Bitcoin Price Analysis: Critical Moment for BTC Amid Today’s Weekly Close

Since the major drop on Wednesday, the bitcoin price mostly traded around the same range of $64K. Today is the last day of the week; this means that on midnight UTC will see a weekly candle close. This candle close is critical for the next short-term.

The bulls need to see BTC makes a weekly close above $64.8k for the first step in breakout confirmation. As shown on the following chart, the bullish Cup and Handle pattern breakout was completed, with a back-test of previous resistance support at $64.8k.

In case of a bullish weekly close above $64.8K, it might turn into a very bullish signal and increase the probability of a rally towards $70k to $80k in the near term.

Despite the above, short-term holders will need to be mindful of the upcoming Mt. Gox Distribution.

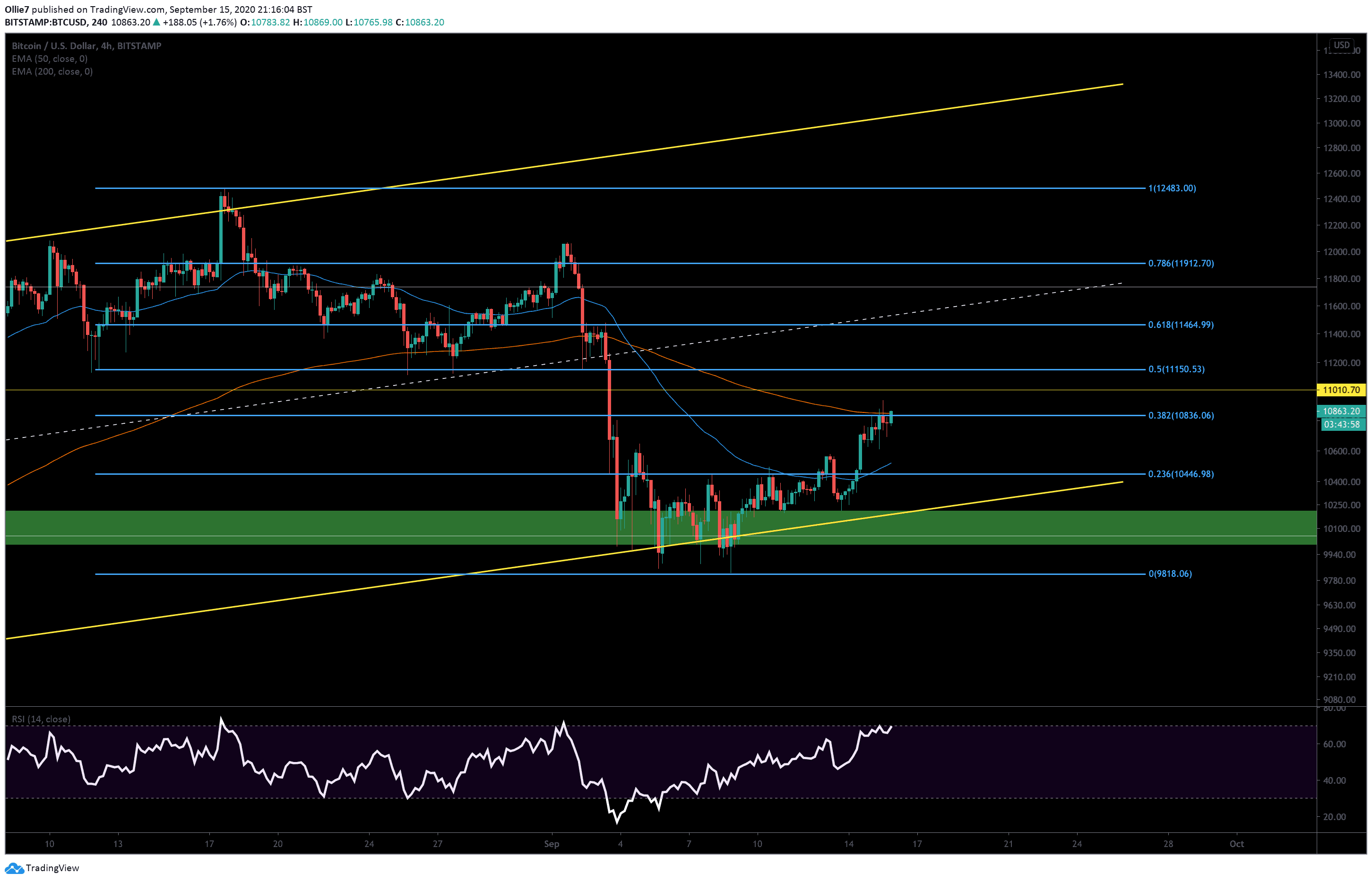

The Technicals

- Overall, higher time frame technical indicators are very bullish

- Near term, 4-hour chart has been slowly trending higher, and if this continues, this could help push BTC price higher over the near term.

- BTC is likely in the middle of larger wave 5 to the upside (in the middle of sub impulse waves higher)

- Near term, pullbacks look attractive to accumulate (if dips take place)

- Near term support levels lie at $62.5k, $61.8k, $61.5k, $60k

- More substantial support at $58.3k to $57.1k in case of more liquidations

- For now, we have to wait for the weekly close, as mentioned above.

Onchain

- Open interest flat at $15.3B with funding rates neutral, and leverage ratio at .19

- Spot exchange reserves remain at multi-year lows despite the near term pullback

- Miners continue to hold, with reserves at 1.855M BTC

- Despite the above, there is a slight distribution from 18M to 2-year-old cohort. All other older cohorts continue to age.

- With BTC making new all-time highs, we have seen certain older cohorts distribute lightly. This is expected and healthy to see as long as the price continues pushing higher (like happened before).

- We have yet to see aggressive distribution from all older cohorts. This implies they are waiting for higher prices

- Mean Coin Age has pushed the new all-time highs, but has been slowing in momentum, potentially starting a downtrend, which has historically led to the bull market’s second half, meaning more aggressive distribution begins.

- It’s important to track the rate of distribution. The bulls need to see a gradual distribution rate as BTC price increases to help make the bull market more sustainable.

Verdict

Technicals will turn very bullish if BTC can make a weekly close above $64.8k, flip $64.8k as support, and follow-through higher. The overall trend in fundamentals, onchain, and technicals remains bullish, suggesting a significant upside ahead for the ongoing bull market.