Bitcoin Plummets Below $22K While Ethereum Eyes $1.7K (Market Watch)

Yesterday’s price drop was followed by another, even more volatile one, which took bitcoin down to a three-week low of under $22,000.

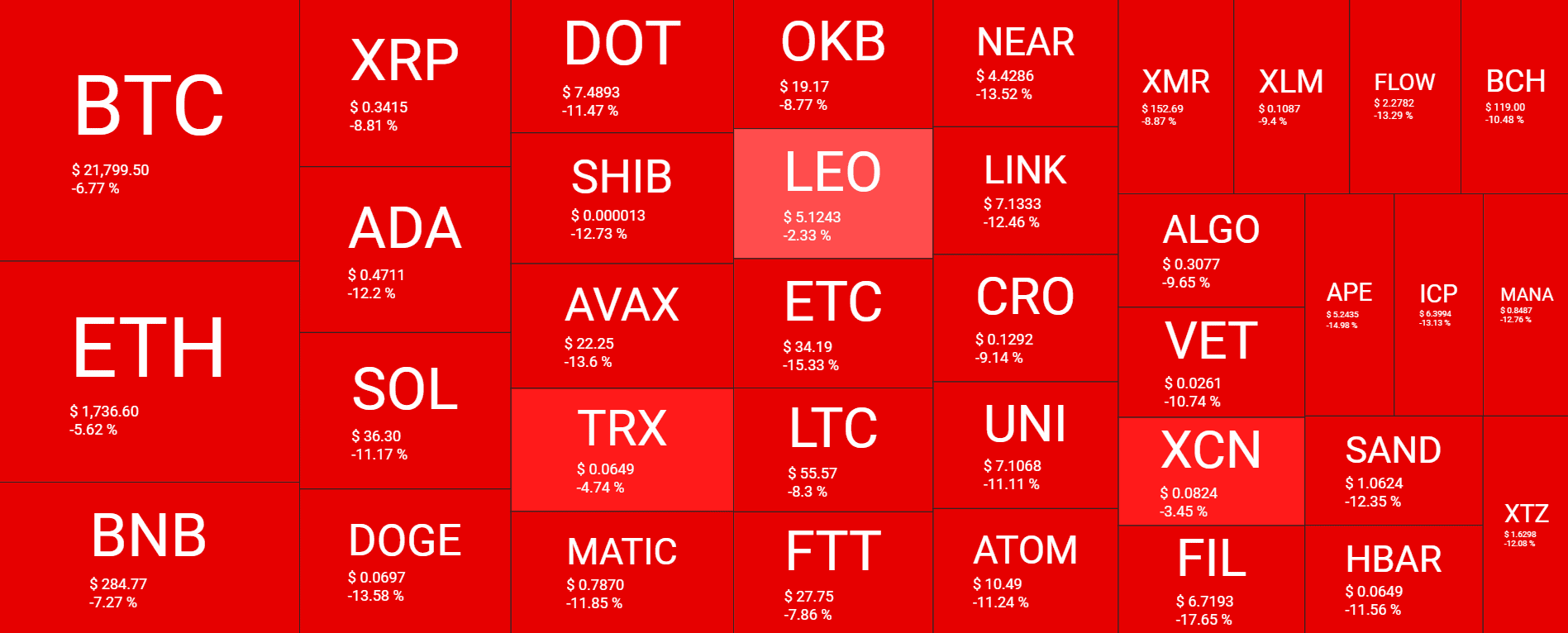

Most altcoins are deep in the red as well, with many double-digit price plummets. Ethereum, on the other hand, is close to breaking below $1,700.

Bitcoin Dumps to 3-Week Low

It was just several days ago – during the weekend – when the primary cryptocurrency was riding high. It took a swing at $25,000 once, got rejected, but returned and jumped to a two-month peak of over $25,200.

However, the same scenario repeated, and the asset was stopped, falling by over $1,000 in hours. Bitcoin calmed there before trying another leg up, which was again rejected at $24,400.

This one brought even more pain for the bulls as BTC found itself slipping by another grand yesterday. The situation worsened earlier today as the cryptocurrency dumped by over $2,000 in hours and fell to a three-week low of $21,400 (on Bitstamp), resulting in over $400 million in liquidations on a daily scale.

As of now, it has recovered some ground, but it’s still way below $22,000, and its market cap has plummeted to $415 billion.

Alts in Deep Red Again

Similar to bitcoin, the altcoins dropped yesterday and are in even worse shape today.

Ethereum was among the best performers recently, having charted a 74-day high above $2,050 during the weekend. It went on a freefall since then, though, and now struggles to remain above $1,700, meaning it has lost over $300 in less than a week.

Binance Coin, Ripple, and Tron are down by up to 9% in the past 24 hours. Even more substantial losses are evident from Cardano, Solana, Dogecoin, Polkadot, Shiba Inu, Avalanche, and Polygon – all of which have dumped by double-digits.

With the lower- and mid-cap alts in a similar state, the crypto market cap is down by $80 billion in a day. The metric has seen over $120 billion gone in the past two days and sits below $1.050 trillion.

Industry News

The Chicago Mercantile Exchange said it plans to roll out ETH options before the completion of the Merge.

JPMorgan analysts claimed that Coinbase can benefit significantly from allowing institutional investors to stake ETH.

Tether hired a new auditor and promised to deliver more frequent reports on its reserves.

HUSD became the latest stablecoin to lose its parity with the dollar, but Huobi said they backed off from the project months ago.

The post Bitcoin Plummets Below $22K While Ethereum Eyes $1.7K (Market Watch) appeared first on CryptoPotato.