Bitcoin Price Analysis: BTC Down 24% Weekly, Reaching Crucial Support Now

As a continuation to its nightmare’s week, Bitcoin dropped another 8% from today’s $35,600 opening price and recorded a current low of $31,700, according to Bitstamp.

The primary cryptocurrency has been in a downtrend since reaching a weekly high of above $41.3K on Tuesday, and so far had seen a drop of 24% in just six days.

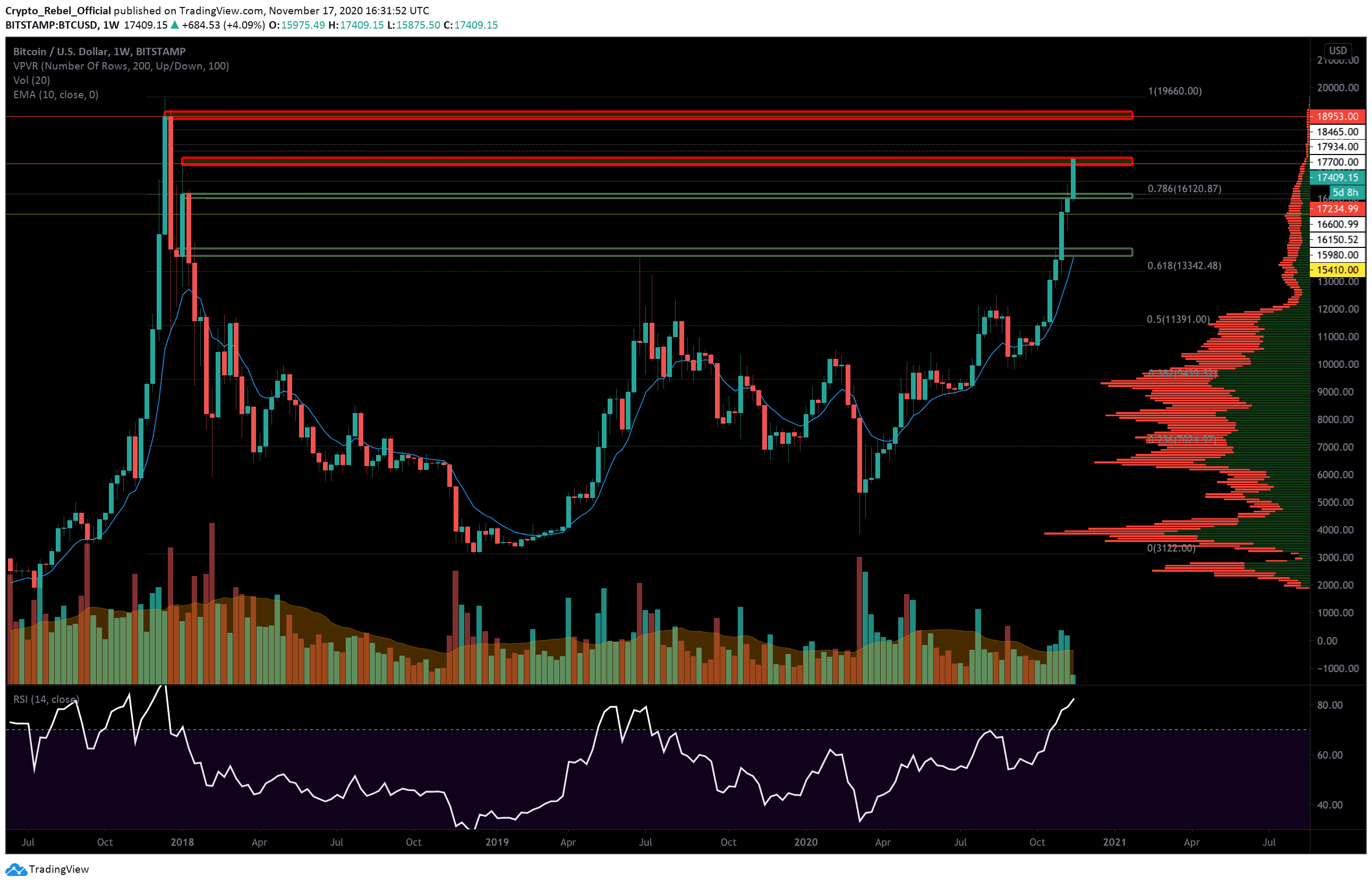

After another Death Cross that took place on Saturday, where the 50-day MA crossed below the 200-day MA, the bulls are now attempting to defend a critical support line around $32K. Failing to close today’s candle above it, could rapidly result in retesting of the lowest BTC price recorded since January – $30K (on May-19).

As can be seen on the following daily chart, today’s current low of $31.7K is an ascending supporting trend-line that was tested on three occasions – May 19, June 8’s low of $31K, and today.

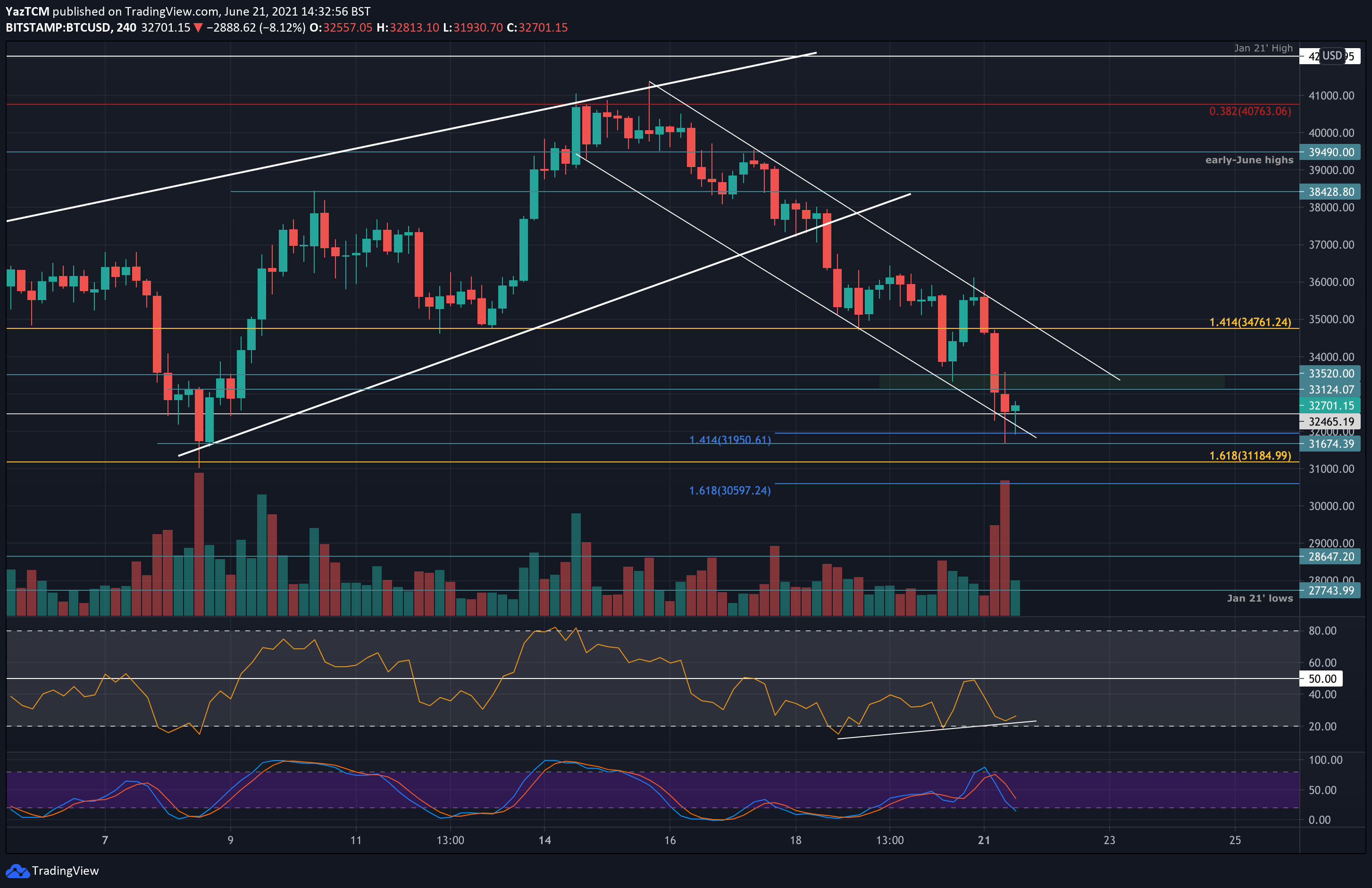

In the short term, as can be seen on the following 4-hour chart, the bears are in full control where bitcoin is trading inside a descending price channel and is currently testing its lower boundary.

Overall, BTC had seen better days, as the nonstop news coming from China, along with a bearish technical event (Death Cross) put a threat upon the ongoing rally of 2021.

One sign that supports the idea of a possible (even temp) correction is the bullish divergence clearly seen on the lower time-frames, such as the 1-hour and 4-hour charts (on the daily chart – subject to today’s close).

BTC Price Support and Resistance Levels to Watch

Key Support Levels: $32,465, $31,700, $31,000, $30,600, $30,000, $28,650.

Key Resistance Levels: $33,520, $34,000, $35,000 $36,750, $38,420.

Looking ahead, the first support lies at current trading levels of around $32K, as mentioned above. This includes today’s current low of $31.7K.

A bit below lies $31K – which is June’s lowest price level. This is followed by $30,600 (downside 1.618 Fib Extension), and $30,000 (lowest since January 2021). Beneath $30K, support is expected at $28,650 and $27,750 (Jan 2021 lows).

On the other side, the first resistance lies at $33,520. This is followed by $34,000 (price channel’s upper angle), $35,000, $36,750 (20-day MA), and $38,420 (early-June highs).

The daily RSI produced a fresh low for June today as the bearish momentum increases. However, as discussed above, the 1 and 4-hour RSI is showing hints of bullish divergence emerging. This might help the market rebound in the short term and help to defend the current $32,460 support.

Bitstamp BTC/USD Daily Chart

Bitstamp BTC/USD 4-Hour Chart