Bitcoin Price Analysis: BTC Could Slump to $80K if This Support Level Breaks

Bitcoin’s price is consolidating below the $100K milestone, as investors are still waiting to witness a six-figure BTC price.

However, the asset fell hard today, and the question remains whether that target will be achieved soon.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

As the daily chart demonstrates, the asset has been breaking through several resistance levels over the past few weeks, paving its way toward the $100K mark. However, the price has yet to reach this level, as the market is moving sideways. With the $90K support level intact, investors could be hopeful that a bullish breakout and rally above the $100K mark would materialize.

Yet, if the $90K level gets broken to the downside, a significant pullback toward the $80K area could be expected.

The 4-Hour Chart

The 4-hour chart illustrates the recent BTC price action, as the market has been consolidating inside a symmetrical triangle pattern. These patterns can either be continuation or reversal ones, depending on the direction of the breakout. Therefore, if the market can break above the triangle, a bullish continuation toward and above the $100K mark would be likely.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

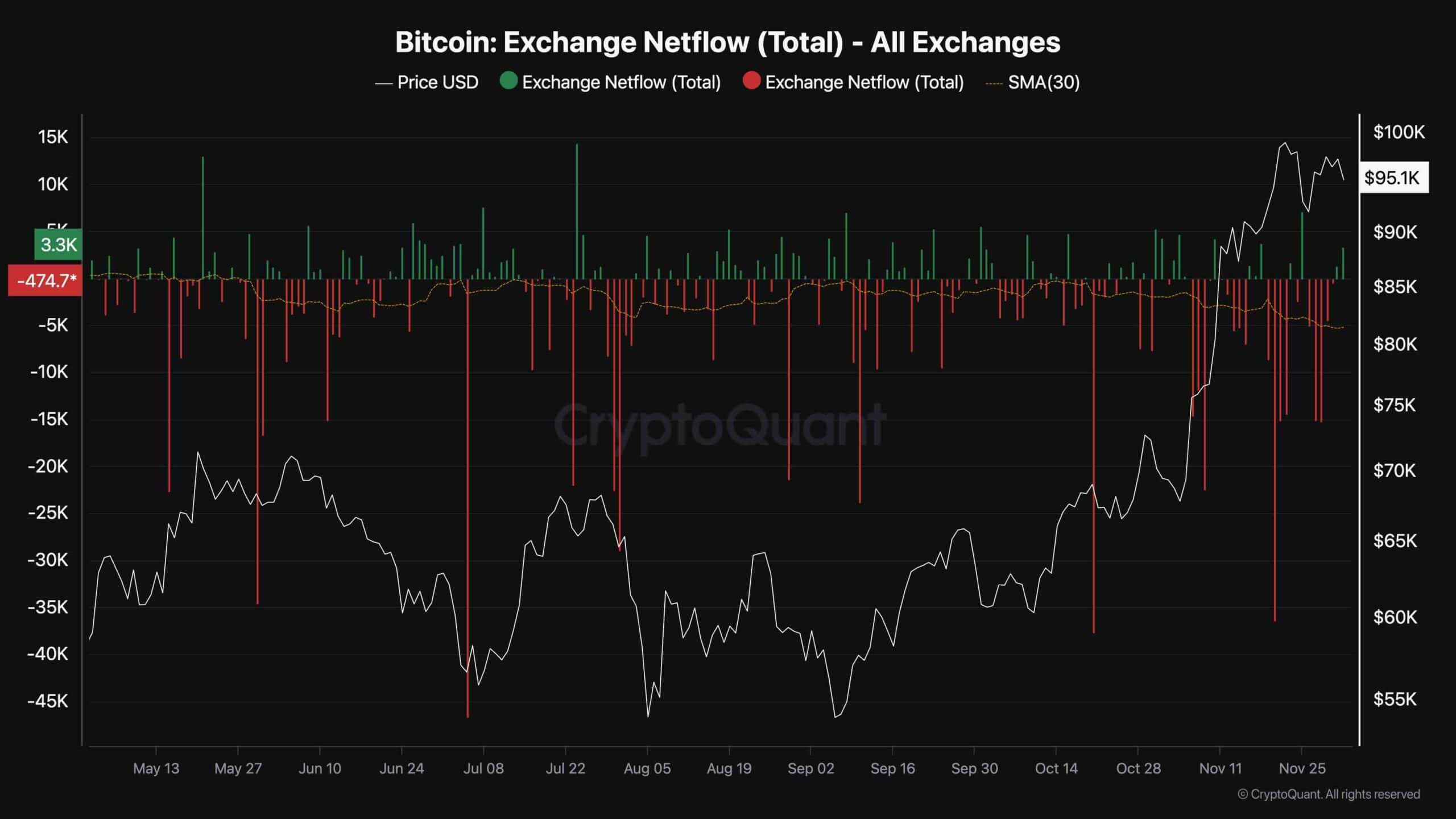

Exchange Netflow (30-Day Moving Average)

It is possible to analyze the accumulation and distribution of Bitcoin in the spot market using the exchange netflow metric. It measures the net deposits and withdrawals of Bitcoin into and from centralized exchanges. Positive values show distribution, while negative numbers indicate accumulation.

As the chart suggests, there have been substantial negative netflows recently, as investors are rapidly accumulating BTC in the hopes of a rally above $100K soon. The 30-day moving average of the BTC netflows has also consistently shown negative values over the past six months. As a result, if the derivatives market does not create an obstacle, the demand in the spot market will likely push the price higher in the coming months.

The post Bitcoin Price Analysis: BTC Could Slump to $80K if This Support Level Breaks appeared first on CryptoPotato.