Bitcoin Price Analysis August 28

Yesterday $50 worth of Tether USDT was dispatched to BitFinex. This might explain the pump up during the night to test the $7000 zone, as expected on our previous price analysis.

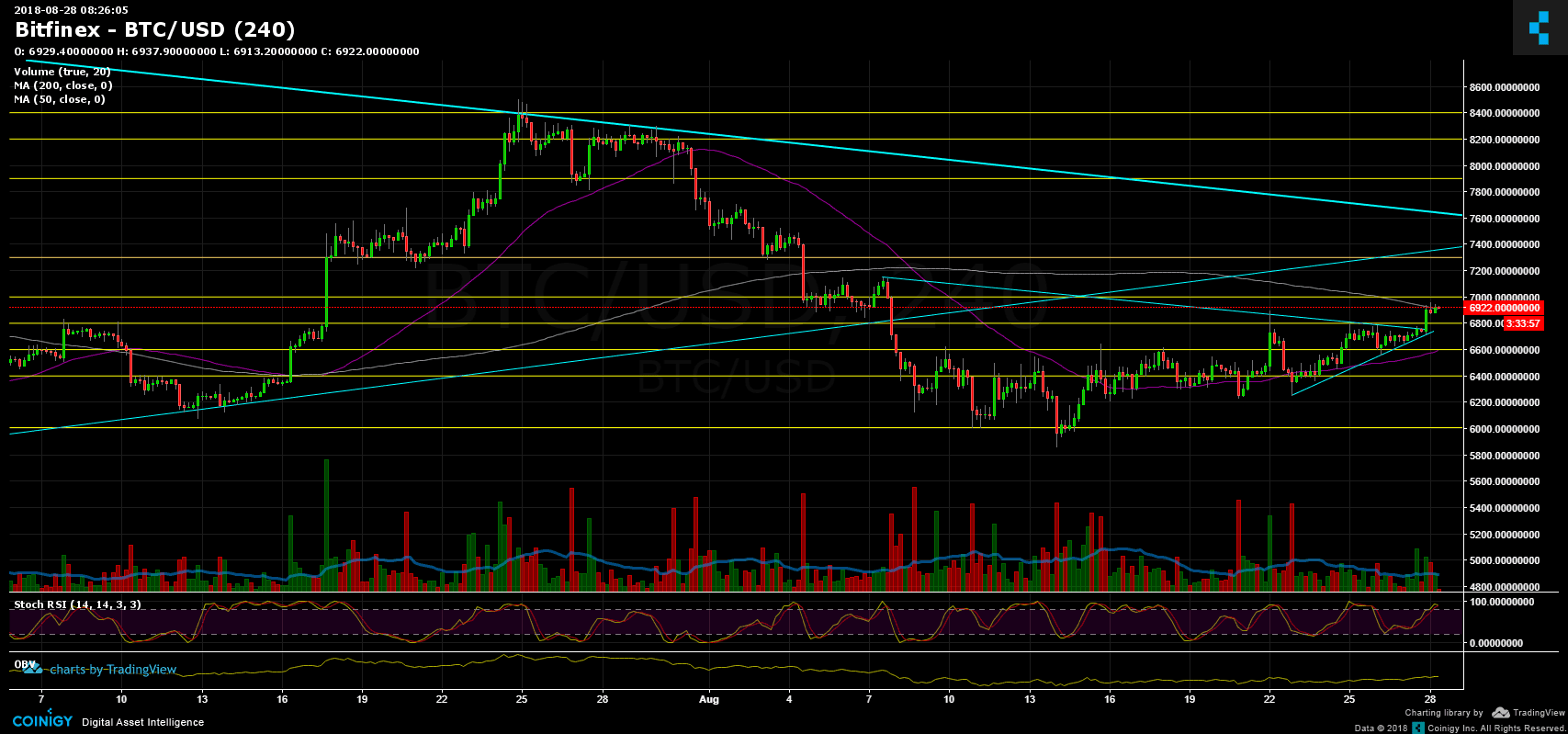

As seen on the chart below, Bitcoin broke up a bullish triangle pattern and is now testing major resistance level of $7000 combined with Moving Average 200 days (the pink line).

RSI levels are at their high – market is overbought, so there might be a correction to re-test support level before testing the $7000 again.

Trading volume is increasing – which is a bullish sign of buyers coming (or a Tether manipulation).

To sum up

Support levels lie at $6800, $6600 (MA-50 – purple line in the chart).

Resistance levels lie at $7000 (strong, MA-200 – pink line), $7250, $7600 (the long-term descending line).

Bitcoin Prices: BTC/USD BitFinex 4 Hours chart

Cryptocurrency charts by TradingView.

The post Bitcoin Price Analysis August 28 appeared first on CryptoPotato.