Bitcoin Price Analysis: Bitcoin Plunged Over $4K In a Day, Where is the Next Key Support?

After the price topped at $52K on Monday, Bitcoin had lost over $4000 in just a day. Is BTC entering a deeper correction, or where is the local bottom?

Technical Analysis

Short-Term Analysis

Last week the bitcoin price broke above a mid-term descending trend line on the 4-hour timeframe. After completing a pullback, the price increased again and touched $52k resistance (Monday).

However, the market did not have enough momentum to continue the rally (low volume), and the bears won the battle. For now, BTC is supported by the static support zone – as can be seen on the following chart.

If BTC loses the first support zone, the $45k-46k range will be the next critical supporting level. Additionally, looking at the RSI indicator, we can see that the lower band of the Bollinger is getting closer to the oversold territory; hence, we likely see a positive correction at some point.

Daily Analysis

Bitcoin could not break out of the Ichimoku Cloud on the daily time frame. Now, the primary cryptocurrency had lost Tenkan-Sen as support.

Based on the historical reactions that the price has shown before, bitcoin must break above the Ichimoku Cloud in order to regain its bullish momentum. As shown on the chart below, the green zones might serve as strong supports levels on the daily time frame.

Onchain Analysis

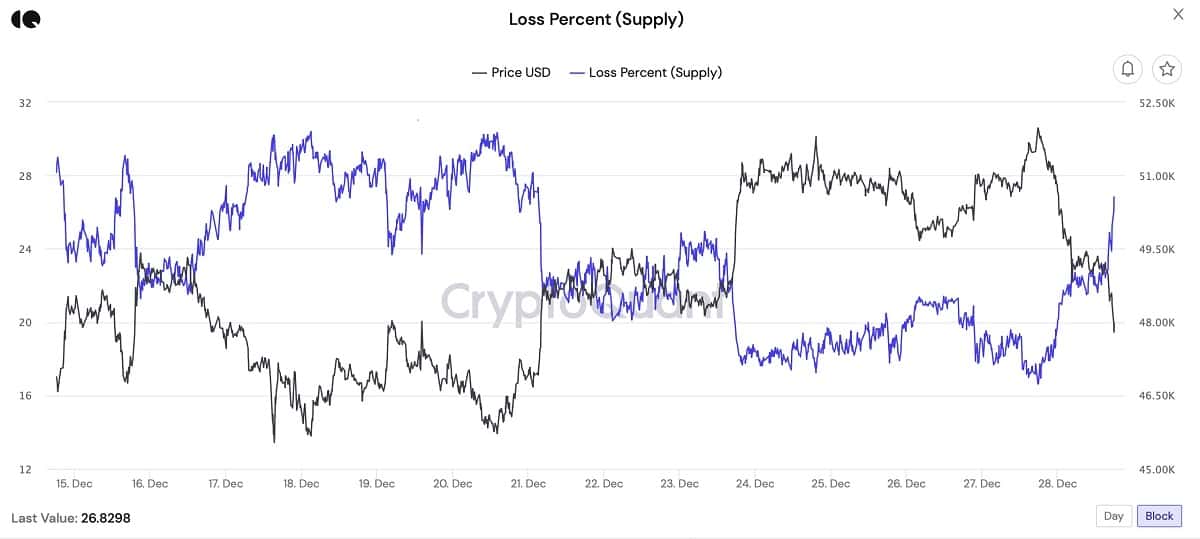

Currently, 26% of the supply is in the loss territory. Historically, the market saw 32% supply-in-loss at $29K bottom in July.

Therefore, there is a high possibility that the $40K-$42K range will be retested, and likely become a local bottom for the midterm. As a matter of fact, the lowest level was reached amid the March-2020 COVID crash, where almost 60% of the supply was in loss.

The above analysis was complied by analysts @GrizzlyBTClover, @N__E__D__A, and @CryptoVizArt exclusively for CryptoPotato.