Bitcoin OTC Deals On The Rise: $131 Billion Moved in a Day (Analyst)

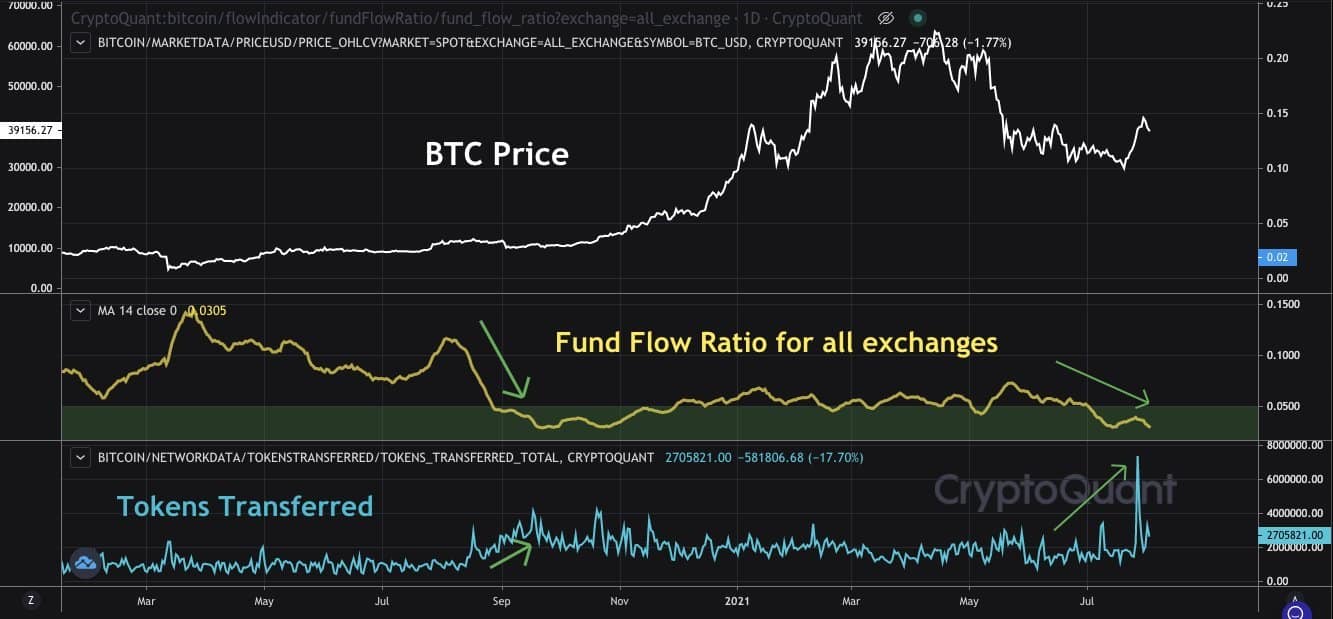

The BTC fund flow towards exchanges has been gradually declining in recent weeks, while the number of tokens transferred has registered a sudden spike, revealed on-chain data. As such, CryptoQuant’s CEO indicated that larger players have become active again with numerous OTC deals.

BTC OTC Deals On The Rise

Apart from digital assets changing hands on cryptocurrency exchanges, over-the-counter (OTC) financial markets enable investors, typically such using more substantial funding, to interact with the industry.

The major difference is that while exchanges act as mediators between buyers and sellers, two parties can directly execute the OTC trades, with another side serving as the “desk” – a business dedicated to the buying and selling of a particular asset class.

OTC Deals have skyrocketed in popularity and volume since early 2020 as more institutional investors have looked into entering the market. On a more micro-scale, the number of BTC tokens transferred saw a massive uptick recently, as shown by CryptoQuant.

The analytics company’s CEO, Ki Young Ju, pointed this out while also indicating that the number of BTC deposits and withdrawals from traditional crypto exchanges has slumped recently.

Consequently, he concluded that “99% of transactions are happening outside of the exchanges. Possibly OTC deals.” He also believes that some “big names” could announce bitcoin purchases soon, which could cause “trouble” for the bears.

The total amount of moved BTC in a day on August 2nd was $131 billion, and just 1% of that came from deposits and withdrawals on exchanges. In fact, the bitcoin Fund Flow Ratio towards such trading platforms reached a new two-year low.

Bitcoin Price Update

Moving such considerable amounts of the primary cryptocurrency could result in immediate effects on the asset’s price. And, bitcoin has indeed been somewhat volatile in the past few days.

It rode high during the weekend as it charted a multi-month record of $42,600. Thus, it added $13,000 in about ten days, since the sub-$30,000 adventure on July 20th.

The bears resumed control over the market in the following two days, as reported, and the cryptocurrency lost more than $4,000 of its value. As of now, bitcoin has reclaimed some ground, but it still stands below $39,000.

Nevertheless, in case CryptoQuant’s CEO is correct, and some large names announce BTC purchases soon, the asset’s price trajectory could head north once again.