Bitcoin Price Analysis: BTC Must Reclaim This Key Level to Resume Its Bull Run

Bitcoin is attempting to stabilize after a corrective move from the $92K region, with the price currently rebounding from the $80K support zone.

Momentum remains fragile, and bulls need to confirm the follow-through above key resistance.

Technical Analysis

By Edris Derakhshi

The Daily Chart

On the daily chart, BTC is trading just below its 200-day moving average after a recent breakdown from the $88K level. The asset found support near $80K, which aligns with previous demand and horizontal structure, and is now pushing higher. However, the 200-day moving average, located around the $87K mark, is acting as dynamic resistance, and the price has yet to close above it convincingly.

The RSI remains below 50%, showing some recovery, but still lacks strong bullish divergence. Unless BTC reclaims the $92K level, the broader trend remains sideways-to-bearish in the short term.

The 4-Hour Chart

The 4-hour chart shows BTC breaking down from a rising wedge formation, leading to the recent dump from $89K to $80K. Since then, the asset has formed a short-term bottom and bounced to retest the $84K–$85K region.

Moreover, the RSI has recovered from oversold conditions and is pushing toward mid-range, hinting at a potential move higher if momentum continues. However, the price must clear the previous wedge support turned resistance and hold above $86K to open the door for another run toward $92K. Failure to do so could result in another leg lower, potentially revisiting $80K or even sweeping into the $75K zone below.

On-Chain Analysis

By Edris Derakhshi

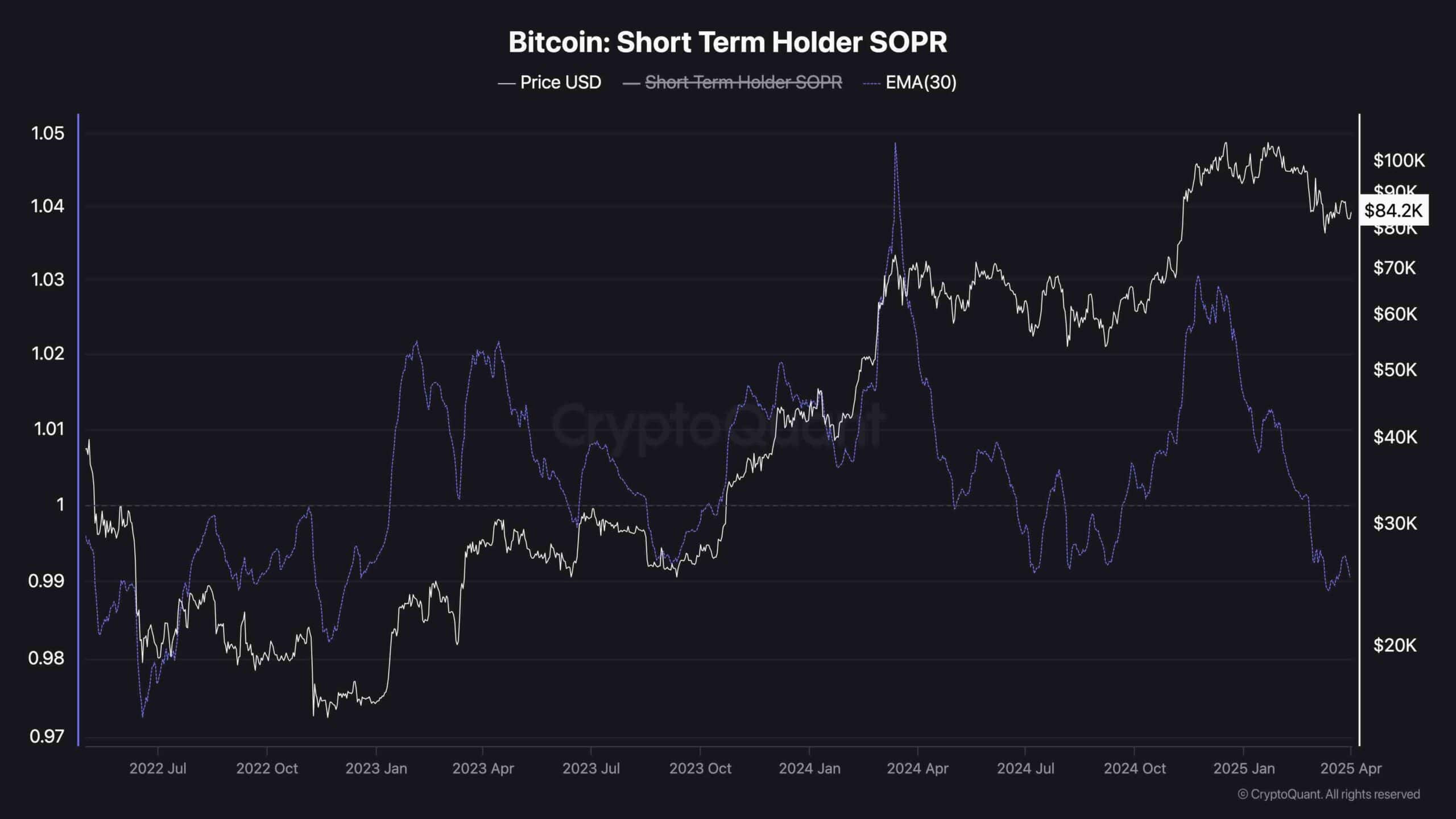

Short-Term Holder SOPR

Bitcoin’s Short-Term Holder SOPR has dropped below one again, indicating that many recent buyers are now realizing losses on-chain. This typically signals weak short-term conviction and adds pressure to any rally attempts. Historically, SOPR values below one during a downtrend reflect capitulation among short-term holders and are often seen near local bottoms, but only when followed by a decisive price bounce.

At the moment, this behavior reinforces the idea that current bullish momentum lacks strength unless accompanied by broader demand and a shift in sentiment. Therefore, investors should watch for SOPR to flip above one again as a potential signal for a healthier recovery.

The post Bitcoin Price Analysis: BTC Must Reclaim This Key Level to Resume Its Bull Run appeared first on CryptoPotato.