Bitcoin Price Analysis: BTC Showing Weakness, Struggling For $10,000. New Lows Ahead?

Since reaching the $11K resistance level three days ago, we have seen Bitcoin’s price slowly decrease. As of writing these lines, the crypto king is struggling to maintain a 5-digit price.

As we stated in our previous analysis, $11K was the real test for the bulls, and failing to break above it meant one thing – the bears were in control of the market. This is exactly what has happened.

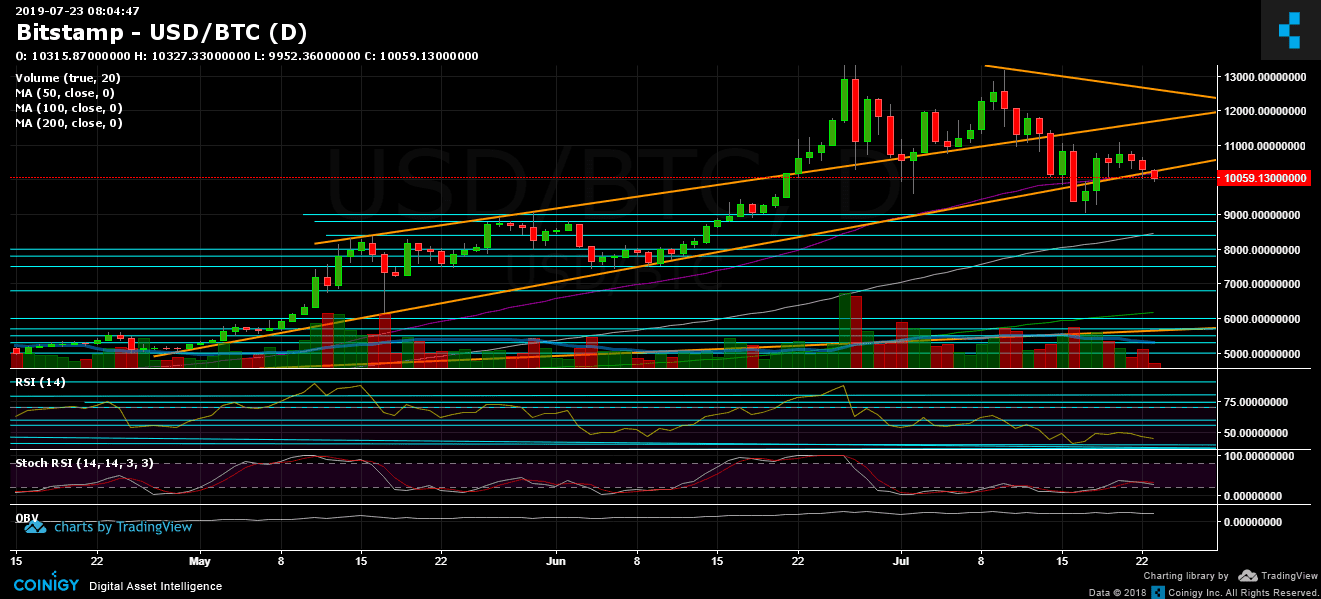

Looking at the bigger picture, Bitcoin is about to break down the critical mid-term ascending trend line (on the daily chart), which started forming in May 2019.

Since reaching the 2019 high of $13,880, the coin has produced a lower-high pattern, which is bearish. Hence, the first test of this trend came at the $11,000 level (as mentioned above).

Remember, trading in these uncertain market conditions can be tough and frustrating.

Total Market Cap: $274 billion

Bitcoin Market Cap: $179 billion

BTC Dominance Index: 65.1%

*Data from CoinGecko

Key Levels to Watch

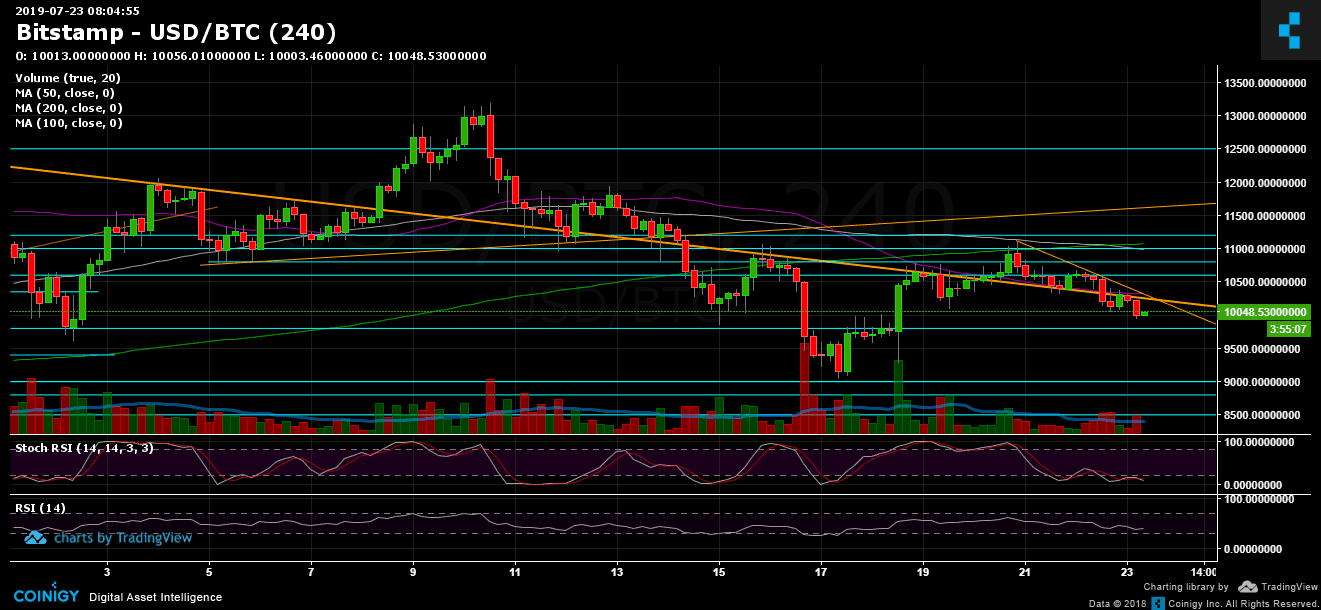

Support/Resistance: Bitcoin is now struggling to stay above the $10,000 support area. Breaking down, and the next immediate targets are $9,800, $9,600 and $9,400. Further below are $9,000 (which is the low from the past week), $8,800 and $8,500 as significant support (along with CME’s futures gap). From the bullish side, the nearest resistance is now the 50-day moving average line (marked in purple) which is roughly around $10,200. Further above is the $10,500 – $10,600 area, before the $10,800 and the problematic $11,000 region.

Daily chart’s RSI: The RSI is showing weakness. In recent days, the RSI couldn’t surpass 50, and as of writing this, the indicator is hovering in bearish territory, and there is much room to fall. The Stochastic RSI oscillator is in the oversold area, however, looking very bearish as well.

Trading Volume: Over the past four days, since reaching the $11,000 weekly peak, the volume has been boring and low. Uninterested, traders are waiting on the sidelines. The news coming from US exchanges’ investigations explains some of this.

BTC/USD Bitstamp 4-Hour Chart

BTC/USD Bitstamp 1-Day Chart

The post Bitcoin Price Analysis: BTC Showing Weakness, Struggling For $10,000. New Lows Ahead? appeared first on CryptoPotato.