Bitcoin Price Analysis: Consolidation Continues, is a Huge BTC Move Imminent?

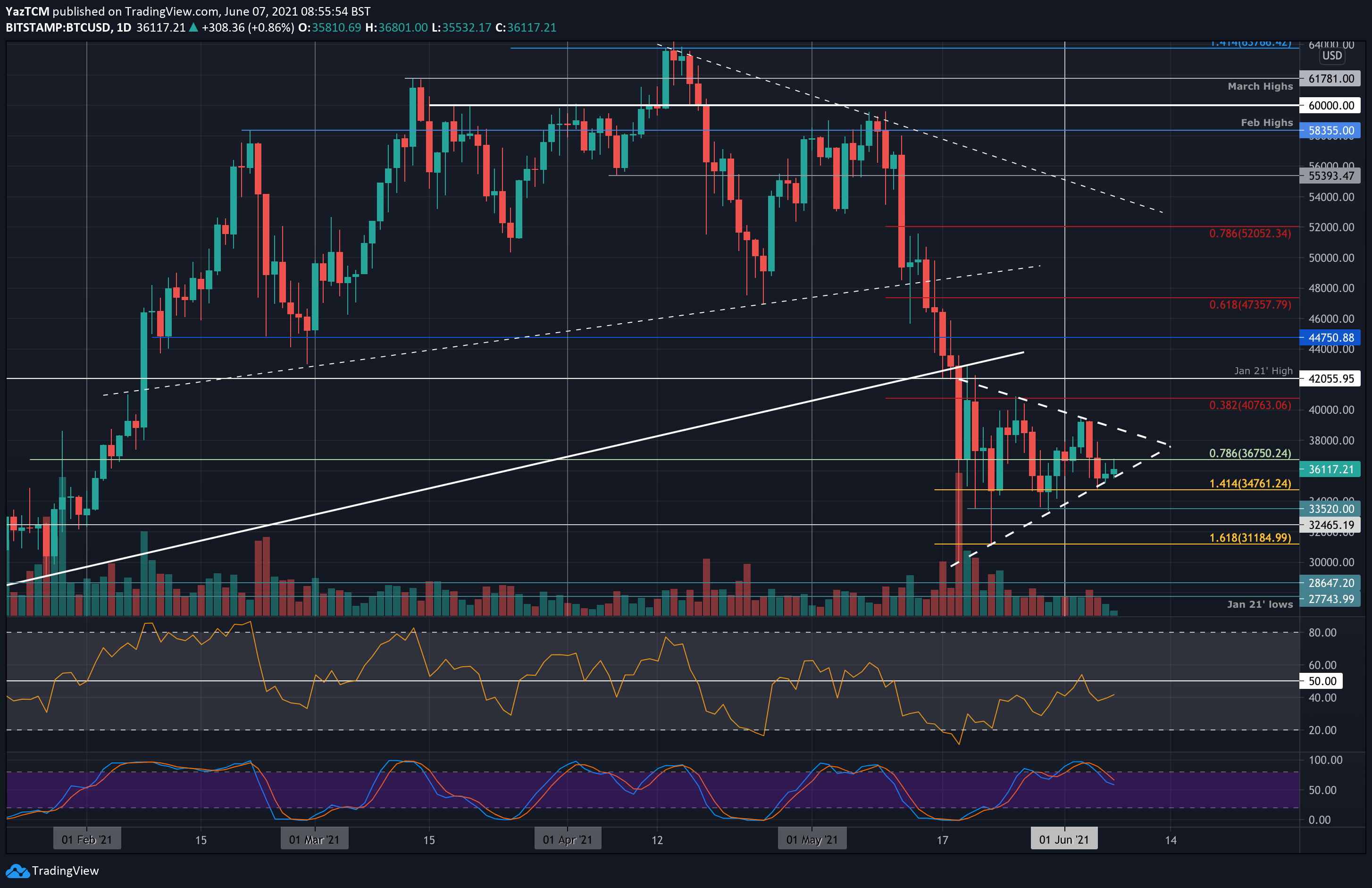

Bitcoin’s consolidation continues as it’s trading exactly where it was a week ago. It had made a push higher toward the end of last week but got heavily rejected by the $38-40k zone, where it met resistance at the upper boundary of a symmetrical triangle pattern (as shown below).

From there, BTC headed lower over the weekend, reaching $34,850 on Bitstamp, where it found support at the lower boundary of the same symmetrical triangle pattern. It has since bounced higher and it attempts to reclaim $36,000.

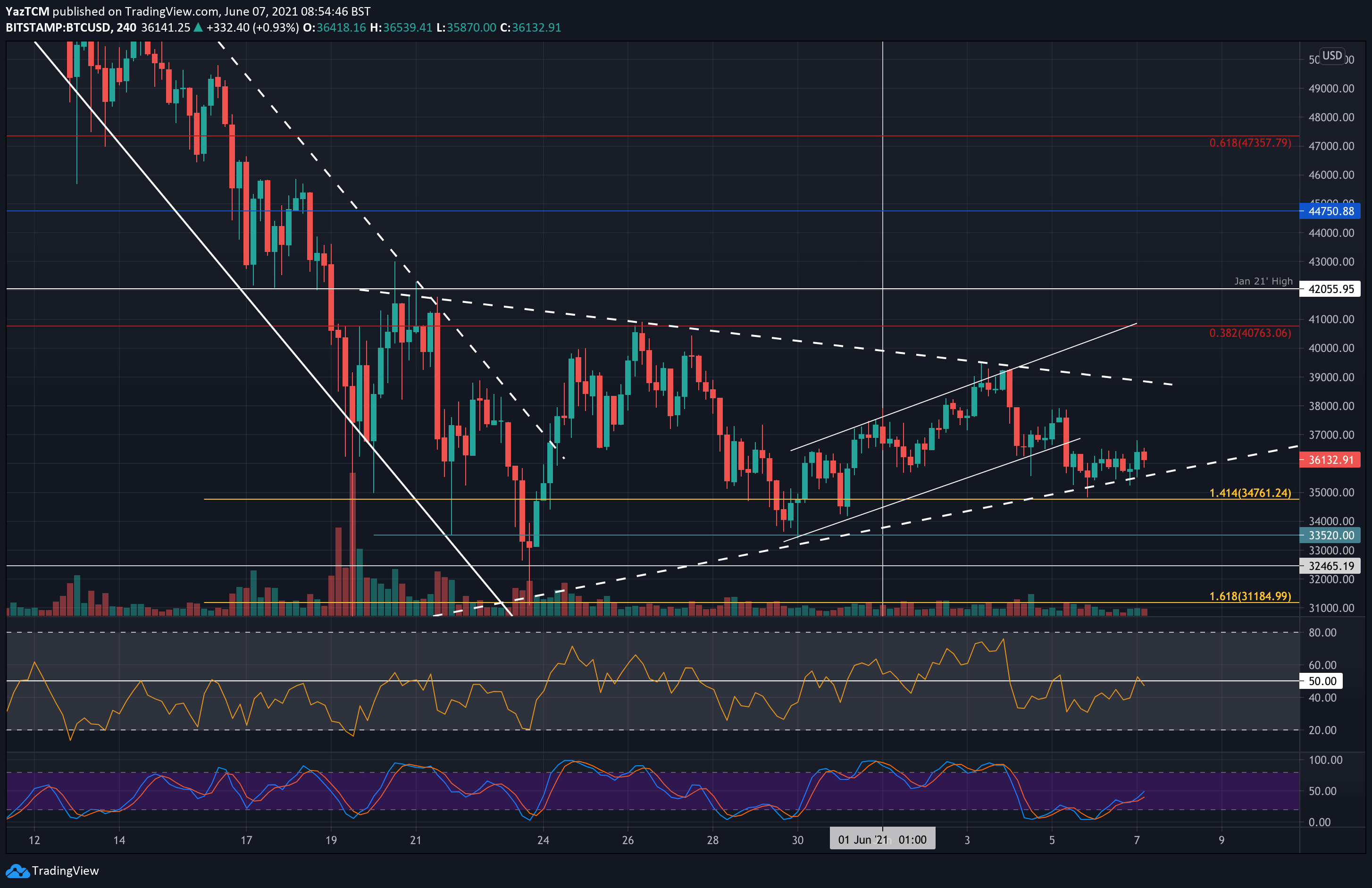

Looking at the short-term chart, bitcoin has penetrated above a short-term symmetrical triangle pattern last week and started to head higher inside an ascending price channel, which turned into a false breakout.

BTC is back beneath this price channel over the weekend but is battling to maintain itself above the longer-term symmetrical triangle. It has been in a phase of consolidation between $32,000 and $40,000 since the market capitulation seen in mid-May. It’s still unclear where BTC would head toward next, but the breakout direction would clarify this.

A breakout above the triangle should allow BTC to face one of the previous all-time highs which turned into solid resistance at $42k. Further above lies the $50,000 milestone.

On the other hand, a breakout below the triangle would see BTC heading toward $30,000, and potentially $27-28k next.

The apex is set for June 14th, and a breakout is likely to take place before it is reached – possibly this week.

BTC Price Support and Resistance Levels to Watch

Key Support Levels: $35,700, $35,000, $34,760, $34,000, $33,520.

Key Resistance Levels: $36,750, $38,500, $39,000, $40,000, $40,765.

Looking ahead, the first support lies at the lower boundary of the triangle at around $35,700. This is followed by support at $35,000, $34,760 (downside 1.414 Fib Extension), $34,000, $33,520, and $32,465.

On the other side, the first resistance lies at $36,750. This is followed by $38,500 (upper angle of triangle), $39,000 (last week’s resistance), $40,000, and $40,765 (bearish .382 Fib).

The daily RSI remains in the weak bearish territory as the bears fail to sustain any momentum. Therefore, for a bullish breakout, the RSI must rise past the midline and climb higher to indicate that the bearish momentum is increasing within the market.

Bitstamp BTC/USD Daily Chart

Bitstamp BTC/USD 4-Hour Chart