Bitcoin Price Analysis: Another Test of $44K – $45K Resistance Incoming for BTC?

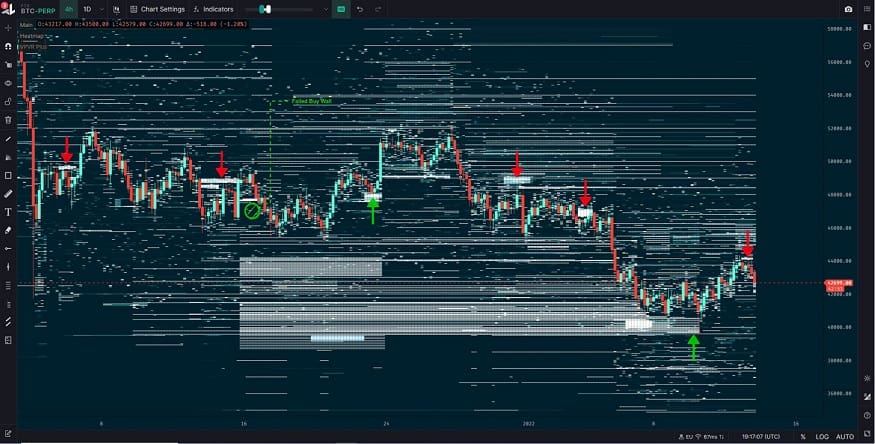

Similar to the consolidation in May-July 2021, the market is forming a significant supply/demand level in the $40K-$42K range. Aside from the short-term price trend, the mentioned area will be a significant support (or resistance) for long-term price actions.

Technical Analysis

Many analysts believe the $40K-$42K zone resembles the $30K-$32K range in May-July. Since December 5th, the $40K-$42K zone acted as good support.

But, considering the low demand in the spot market, bitcoin can see lower prices if this strong support fails (bitcoin closes a daily candle below it). The Fibonacci levels are shown in a daily time frame. The 0.382 Fibonacci level and the red zone that covered each other make a strong resistance of $50K-$51.5K.

It seems that there will be some selling pressure for this level if bitcoin touches this resistance.

Short-Term Analysis

Despite a positive move in price during last week, bitcoin could not break above $44.5K. As the chart shows, there are multiple resistance levels on the way up to $50K. BTC was rejected by several of them, which crossed each other and made $44.5K-$45K a powerful barrier.

In a 4-hour time frame, bitcoin broke out the bearish trend line (orange line). It seems that the pullback has been completed, and the cryptocurrency can make another attempt to break the $44.5K-45K resistance in the coming day.

Order Book Analysis

Considering the heat map for open limit orders, it is clear that FTX played an influential role in recent price actions since the market crashed to 40K (Dec 2021). There are many examples where the price reacted to this exchange’s buy/sell walls. Therefore, it might be wise to monitor this order book for near-future price actions.

The Technical Analysis is prepared by N_E_D_A .