Bitcoin Price Analysis August 22

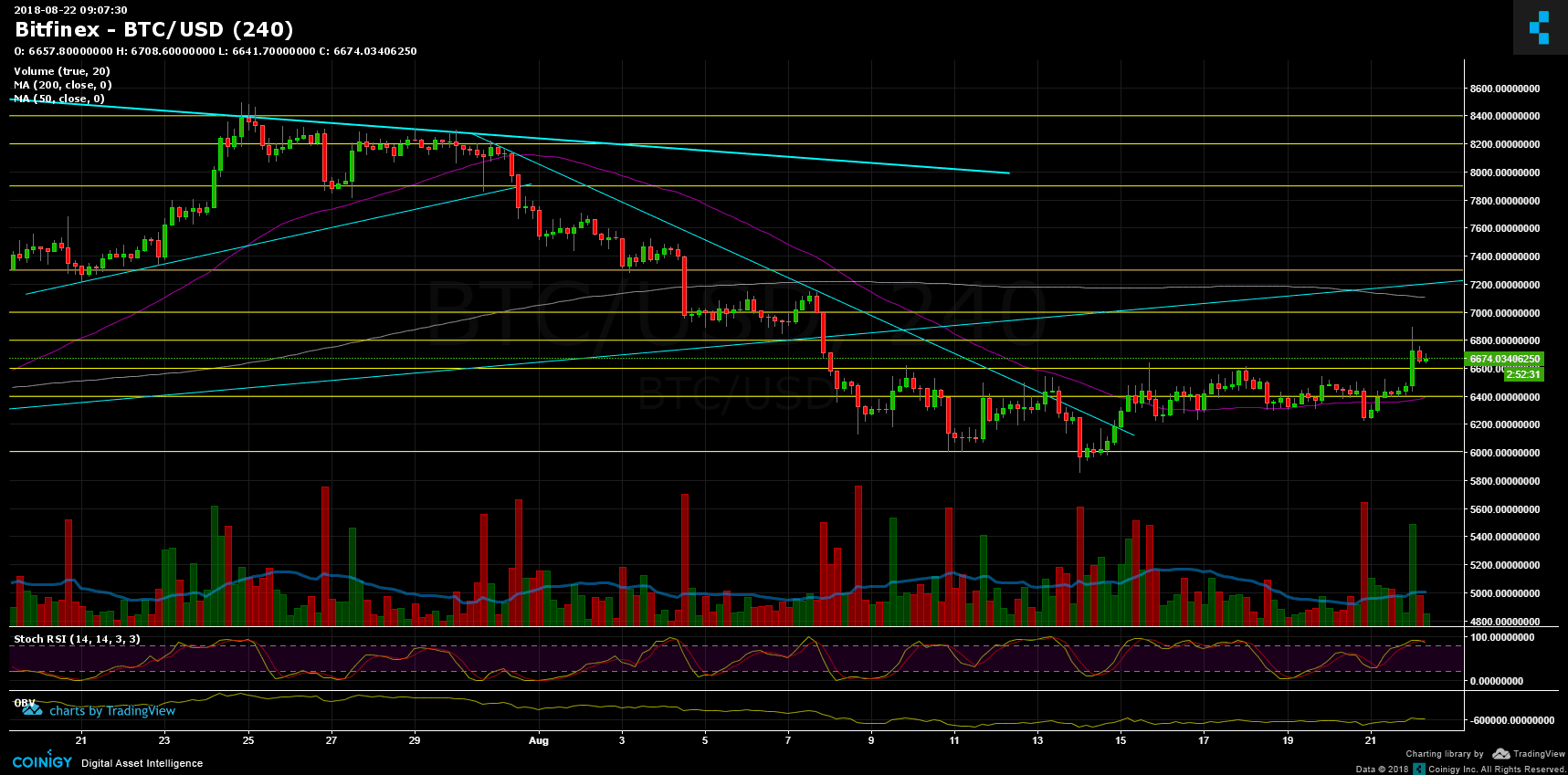

Finally the $6000 – $6600 range has been breached. During this morning, a massive short squeeze took place in Bitcoin: A short squeeze happens, in simple words, when there are a lot of open short positions (short positions were at their peak yesterday). Getting Bitcoin to the levels where lie liquidations of those shorts triggers the market to go higher (due to the liquidations) and that liquidates more shorts.

For the market makers, the option of a massive short squeeze became easier since Bitmex exchange had a scheduled maintenance. The squeeze effect reached a high of $7148 on Bitmex! Before getting down to the current levels around the $6600 famous resistance – turned support.

What now? RSI levels are very high (market is overbought) so for the next hours we could expect re-testing the $6600 level again. Next resistance lies at $6800, and afterwards $7150 – $7200 (Moving Average 200 days and strong resistance level). An Interesting month to Bitcoin, with ETF decisions ahead.

Bitcoin Prices: BTC/USD BitFinex 4 Hours chart

The post Bitcoin Price Analysis August 22 appeared first on CryptoPotato.