Bitcoin Price Analysis: Blowing Through Support Levels on the Way to $3,000

Bitcoin continues to tumble lower and lower as it struggles to claim any footing in the market. It’s down almost 50% in three weeks and it’s showing very little sign of stopping. It’s currently clutching onto the $3,500 values but it doesn’t look like it can hold on much longer.

BTC-USD, Daily Candles, Macro Downtrend

BTC-USD, Daily Candles, Macro Downtrend

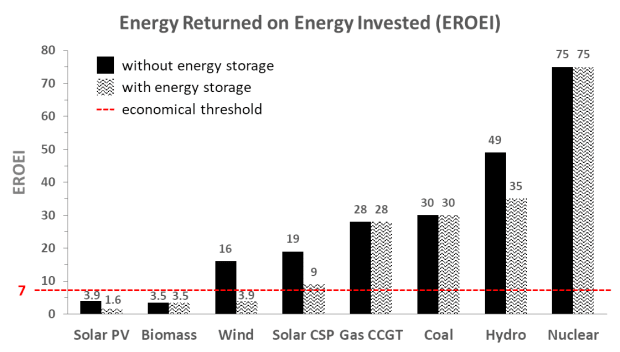

Unfortunately, the consequence of a parabolic market is that, toward the tail end of the parabolic move, it doesn’t bother to retest or establish strong support. And now bitcoin is brutally busting through all the untested support levels. The figure above shows all the untested support levels (in blue).

When we zoom out to the entirety of the previous trend, it becomes pretty clear that there were no retested/established support levels. Because of this, the market is accelerating through the previous highs with very little to stop it. Supply surfaced when we initially broke the support in the $6000s and demand vanished. When we look at intraday time frames, like the 4-hour candles, it becomes quite apparent just how unrelenting this move downward has been:

BTC-USD, 4-Hour Candles, Break Below $6,000 Support

BTC-USD, 4-Hour Candles, Break Below $6,000 Support

With few little rallies to speak of, bitcoin has seen brutal, continuous 10-15% moves. Currently, there are very few buyers taking hold, and shorts are beginning to pile up. Eventually those shorts will have to take profit and we will see a strong round of buying hit the market. However, this level doesn’t appear to be the level for that to take place. If we manage to break the current support (which I’m entirely anticipating at this point), we can expect the next pitstop to be around $3,000. This level is the next, untested support level that was marked during the parabolic market last year:

BTC-USD, Daily Candles, Next Untested Support

BTC-USD, Daily Candles, Next Untested Support

If we manage to break current support and test the $3,000 area, I think we will start to see some larger players take up positions in bitcoin. We will have to keep an eye on the volume, but this capitulation is expanding in volume and spread, and there will eventually be a snapback in price action.

There is an entire group of so-called “smart money” that has been patiently waiting on the sidelines during this entire bear market and they are waiting for the right time to re-enter the market. These are people/entities that are likely to take up large, long-term positions that won’t be easily shaken out. Historically, bitcoin has retraced somewhere between 80-90% during parabolic blow-off. If we manage to test the $3,000 area, that would essentially be an 85% retracement from its all time high.

Summary:

- Bitcoin has seen a brutal decline in value over the last few weeks. It is currently down almost 50% in three weeks and is showing very little signs of stopping.

- Because we rose so fast during the bull run, there were never any established support levels for the market to find a foothold on the way back down. Currently, we are in the process of blowing through untested support with great ease.

- If we manage to break through the current support level, we can expect to see a test of the $3,000 level as this represents the next level of untested support.

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.

This article originally appeared on Bitcoin Magazine.