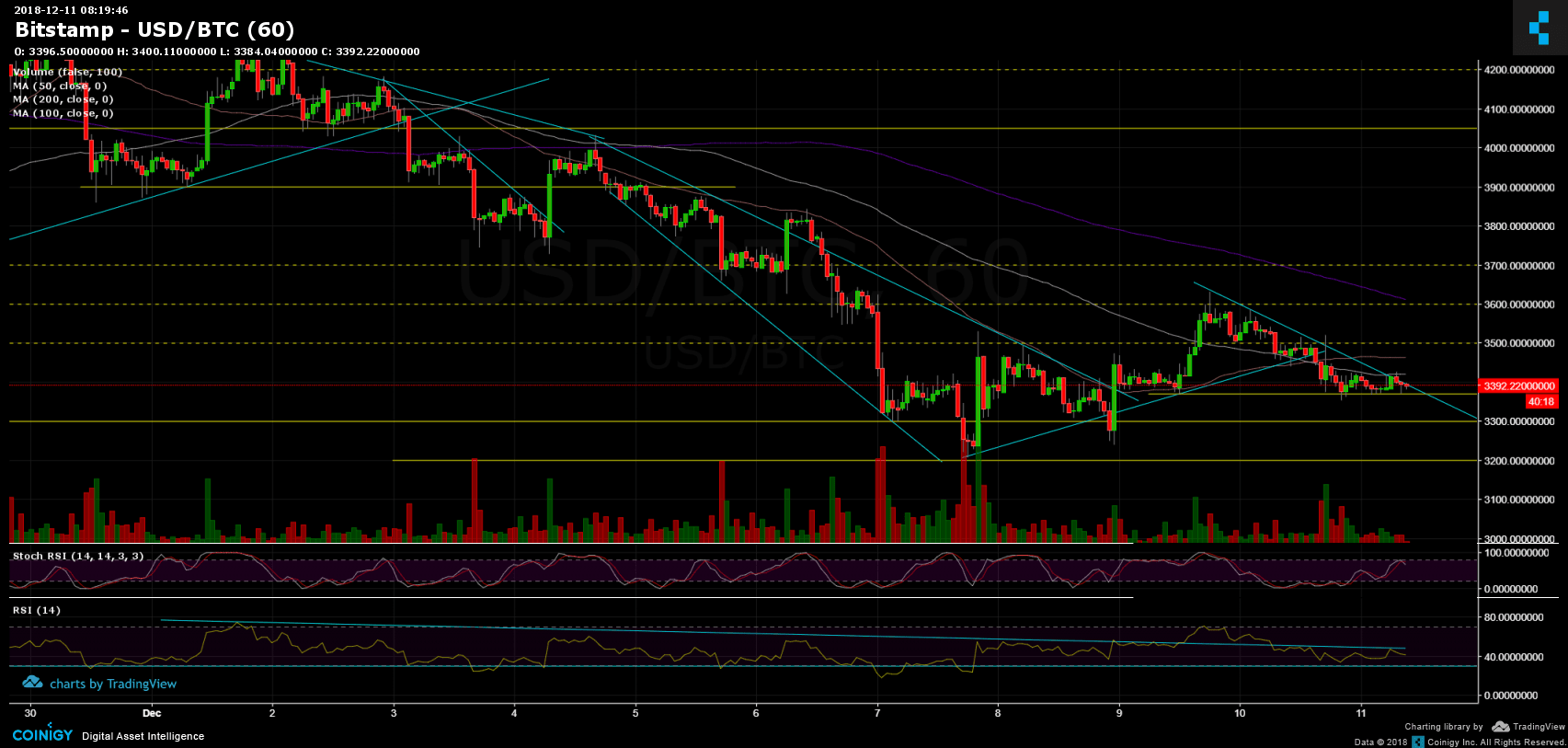

As of now, Bitcoin is consolidating over a tight range between $3370 and $3430 – just underneath the 100 days moving average line (marked in white on the 1-hour chart). This line was supporting Bitcoin yesterday, but now Bitcoin is testing it this time as a resistance.

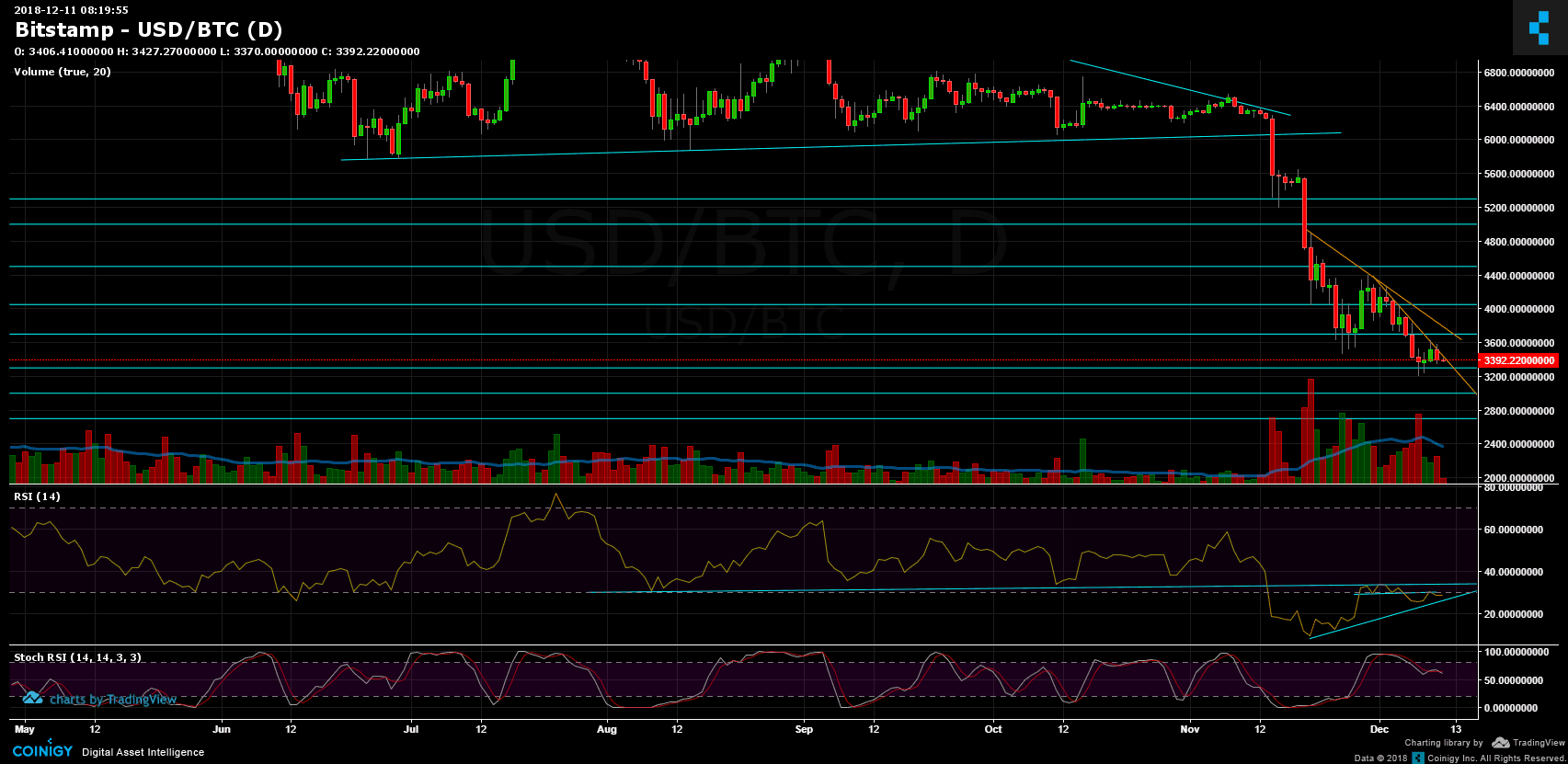

Over the past two weeks, we talked a lot about the importance of the RSI indicator – both in the daily and in the hourly chart. For me, as long as the RSI can’t break up the resistance (on the daily), the market would stay with no buying power.

The above can also be told by looking at the trading volume on the daily candles’ chart. We are still seeing that the sellers’ candles are much higher than the green ones of the buyers’. No market can turn green without buying power.

Looking at the 1-day & 1-hour charts

- Talking about the RSI (short-term): in the hourly chart, we can see the descending trend-line and the bearish triangle that is forming. Bitcoin did attempt to break above the RSI triangle; however, it didn’t hold there much (it was tested once as support before breaking down back inside the triangle).

- Now, looking at the daily chart’s RSI: We’ve mentioned this yesterday – “the RSI found support and now encountering tough resistance.”, Unfortunate to the bulls, the RSI resistance didn’t break up, and as can be seen on the following chart it is facing down again. Unlike the hourly chart, the daily chart RSI pattern (mid-long term) is in a formation of a bullish triangle. The critical level is breaking up the 35 RSI level.

- Bitcoin is now underneath the 100 days MA support-turned resistance line (the white line), along with the descending trend-line.

- For the bulls, behind the 100 MA resistance, there is the $3500 level before reaching the $3600 – 3630 resistance area, where also lies the 200 days MA (the purple line).

- From the bear side – the closest support is nearby: $3350 – $3370. Below is the $3300 and $3200 level.

- As mentioned, the trading volume is in favor of the sellers.

- BitFinex’s open short positions had no change since yesterday, and currently stand around 36,700 BTC of open positions.

BTC/USD BitStamp 1-Hour chart

BTC/USD BitStamp 1-Day chart

Cryptocurrency charts by TradingView. Technical analysis tools by Coinigy.

The post Bitcoin Price Analysis Dec.11: Tight Range, Is It Time For A Larger Move? appeared first on CryptoPotato.