Bitcoin Price Analysis: BTC Breaks Above $100K, Is $120K Next?

Bitcoin’s price is on the verge of decisively breaking out from the $100K resistance level as investors are getting ready for a potential rally higher.

Is a new all-time high on the horizon?

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, the asset has consistently been making higher highs and lows since rebounding from the $52K support level. It has also broken above several resistance levels and now sits well above the resistance of $100,000.

Meanwhile, the RSI is showing clear bullish momentum, and it’s likely for the market to finally decisively conquer $100K and move toward the $120K psychological resistance zone.

The 4-Hour Chart

The 4-hour chart shows a more clear picture of recent price action, as the market has been climbing higher inside a large ascending channel.

Yet, with the lower boundary of the pattern remaining intact, the market is now paving its way toward the higher trendline and potentially the $105K level in the short term. A breakout above the ascending channel is likely to lead to an aggressive rally higher.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

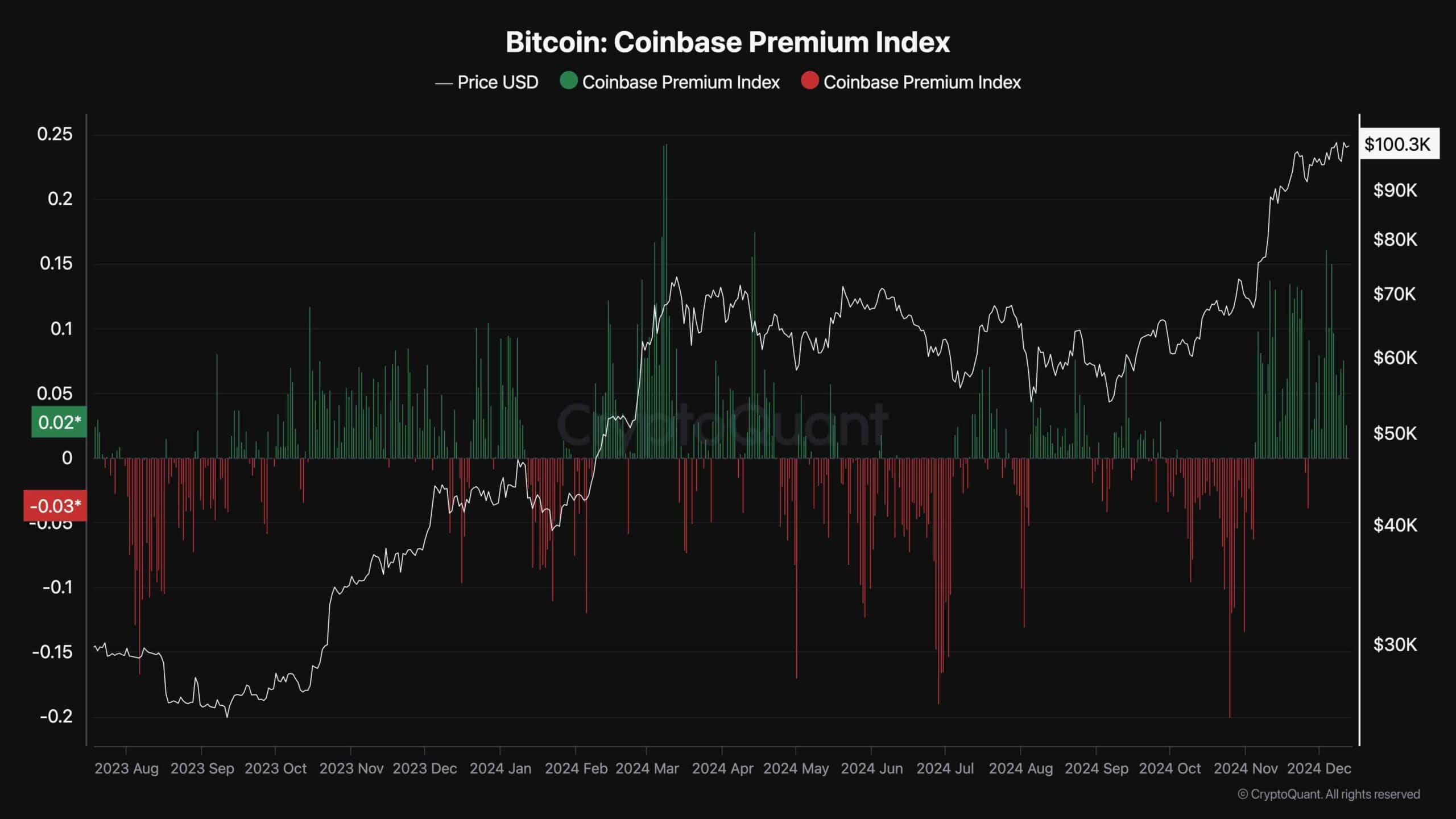

Coinbase Premium Index

American investors, including US institutions, are mostly the ones responsible for market moves. As a result, analyzing their behavior can be beneficial in making an accurate prediction about short-term market moves.

This chart presents the Bitcoin Coinbase Premium Index, which is a metric that measures the relative buying and selling pressure on Coinbase compared to Binance. Coinbase is mostly used by American traders, while Binance is utilized worldwide. Therefore, this metric can indicate whether American investors are buying or selling at a higher or lower rate than other parts of the world.

As the chart demonstrates, the Coinbase Premium Index has demonstrated highly positive values over the last couple of months, indicating the buying pressure from the US post-election, which is likely responsible for the market’s recent rally. As long as this metric shows positive readings, BTC could expect more upside.

The post Bitcoin Price Analysis: BTC Breaks Above $100K, Is $120K Next? appeared first on CryptoPotato.