Bitcoin Price Analysis: BTC Surges After Retesting MA-200, Local Bottom Confirmed?

The past 24 hours have been rather favorable for the cryptocurrency markets as most of the coins are painted in green.

There seems to be a fundamental reason for this, and it hides within the Fed’s decision to leave interest rates untouched. Bitcoin spiked by almost $3K immediately after the news, and the rest of the market followed.

Technical Analysis (mid-term)

Let’s take a fractal look at the daily chart. In the previous market correction, the pullback to the broken downtrend was about 11% below the breaking point, and after that, an upward movement began. It led to the recording of a new ATH. In the recent correction of the market, the pullback to the downtrend has been about 10% below the breaking point, and now the price is moving sideway and making a bottom. we have to wait and see if, like the previous move, Bitcoin can still set a new ATH or not.

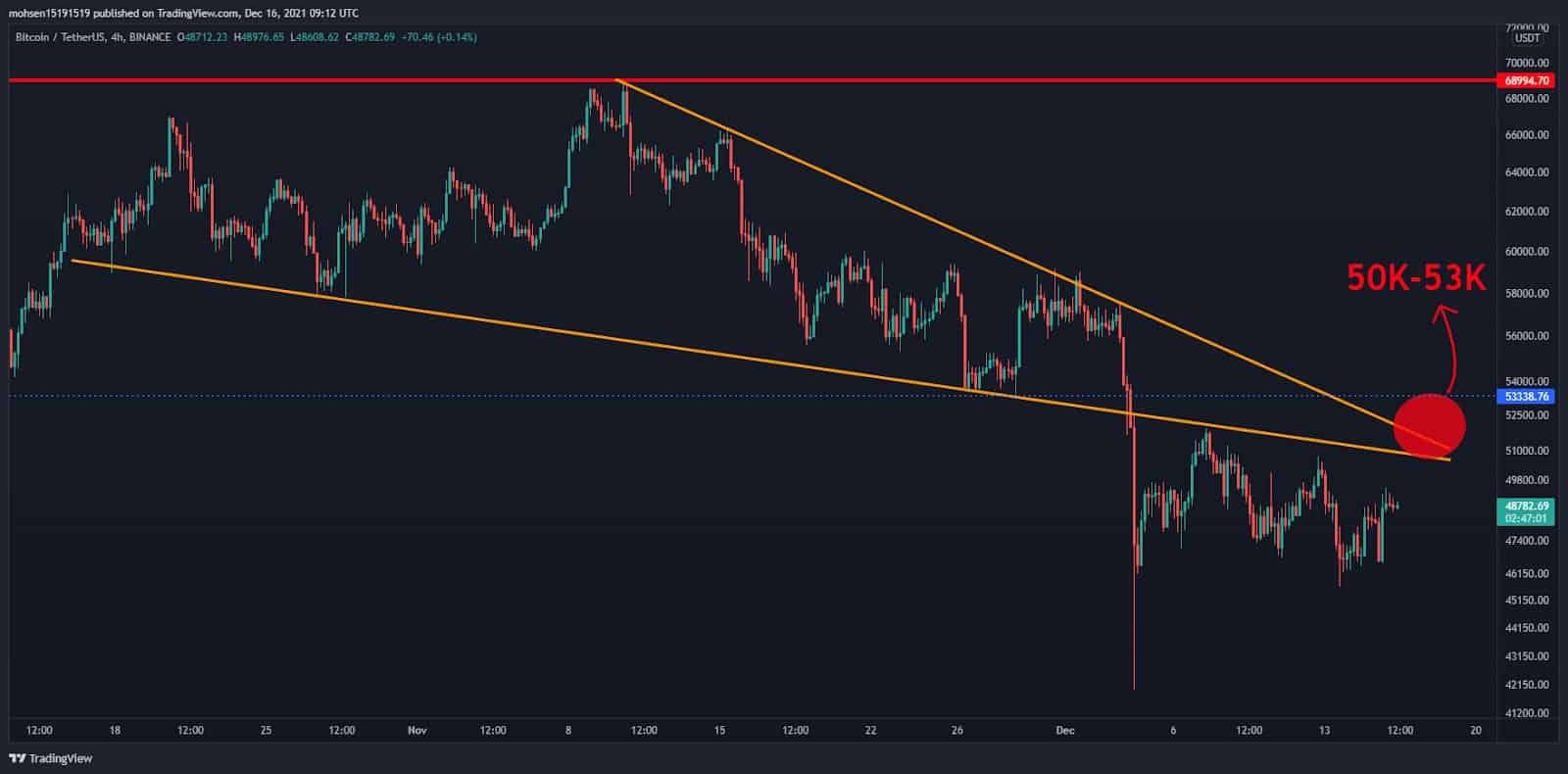

Technical Analysis (short-term)

Despite last night’s news from the Federal Reserve and a 5% rise in price, Bitcoin still could not make even a higher high, and it seems that in the low time frame, there are still no signs of a reversal. The $50k-$53k area is still a strong resistance on the way of BTC to go up, and crossing this area could restore hopes of continuing the uptrend.

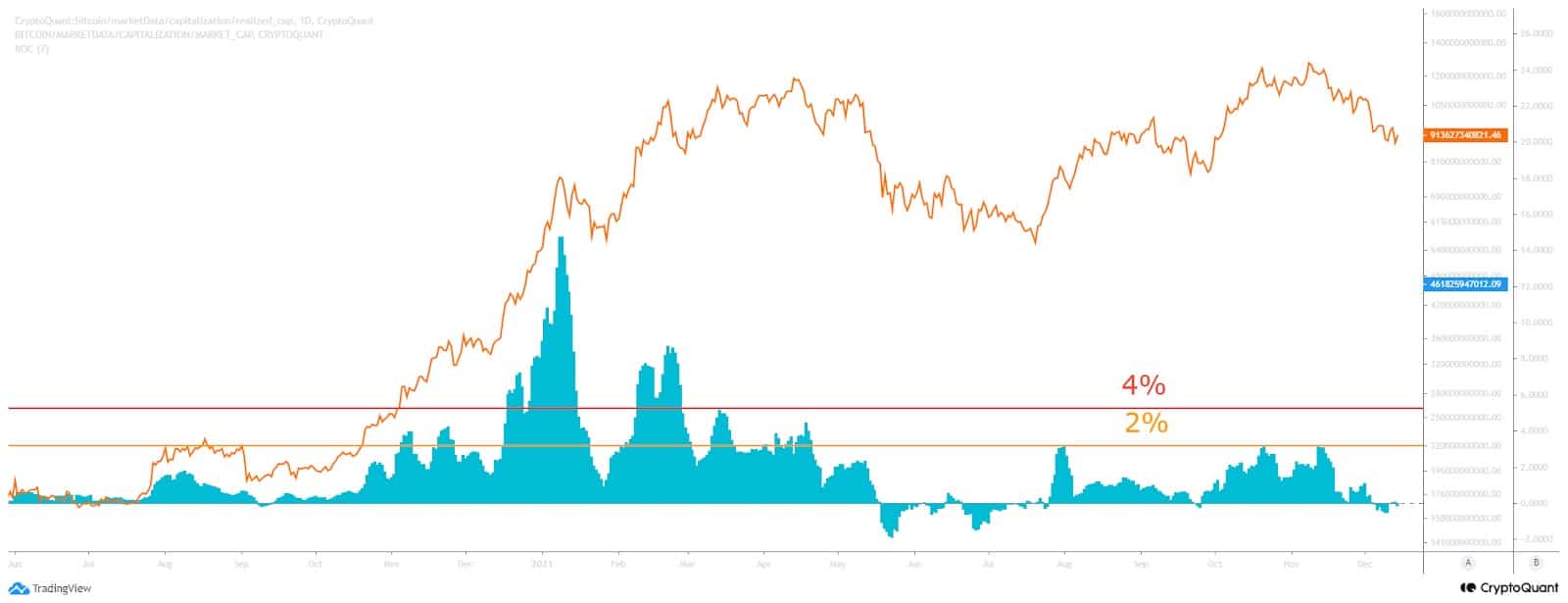

Onchain Analysis

Looking at the Realized Cap’s 7D Oscillator, it’s evident that the BTC market has begun to see some significant loss realization. Similar to May 2021, we might stay in this ranging phase before getting back to green days.

To determine the main class who took the significant portion of the damage, we can look at the STH-SOPR. The overall trend is now fluctuating less than one, which can be translated to “short time holders are selling mostly on loss.”

The above analysis was complied by @GrizzlyBTClover and @CryptoVizArt. Data provided by @tsypruyan exclusively for CryptoPotato.