Bitcoin Plunge Recalls a Crucial Decision Day From 2017: Will $8,500 Stop the Bleeding?

Just yesterday, we mentioned the impressive Bitcoin recovery. However, we also wrote that danger remained.

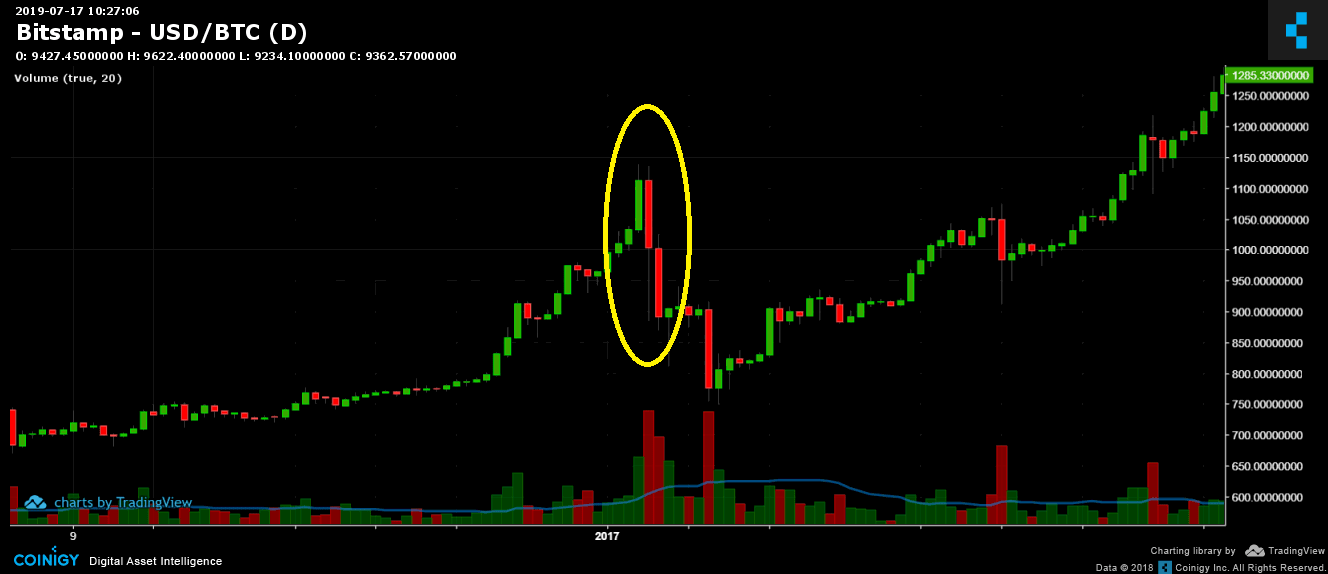

Yesterday’s move, in anticipation of the first congressional hearing regarding Facebook’s Libra, reminds me of another critical date from Bitcoin’s short history: January 4, following the Winklevoss Brothers’ Bitcoin ETF denial (or delay of approval).

On the following chart, the candle from that day is marked by the yellow circle. We see Bitcoin surging, in what looks like a classic short squeeze, and from there plunging. On that day, Bitcoin’s price saw a high of $1,136 and a low of $885, which was approximately a 23% turnover in its value.

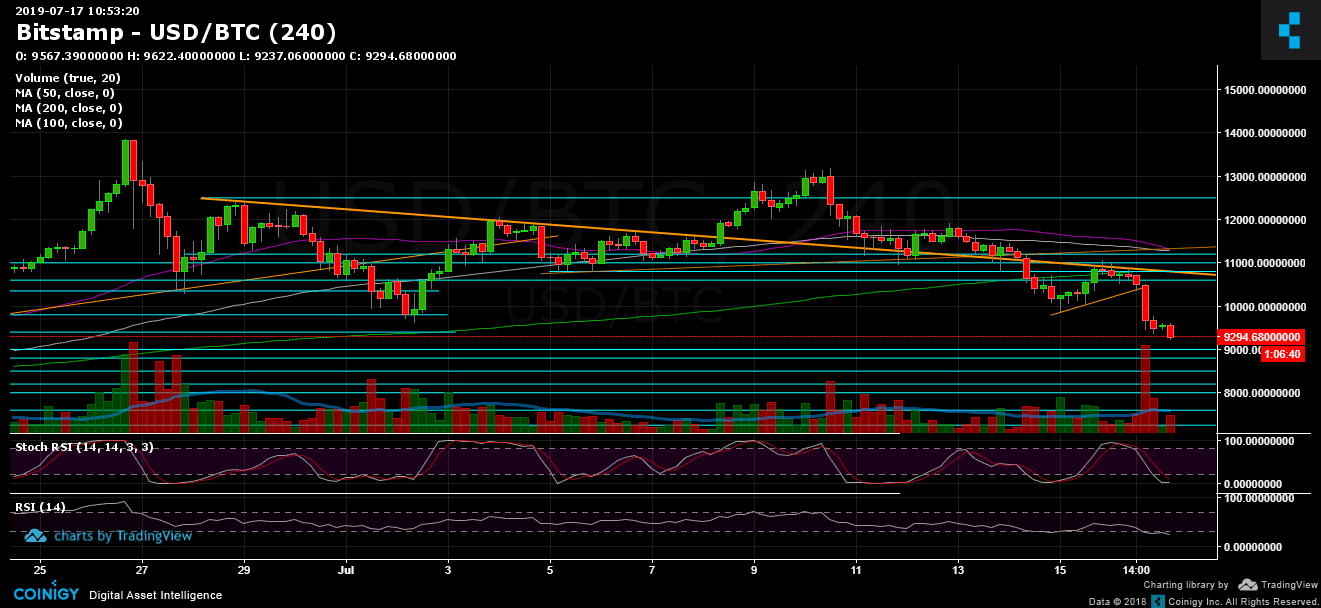

Yesterday was very similar: Surge (short squeeze) up to the $11,000 resistance area, followed by a plunge following the hearing and the negative outcomes for the cryptocurrency world. Bitcoin broke the key-level 50-day moving average (marked in purple on the daily chart at $9850, which was the bottom from two days ago). It then broke the lower ascending trend line, along with $9,600 which had been the low following the recent parabolic move as well as the $9,400 support (the high from June).

The outcome was devastating: a lower low on the daily chart, which turned the trend to bearish.

We also mentioned the RSI, which departed bullish territory and created another lower low. That could have helped predict this outcome (the negative divergence in the RSI). The RSI is now at 42, which is its lowest level since February of this year. The sad thing is that there is more room to go down.

Total Market Cap: $252 billion

Bitcoin Market Cap: $166 billion

BTC Dominance Index: 66.0%

*Data by CoinGecko

Key Levels to Watch

Support/Resistance: Bitcoin broke all mentioned support lines from yesterday and is now facing crucial old support areas. The nearest levels lie at $9,000 and $8,800. Between $8,800 and $8,500, there is a steady supply zone which could help the bulls. $8,500 is also a long-term Fibonacci retracement level. Further below lies $8,200, $8,000, $7,600 and $7,200, which is also a Fibonacci retracement level from the last move.

From above, $9,400 is the nearest support-turned-resistance level. Higher above lie $9,600, $9,800 and $10,000. Further up are $10,300, $10,600 and $11,000.

– Daily chart’s RSI: Discussed above. The Stochastic RSI oscillator is greatly oversold, but it hasn’t entered the bullish zone yet.

– Trading Volume: Yesterday’s sell-off was followed by a huge amount of volume. There are still sellers around with bags to sell, according to yesterday’s volume candle.

BTC/USD Bitstamp 1-Day Chart

BTC/USD Bitstamp 4-Hour Chart

The post Bitcoin Plunge Recalls a Crucial Decision Day From 2017: Will $8,500 Stop the Bleeding? appeared first on CryptoPotato.