Bitcoin Price Analysis: BTC Needs to Reclaim This Level to Resume Bull Run

Bitcoin’s recent price action has spread fear over the whole crypto market, as participants are worried that the bull market might be over.

Yet, things can change very quickly in the crypto space, and there is still a probability of recovery.

Technical Analysis

By TradingRage

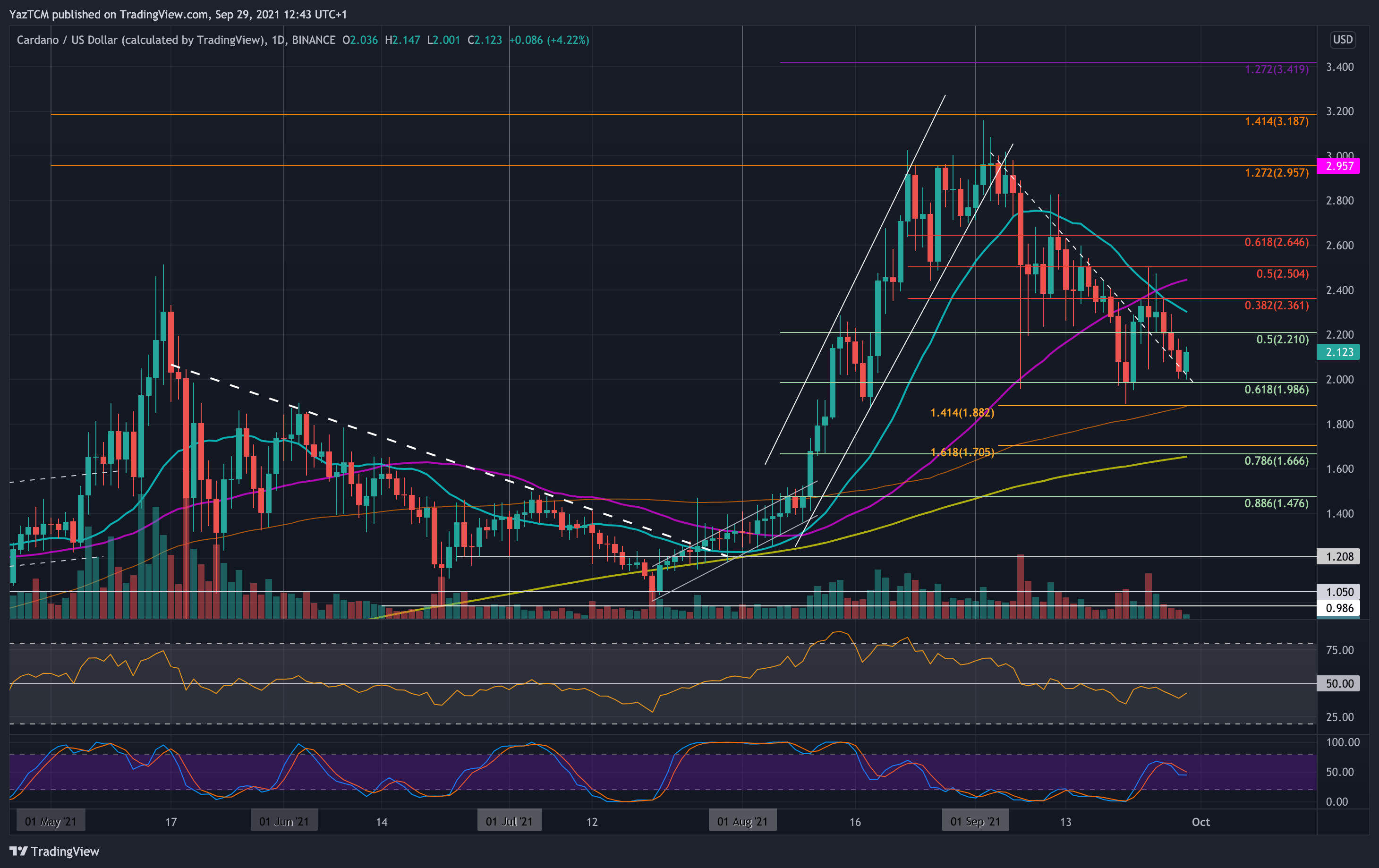

The Daily Chart

On the daily timeframe, the price has been making lower highs and lows since dropping below $70K, demonstrating a clear bearish trend.

Last week, the market even broke below the key $60K level and the 200-day moving average, which is located around the $58K mark.

Meanwhile, the $57K support level has held the price, preventing it from dropping further. So, if the price is able to climb back above the 200-day moving average quickly, this recent decline could be considered a bear trap, and a rally higher could be expected.

The 4-Hour Chart

The price action has been clearly bearish on the 4-hour timeframe, with the market creating a bearish trendline that is still intact. However, with the recent rebound from $54K, the $57K level is currently being tested.

If the price breaks through $57K to the upside, a rally toward the bearish trendline could be expected in the short term. Yet, the overall bias remains bearish as long as BTC is trading below this trendline.

On-Chain Analysis

By TradingRage

Bitcoin Exchange Reserve

With Bitcoin’s recent price downtrend, many might assume that investors have lost hope for the crypto market to continue its bull run. However, this might not be the case for all BTC holders.

This chart presents the Bitcoin exchange reserve metric, which measures the amount of BTC held in exchange wallets. Typically, increases indicate distribution, while declines are associated with accumulation behavior.

As evident, during the last phase of the recent price drop, the exchange reserve values have seen an increase.

Yet, in recent days, the metric has plunged rapidly, indicating that some investors are seeing this price as a buying opportunity and are buying and withdrawing coins from exchanges. If this trend continues, the supply and demand equation could shift in favor of a bullish move, and the correction can be over soon.

The post Bitcoin Price Analysis: BTC Needs to Reclaim This Level to Resume Bull Run appeared first on CryptoPotato.