Bitcoin Options Open Interest Climbs to Record $15B on Crypto Exchange Deribit

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

Notional open interest in BTC options listed on Deribit set a new peak of $15 billion last week.

-

Record activity points to an increased preference for options for hedging and leveraging gains.

Trading in bitcoin (BTC) options listed on the cryptocurrency exchange Deribit is more popular than ever.

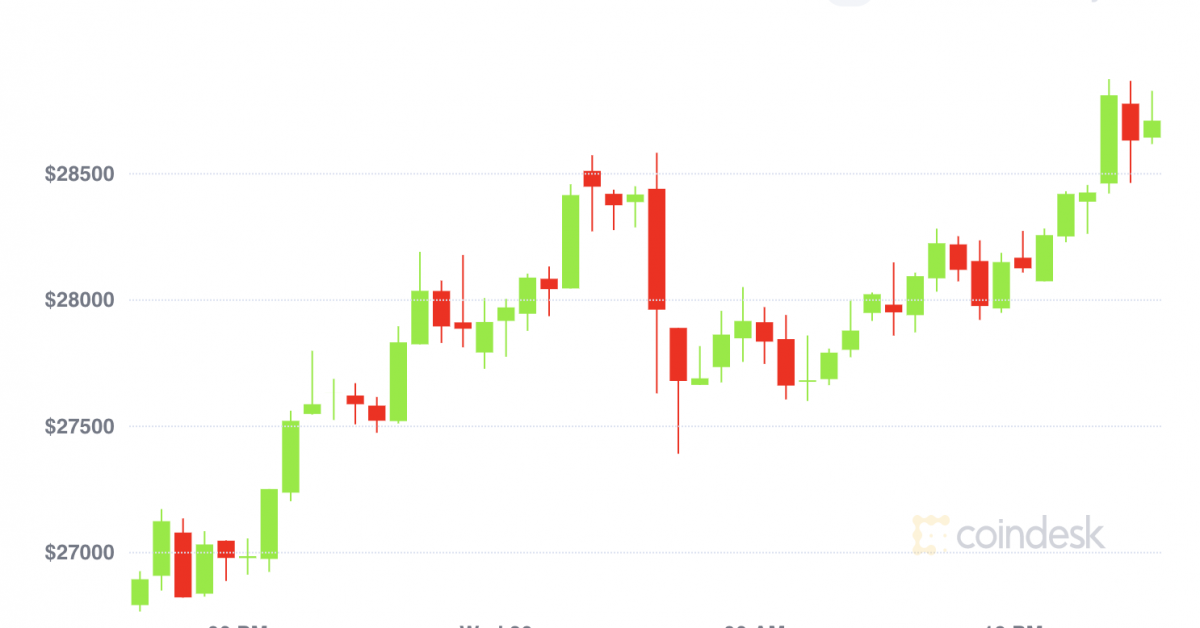

On Friday, the notional bitcoin (BTC) open interest, or the U.S. dollar value locked in active bitcoin options contracts, rose to a record high of $15 billion. The figure has more than doubled since late September, topping the $14.36 billion peak registered during the bull-market days of October 2021. Back then, BTC traded above $60,000; today it’s about $37,200.

At press time, notional options open interest had dropped back to $13.8 billion. In contract terms, open interest stood at over 376,000 BTC, nearly double the October 2021 tally, but well short of the record 433,540 BTC of March this year. On Deribit, one options contract represents one bitcoin.

“We’re excited to announce that we’ve just achieved a record-breaking $15 billion (ATH) in notional open interest in BTC options,” Chief Commerical Officer Luuk Strijers said in an email. “This development underscores the increasing preference for options as a strategic tool among traders, whether for positioning, hedging, or leveraging the recent surge in implied volatility.”

Deribit is the world’s leading crypto options exchange, accounting for almost 87% of the global crypto options open interest of $25 billion. Options are financial contracts that represent the right to buy or sell an asset, in this case, bitcoin, at an agreed-upon price for a specific period of time. A call option gives the right to buy and a put the right to sell.

Recently, the BTC options market surpassed the BTC futures market in a sign of growing market sophistication.

Bitcoin has been on a tear since early October, rising to $38,000 from $25,000. There are several reasons for the rally, including optimism of an impending spot bitcoin ETF approval and macroeconomic developments. The positive price action has sent traders scrambling to take bullish exposure through call options.

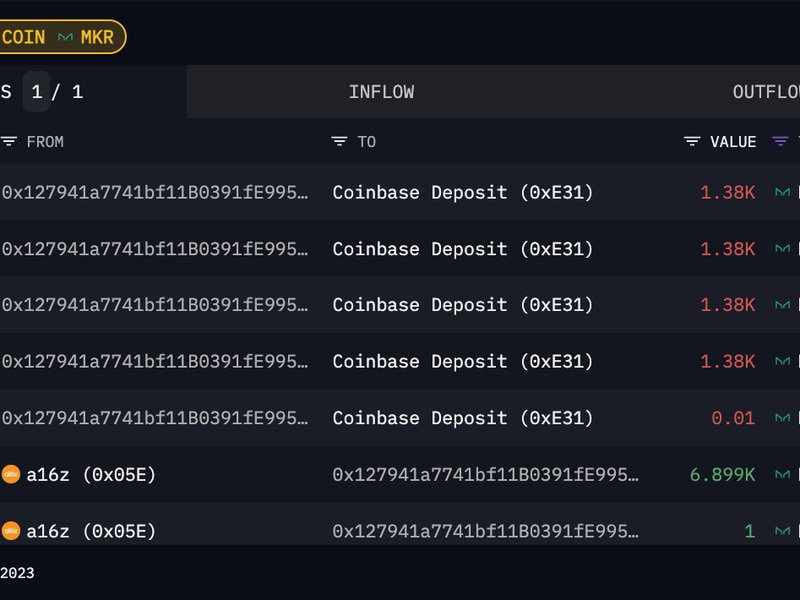

“Options flow remains very bullish with outright calls bought in large sizes on both BTC & ETH while call spreads are rolled higher on BTC,” said over-the-counter institutional cryptocurrency trading network Paradigm in a Telegram message on Friday.

In 2019, Deribit partnered with Paradigm to launch a block trading tool. Block trades are privately negotiated large transactions in futures and options or a combination of the two.

According to Amberdata, large block trades of the December expiry call were executed last week at $40,000 and the January expiry call option at $50,000.

One trader sold a straddle, which is an options strategy aimed at profiting from a decline in price volatility, for a premium of $2.8 million. Such volatility selling strategies were quite popular in BTC and ETH during the summer, when both cryptocurrencies were listless.

The notional open interest in ether options has increased notably to $6.83 billion. Still, it remains well below September 2022’s record high of nearly $8 billion, when the Ethereum blockchain completed its switch to a proof-of-stake consensus mechanism.

Edited by Sheldon Reback.