Bitcoin Price Analysis: BTC Retests the Critical $11,200 Zone; Another Price Plunge Coming Up?

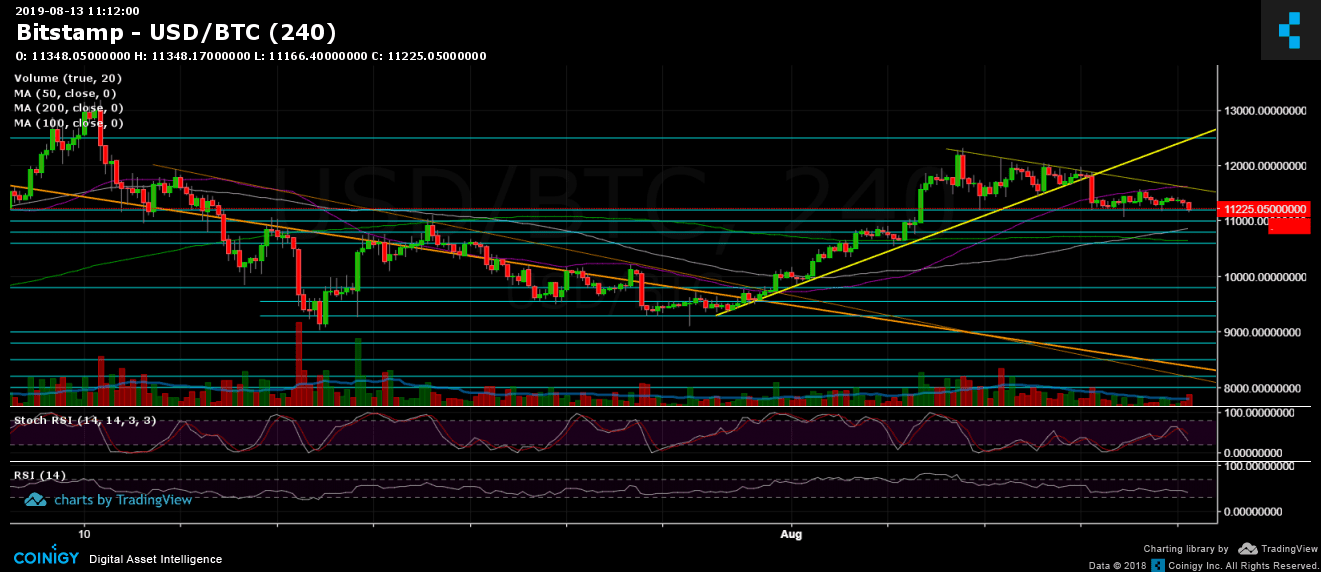

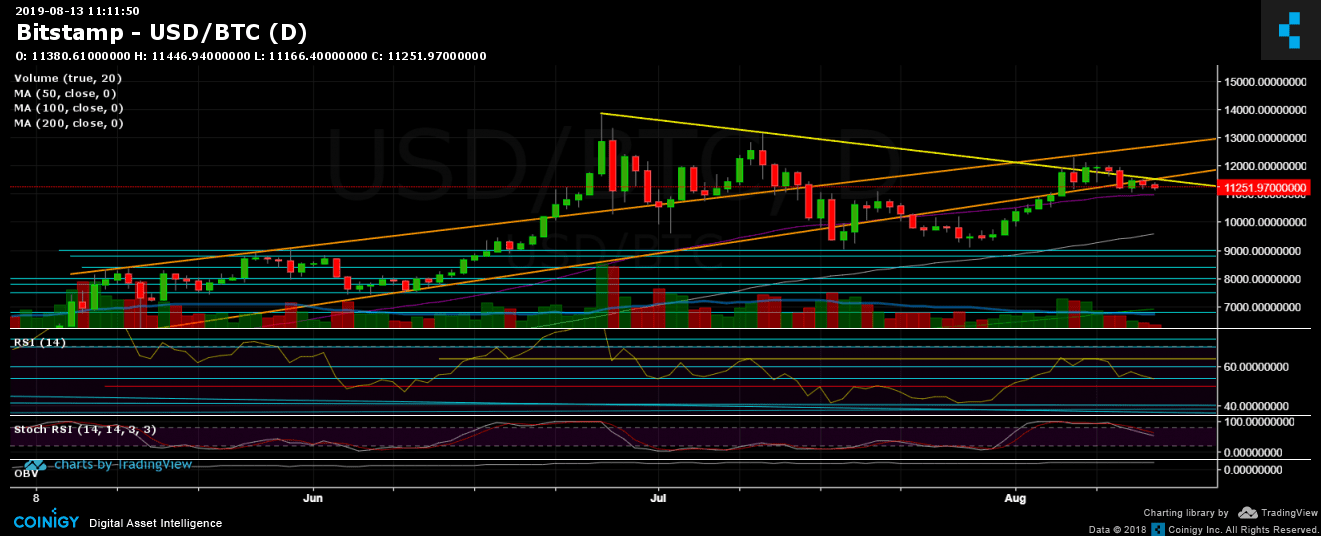

Over the past three days, since breaking beneath the horizontal triangle formation, the Bitcoin markets were rather boring, as the coin’s price was consolidating between $11,200 to $11,500 accompanied by low trading volumes.

As of writing this, Bitcoin is facing its third challenge at the $11,200 support line. The past efforts to defend this support have held up; however, the more attempts to break down, the higher chance that the support line will actually break.

In the case of a breakdown, the next significant support level is nearby at $10,800-$10,900. The area contains the significant 50-day moving average line (marked in purple on the chart below).

Looking on the bullish side, the next major resistance area is the marked yellow line, which is the famous descending trend line that started forming at the 2019 high of $13,880.

With respect to the BTC dominance rate, after touching 70% and retracing to 68.7%, there has been no significant change. Hence, the alt season is again postponed.

Total Market Cap: $293.4 billion

Bitcoin Market Cap: $201.1 billion

BTC Dominance Index: 68.7%

*Data from CoinGecko

Key Levels to Watch

Support/Resistance: As mentioned above, in the case of a breakdown, the nearest support level below $11K is $10,800-$10,900. Further below lies $10,600 and $10,250 before the $10,000 mark. If the BTC price falls lower, then $9,600 and $9,400 might serve as possible support areas.

From above, the $11,500-$11,600 level has turned into resistance. This level also contains the 4-hour triangle’s descending trend line (marked in yellow). Above it are $12,000 and $12,300. The latter was the recent days’ resistance zone.

Daily chart’s RSI: The support area is also reflected in the RSI, as the latter is facing horizontal support at 54 for the second time since Bitcoin broke down from the triangle. Bitcoin’s RSI has more room to fall, although staying above 50 would still be considered bullish.

Trading Volume: Yesterday’s trading volume was probably the lowest since the end of April. This aligns with recent data showing crypto funds flowing out of the major exchanges.

BTC/USD Bitstamp 4-Hour Chart

BTC/USD Bitstamp 1-Day Chart

The post Bitcoin Price Analysis: BTC Retests the Critical $11,200 Zone; Another Price Plunge Coming Up? appeared first on CryptoPotato.