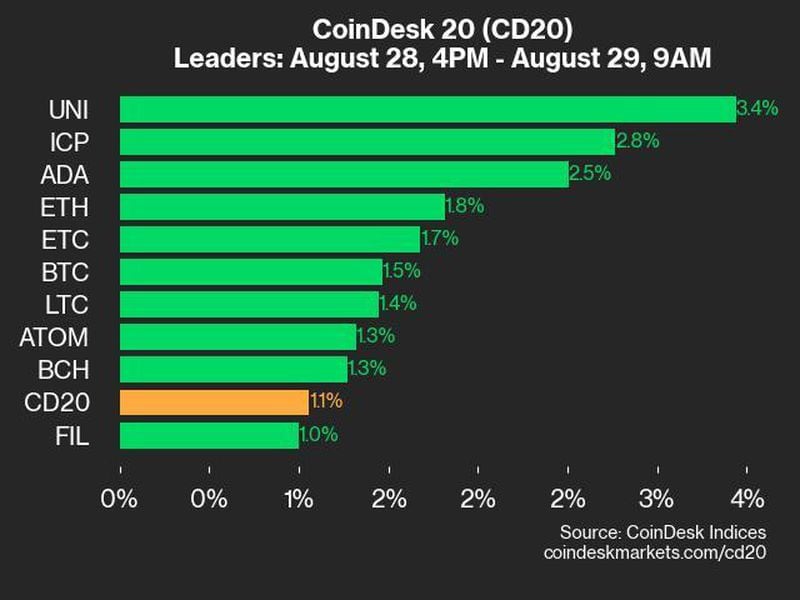

Bitcoin Options Trader Takes $20M Bet to Hedge Against Prices Dropping to $47K

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

The long-put “butterfly” strategy guards against a potential bitcoin price drop to $47,000 by the end of March.

-

The strategy, involving multiple trades, cost over $20 million.

A large bitcoin (BTC) options bet crossed the tape on Tuesday, aiming to profit from a potential short-term price drop in bitcoin with the floor at $47,000.

The trader bought 100 lots of March 29 expiry on crypto block trading service provider Greeks.Live, and put options at strikes $50,000 and $43,000, partly financed by selling 200 lots of similar expiry puts at $47,000.

A put option gives the purchaser the right but not the obligation to sell the underlying asset at a predetermined price at a later date. A put buyer is implicitly bearish on the market, while a call buyer is bullish.

The so-called block trade and comes at a notional cost of over $20 million, Greeks.Live told CoinDesk. A block trade is a large transaction executed off the regular public market and is considered synonymous with institutional activity.

The strategy will earn maximum profit if bitcoin falls to $47,000 on the expiry day. The forecast, therefore, is for prices to drop in the next few weeks but not below $47,000. The payoff diagram shows a maximum profit at the center and a fixed loss in case prices breach the two ends, mimicking the body of a butterfly. Hence, the strategy is called a “butterfly” bet.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/UD7IIITIKNBLPHE24F62YR4Y7A.png)

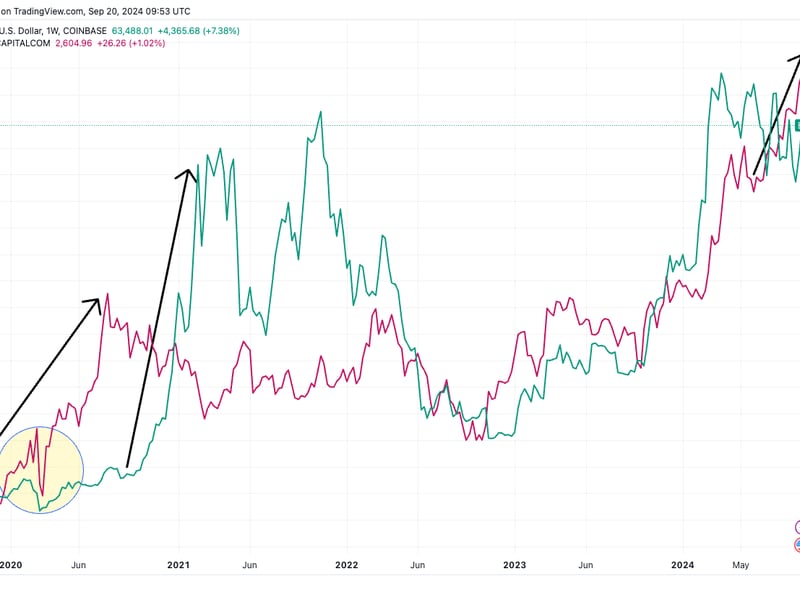

The simulated payoff diagram shows peak profit at $47,000, with breakeven levels at $44,201 and $49,770.

“Whales have continued to add to their short positions, betting that bitcoin will fall slightly before March 29,” Adam, an analyst at Greeks.Live, told CoinDesk.

“Recent block trades have been concentrated in two directions – short price or long volatility. Term selection has mostly been concentrated before BTC halving. Looking at the characteristics of the trades, it is likely that traders are holding spot and purchasing hedging positions,” Adam added.

Edited by Parikshit Mishra.