Bitcoin Price Analysis: BTC Sees Third Rejection of $60K In 2 Weeks, What’s Next?

Bitcoin saw some wild price action today as the cryptocurrency spiked almost 2% to the daily high of $59,815 but immediately dropped 5% in a matter of minutes, from there to reach the daily low of $56,710. It has since recovered, but the bottom line is that the $60K mark got rejected for the third time over the past two weeks.

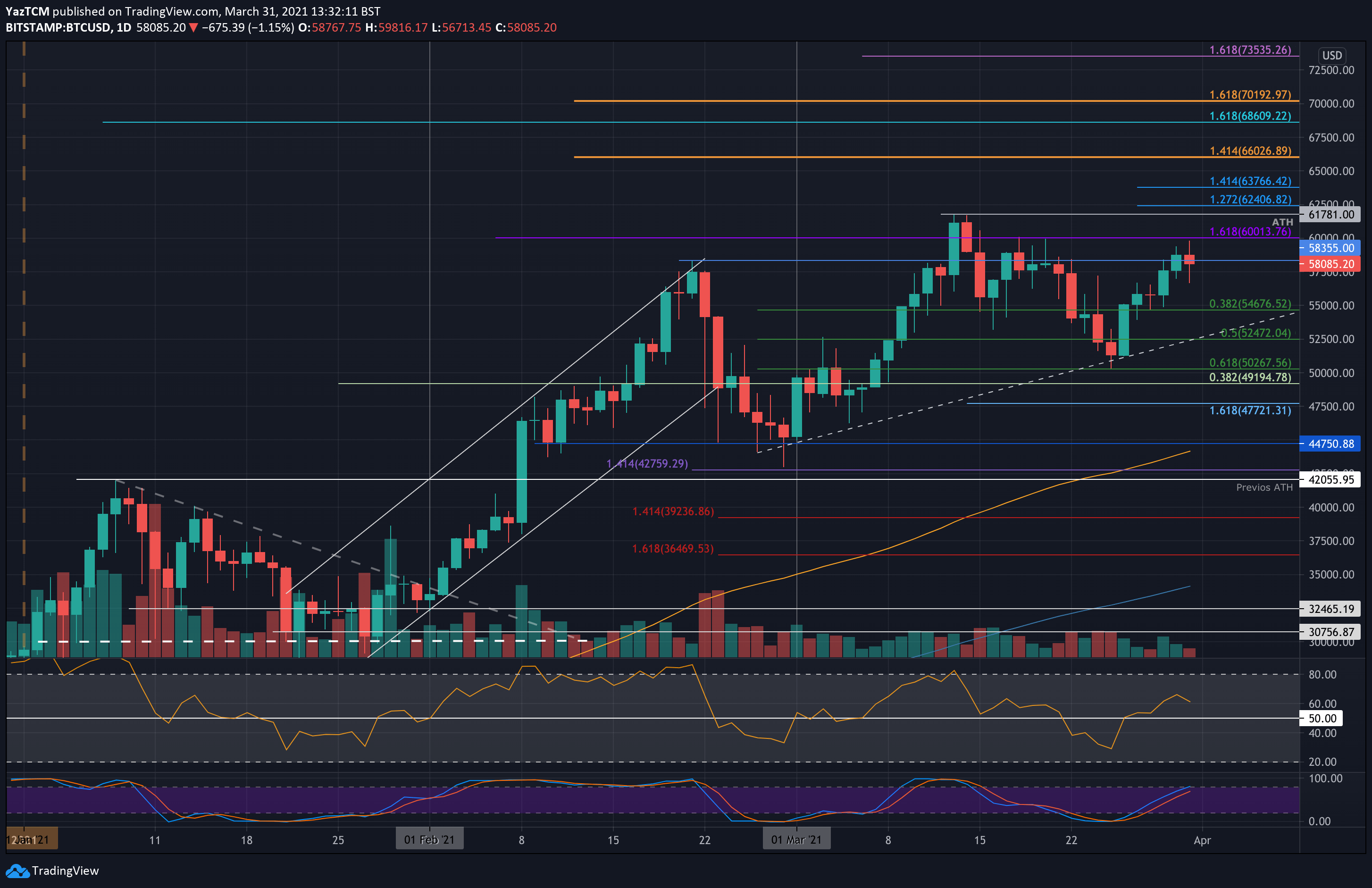

A quick recap: Bitcoin had rebounded from the $43-44k zone at the beginning of March, and reached its current ATH of $61,781 toward the middle of the month.

From there, Bitcoin went on a short-term downtrend for 12 days until finding support at $50,265 (.618 Fib Retracement) on Thursday. It rebounded from this support last week and has since pushed higher to retest the crucial resistance of $60k just a few hours ago.

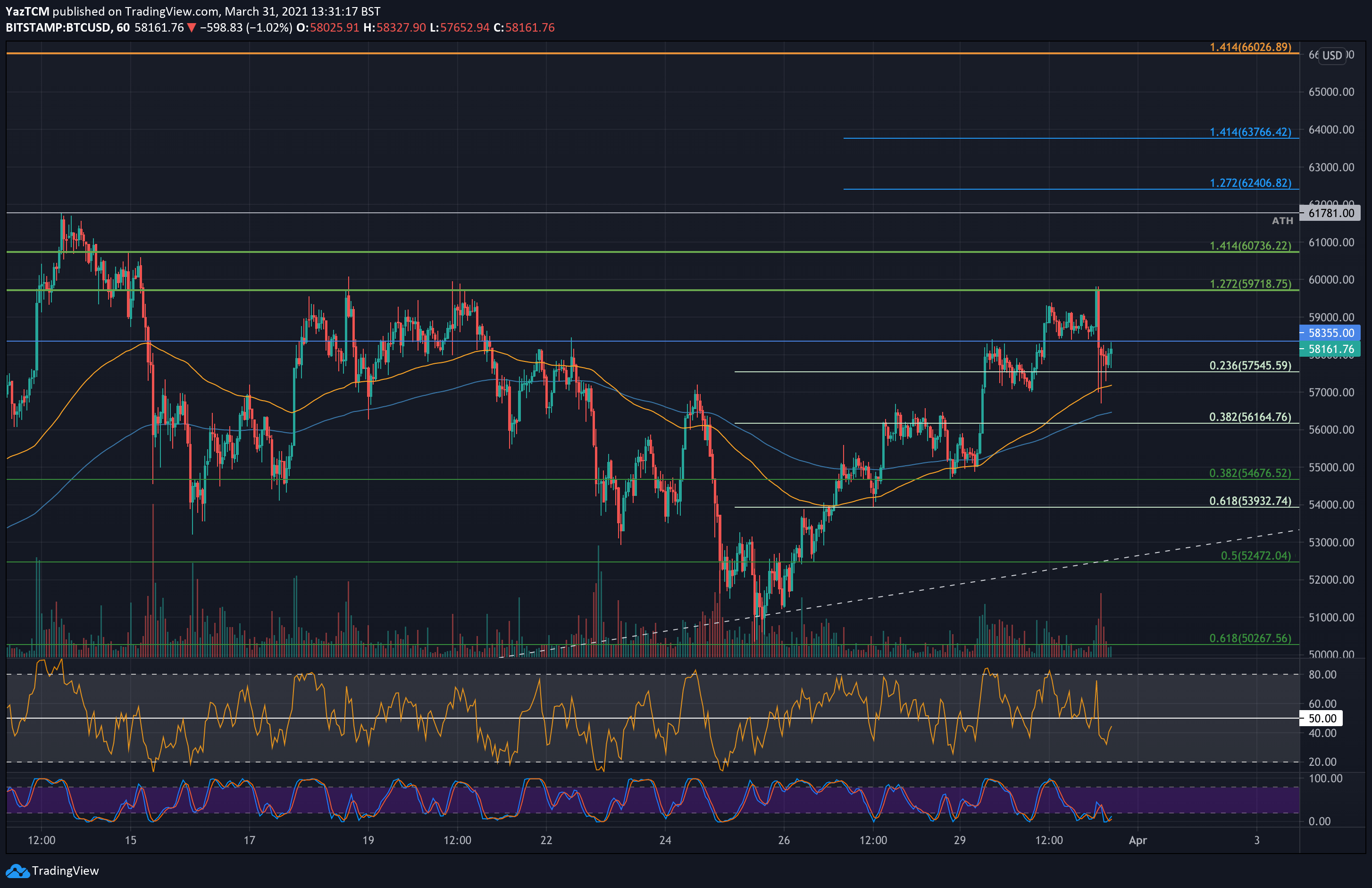

As of writing these lines, and after $600 million worth of positions got liquidated, BTC found support at $56,700 which is the 20-day moving average line. It held at this support and has since rebounded from there. This is best seen on the short-term charts.

A break of $60,000 will leave Bitcoin free to target the mid-March all-time high level. However, the third rejection today emphasized how much sellers’ supply is waiting there.

Overall, on the following daily timeframe Bitcoin is maintaining the higher-lows trajectory, which is long-term bullish.

BTC Price Support and Resistance Levels to Watch

Key Support Levels: $57,545, $56,700, $56,165, $55,000, $54,675.

Key Resistance Levels: $58,355, $59,000, $60,000, $60,760, $61,780.

Looking ahead, the first level of resistance lies at $58,355 (Feb 2021 highs). This is followed by $59,000, $60,000 (major resistance), and $60,760 (short term 1.414 Fib Extension). Above this, additional resistance lies at $61,780 (ATH price), $62,400 (1.272 Fib Extension), and $63,000.

On the other side, the first level of support lies at $57,545 (short term .236 Fib). This is followed by $56,700 (today’s low and MA-20), $56,165 (short term .382 Fib), $55,000, and $54,675 (.382 Fib).

The daily RSI is in the bullish territory, also facing critical support around the 60 mark.

Bitstamp BTC/USD Daily Chart

Bitstamp BTC/USD 4-Hour Chart