Bitcoin Price Analysis August 8

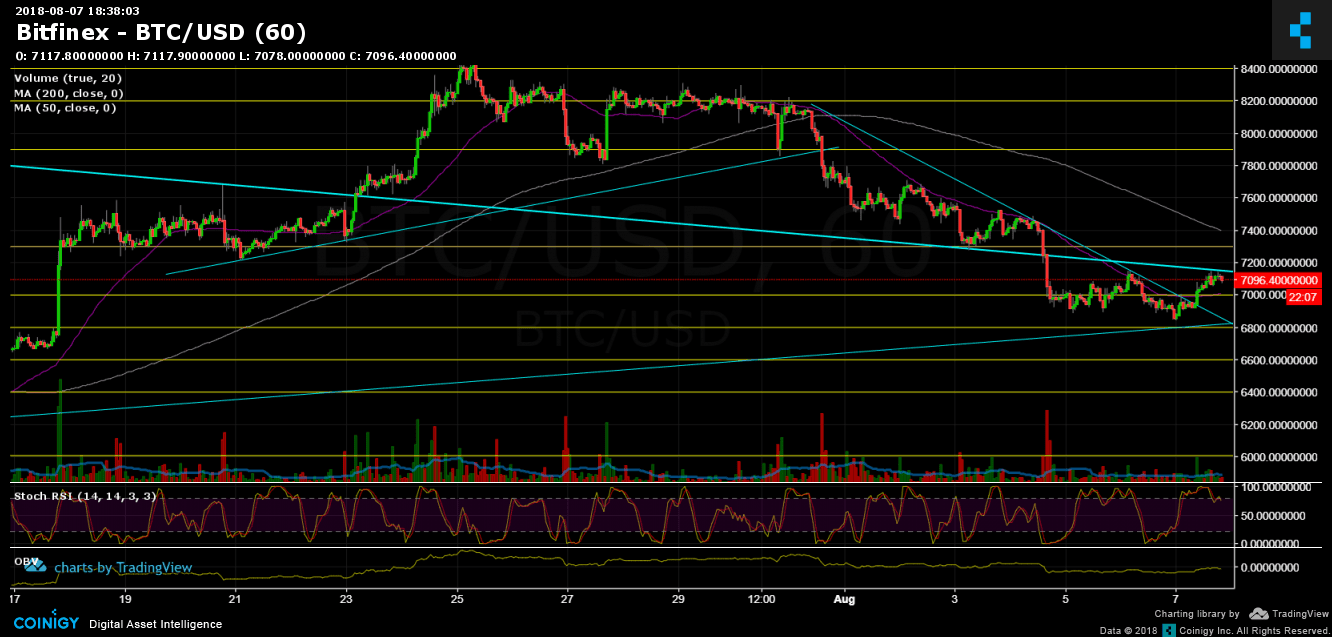

So over the past 48 hours the $6800 important support level have been tested again, and so far seems to hold. Together with breaking up the ascending trending line, Bitcoin had gained some momentum to re-test the long-term descending trend line (marked in bold light blue on the chart below). Breaking it up will likely send Bitcoin to re-test resistance levels at $7300 – $7400 (Moving Average 200 days).

However, Bitcoin is testing resistance as of writing these words, along with the high RSI levels (market is overbought) – we can expect a correction or consolidation till trying to continue the way up. The volume of buyers is still a lot lower than the sellers’ volume levels. The market will stay bearish unless buyers will step in (and create green volume candles).

From the bear side, $7000 is now resistance-turned support, and below stands the important $6800 support area. Next is $6600 support (weaker support level).

Bitcoin Prices: BTC/USD BitFinex 4 Hours chart

The post Bitcoin Price Analysis August 8 appeared first on CryptoPotato.