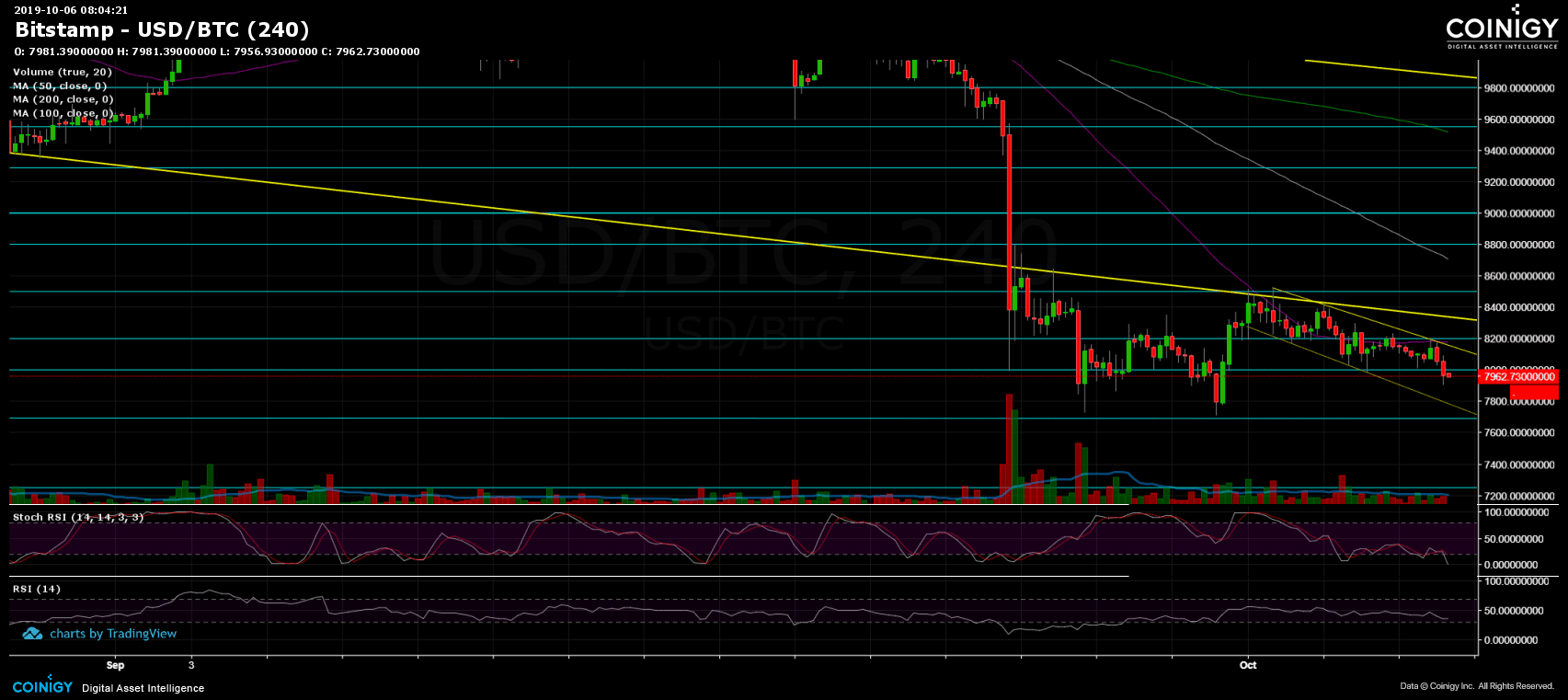

Bitcoin Plunges (Again) Below $8,000: New Lows Or a Clue That Might Turn BTC Bullish?

The past days had been boring for the crypto traders, whereas the price of

Bitcoin is ‘stuck’ between a tight range of $8,000 to $8,400.

However, Bitcoin just plunged below $8K one more time, marking $7920 as the current daily low (Bitstamp). What does it

mean? Is Bitcoin finally leaving the significant $8K support area searching for

new lows?

By looking

at the declining daily volume candles, together with the steady but stable recent

Bitcoin price action, we can assume that a stronger move will be coming up shortly.

In my opinion, any breakout at the broader

range of $8400 from above and $7700 from below, will signal the direction of

Bitcoin’s next major move.

Divergence in RSI might turn bullish

Another thing to note is the bullish

divergence in the daily RSI. While the price of Bitcoin is moving down, a

slight positive ascending uptrend of higher lows is spotted in the RSI, the momentum indicator. This kind of

divergence might turn to be a bullish sign, that indicates on quiet

accumulation. To my opinion, till Bitcoin breaks up the 200-days moving average

line, it will be hard to see the bulls back in the market.

Total Market Cap: $216 billion

Bitcoin

Market Cap: $144.7 billion

BTC

Dominance Index: 67.0%

*Data

by CoinGecko

Key Levels to Watch

– Support/Resistance:

As of writing this, Bitcoin is struggling

to maintain the $8000 support level. If Bitcoin fails to do so, then the next

support levels are likely to be $7,900 and $7,700 along with the lower

descending trend-line of the marked price channel on the 4-hour chart. $7700 is

also the lowest price of Bitcoin since the parabolic move to $13,880 (2019 high).

So far, $7,700 has held twice; can it hold for the third time?

In case of a breakdown, then $7500 is the next support, whereas the $7200 could

be a possible target. This level contains a

historic Golden Fibonacci retracement level (61.8%) from Bitcoin’s

all-time high.

From above, maintaining the $8K level,

could send Bitcoin to retest old support turned resistance levels at $8200 (the

4-hour MA-50 marked in purple) and $8400. Further above is the significant 200-days

moving average line (marked light green on the following daily chart), which currently lies around $8550.

– The RSI Indicator (Daily): Discussed above.

– The Trading Volume: Discussed above.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

The post Bitcoin Plunges (Again) Below $8,000: New Lows Or a Clue That Might Turn BTC Bullish? appeared first on CryptoPotato.