Bitcoin Price Analysis: BTC Facing Critical Decision Following $42K Rejection

Bitcoin is resuming its flat price action, consolidating inside a huge bearish flag. Currently, the price is struggling with the $42K level. In case of a breakout and a higher high above $42K – Bitcoin will likely head towards $46K.

The $46K – $48K area is significant from both the classical price action and supply and demand perspectives, as it forms the top trendline of the bearish flag pattern, along with a critical supply zone.

The Daily Chart

Technical Analysis by Edris

Looking at the bigger picture, in the case of a $46K breakout, the following significant level would be at the $52K area on the daily chart, which is shown on below.

On the other hand, the $30K demand zone remains intact and could attract the BTC price in the short term, which would result in a bearish flag breakout to the downside.

There are two probable scenarios in the short term.

- BTC would likely target the liquidity in the form of buy stops above the $46K level before reacting to the supply zone. The price action in this area should be observed closely to determine if a bullish breakout or rejection is more likely based on the lower time frame behaviour. If it can break out, the bearish flag would be considered failed, and a rally towards the $52K zone and beyond would likely occur.

- On the other hand, if the price gets rejected, we will likely get a completion of the bearish flag pattern. In this situation, all eyes should be focused on the $30K demand zone as it would be the next support.

The 4-Hour Chart

On the 4-hour timeframe, the price consolidates after a bullish breakout from the triangle pattern. Looking at the last two highs, it is evident that a bearish RSI divergence formed.

Furthermore, the RSI was at the overbought zone (above 70%), and these bearish signals have led to a short-term drop in the price.

The RSI has broken below the 50% mark, indicating that the bears are again in control. A deeper pullback may be the most probable scenario in the short term, followed by a bullish continuation towards the $46K supply zone. On the other hand, if the triangle breakout fails and the price does not continue the bullish trend, a bearish breakout and a downtrend towards the $30K zone would be likely.

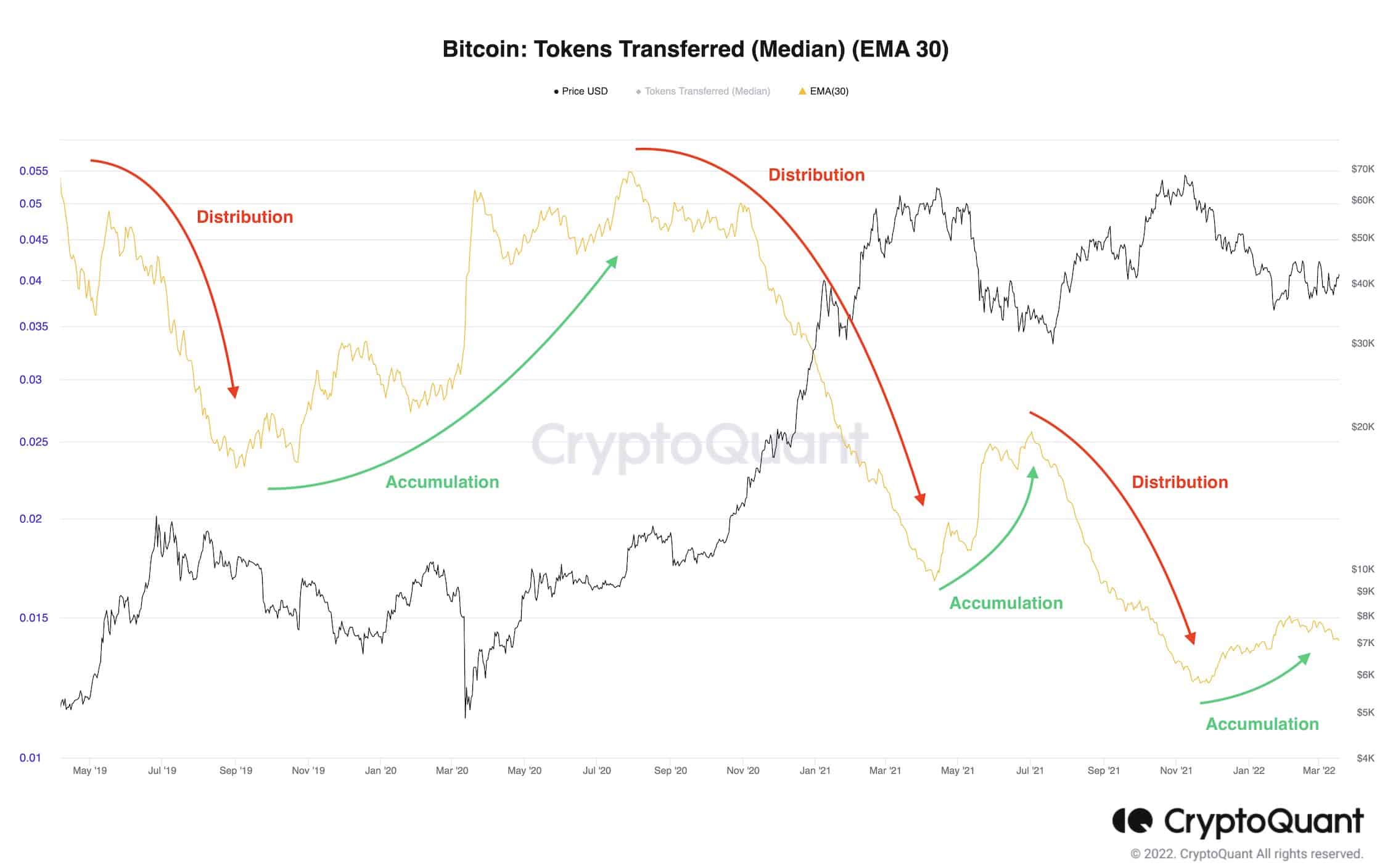

Onchain Analysis: Tokens Transferred (Median)

Onchain analysis by Edris

Analyzing the exchanges’ balances by itself is not informative, as many large market participants use OTC deals to buy bitcoin.

Instead, the Tokens Transferred (Median) metric can be a tool to determine if the big players (whales) are making their significant moves: (A) purchases or (B) distributing.

In the first scenario, the Tokens Transferred (Median) metric should rise as the transaction volumes grow because of large OTC deals and whales’ accumulation.

In the second scenario, this metric should fall as the retail traders and investors come into the market, buying the massive amount of coins distributed by the whales in smaller deals, leading to a decrease in the transaction volumes.

As the chart reveals, smart money tends to accumulate at a discount when the price drops and sell to the masses when the market is under hype due to the rising prices.

Currently, it seems like the whales are accumulating at a slower pace in the current bearish trend, which is both good and bad news.

The good news is that the whales deem current prices valuable and have begun accumulating. However, the bad news is that not all of them are convinced that these prices would be safe entry zones, considering the economic and geopolitical turmoil surrounding the world, hence the accumulation seems slower than before.